In investing, the value premium refers to the greater risk-adjusted return of value stocks over growth stocks. Eugene Fama and K. G. French first identified the premium in 1992, using a measure they called HML (high book-to-market ratio minus low book-to-market ratio) to measure equity returns based on valuation [1].

“The value factor clearly works, but the explanations for why vary. Historically, value stocks have outperformed growth stocks. The evidence is persistent and pervasive, both around the globe and across asset classes. While there’s no debate about the premium, there are competing theories to explain its existence” [2].

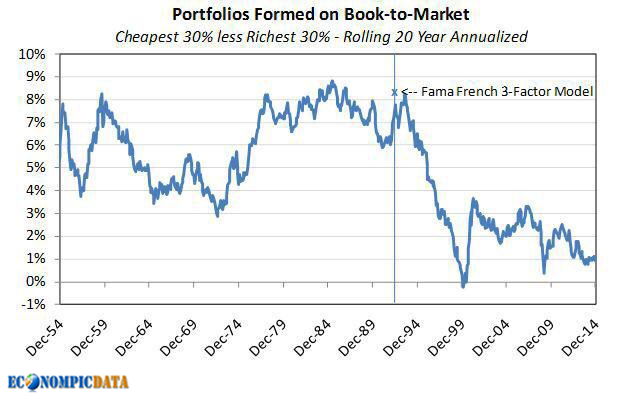

Notwithstanding the above quote there is definitely a debate to be had on the existence of the “Value Premium”, not least because it has been conspicuous by its diminishing presence in the recent past. The chart below shows the returns to value over the past 20 years.

As of 28/2/15 [3]

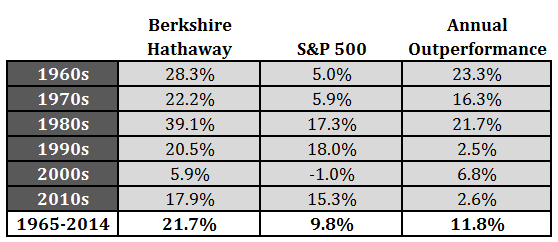

The same can be seen in the (relative) drop in the performance of the Warren Buffett’s Berkshire Hathaway group.

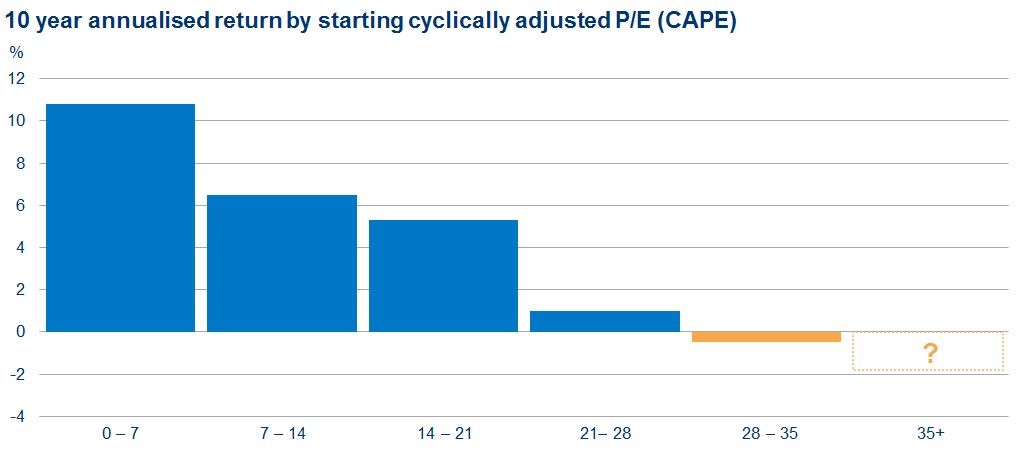

The problem proponents of the “end of value” theory have is to explain what is currently driving returns. The overwhelming determinant of future returns tomorrow is the price paid today, and the multiplicity of valuation methods being employed attest to that basic truth, since if valuation was not relevant, no-one would bother pricