August Economic Background

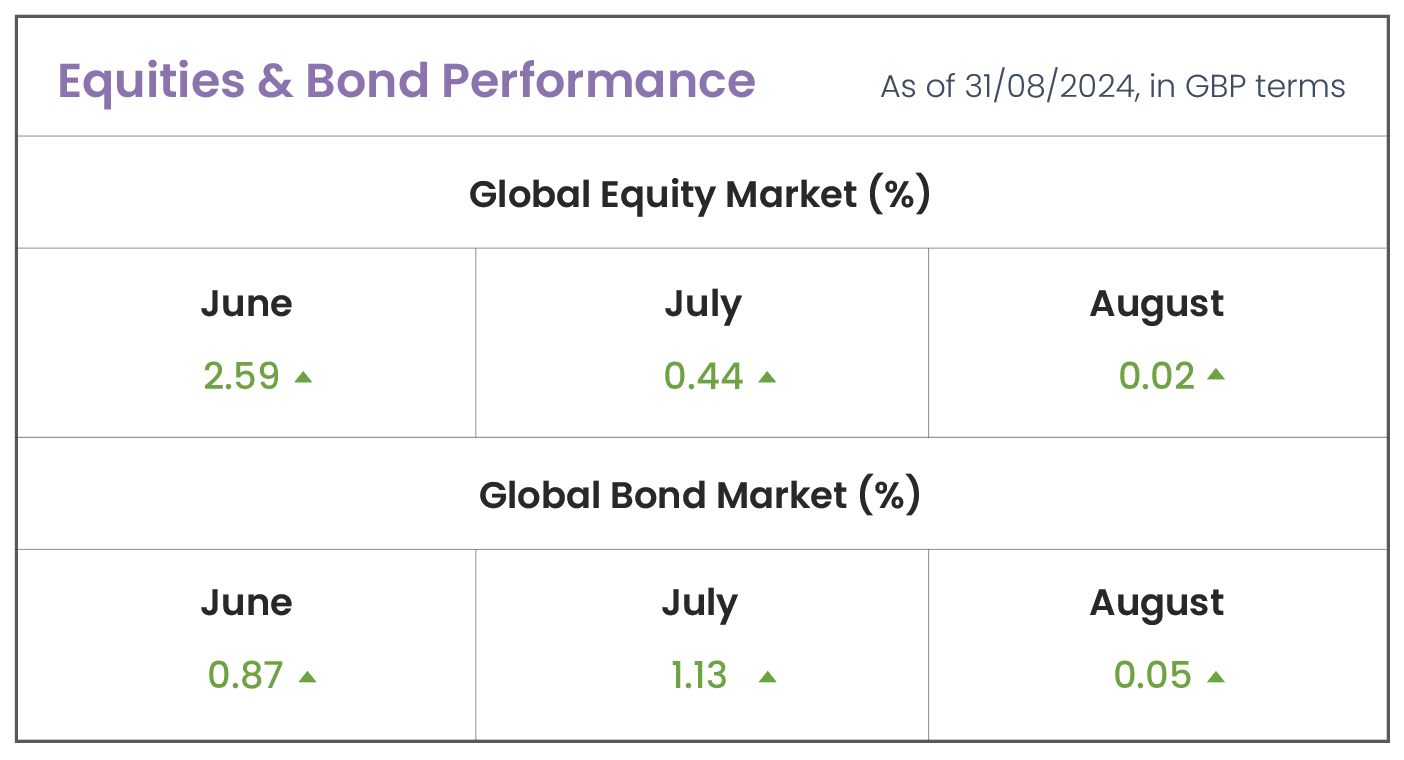

- Despite significant volatility, global stock markets ended the month flat.

- Bank of England cuts rate by 0.25% to 5%.

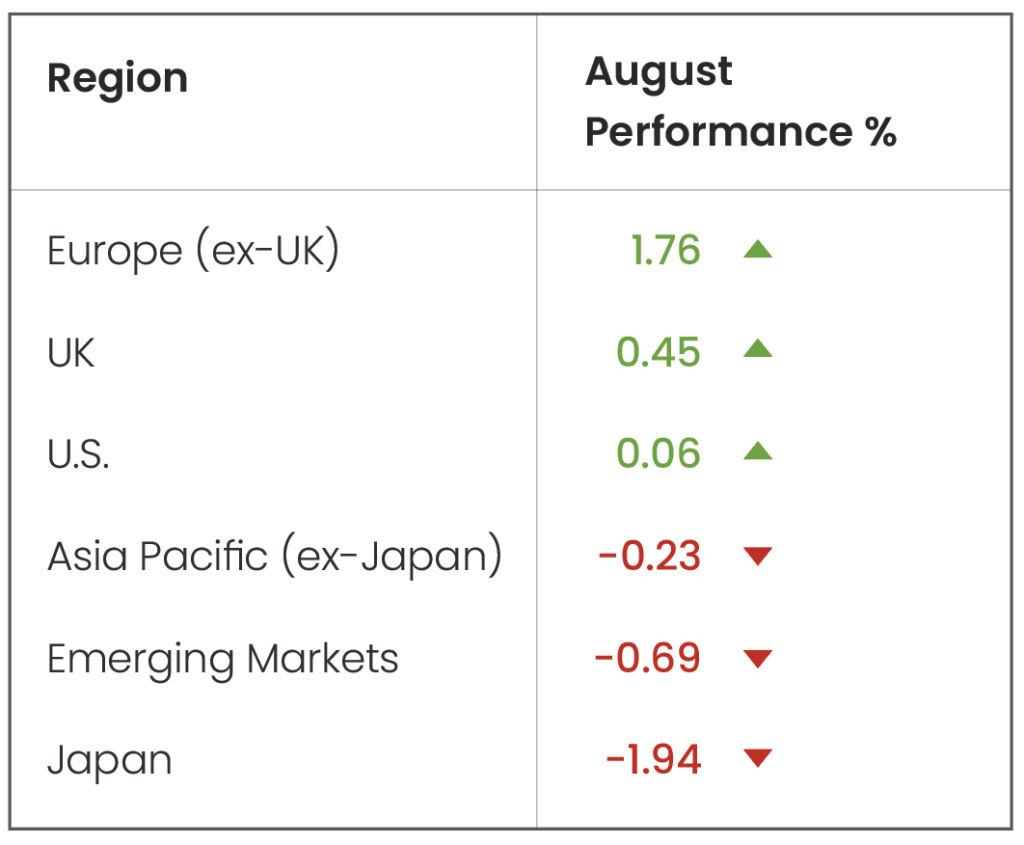

- Europe keeps global stocks markets in the green for August.

Source: Morningstar (MSCI ACWI IMI; Bloomberg Global Agg)

Market Review

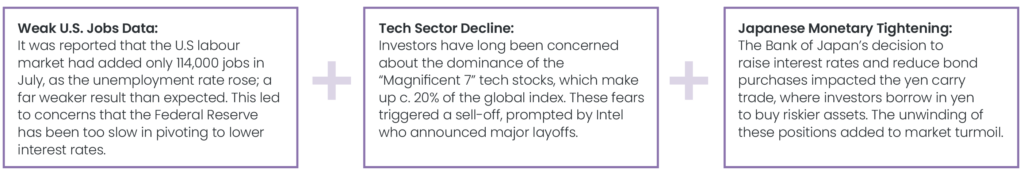

August Volatility: On Monday August 5th, global stock markets experienced a sharp sell-off, with Japan and the broader Asia region leading the declines. The Tokyo Stock Price Index (TOPIX) fell by 12%, marking its steepest one-day drop since the 1987 “Black Monday” crash. This downturn spread to other Asian markets, Europe, and the U.S, where the S&P 500 index dropped over 2%, and the VIX index (which measures market volatility) surged to its highest level since the COVID-19 crash in 2020. Several factors contributed to this sell-off:

Nonetheless, the following day (Tuesday 6th August) saw significant stabilisation globally, with markets in Asia reversing much of Monday’s sell-off (with the TOPIX rising c. 9%), as well as the S&P up around 1%. This shows just how volatile markets can be, and just how challenging market timing is to deploy effectively. The recovery was supported by expectations that the Federal Reserve (Fed) would cut interest rates at their next meeting, coupled with investors stepping back into the market to pick up assets at significantly lower valuations than seen just a few trading days prior.

Interest Rates Fall: The Bank of England (BoE) cut interest rates by 0.25% to 5% in August, marking its first reduction after an entire year at 16-year highs. However, it was a close call, with four members of the bank’s Monetary Policy Committee (MPC) voting to hold rates, while five members voted to lower it. The BoE later announced plans to proceed cautiously with further cuts until inflation is clearly under control. Markets now anticipate one more cut in 2024, which could bring the base rate down to 4.75% by year-end. Across the pond, Fed chair Jerome Powell gave clear signals that U.S interest rates (which have remained unchanged since August last year) will be cut in their September meeting, citing further confidence that inflation is slowing to their target of 2% and a cooling labour market after weaker-than-expected jobs data in July – conditions that provide central banks with the flexibility to lower rates, hopefully without reigniting inflationary pressures.

European Stocks: Global stock markets have been buoyed by strong performance in the UK and Europe this month, driven by Eurozone inflation dropping to a 3-year low of 2.2% in August and improved UK economic growth forecasts. Lower interest rates in these regions could further bolster UK and European stocks by reducing borrowing costs and encouraging investment. In contrast, after the S&P 500 hit its 38th all-time high in July, a significant sell-off in early August erased much of the year’s gains. However, a swift recovery helped the index finish the month slightly in the green.

The same resilience hasn’t been seen in emerging markets and Asia, particularly Japan. The Bank of Japan’s interest rate hike has made yen borrowing more expensive, prompting investors (especially hedge funds) to rapidly unwind positions in Japanese equities that were previously funded by the cheap yen. The forced liquidation of these positions led to a sharp decline in Japanese markets. China (-1.3%) also weighed on the broader Asia region, as ongoing real estate challenges and weak consumer confidence continued to dampen investor sentiment. The government remains cautious about implementing further large-scale stimulus measures, aware that past interventions have fueled speculation and economic imbalances, but instead remains focused on technology-led investment.

Source: Morningstar (as of 31/08/2024)

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025

- October Market Review 2025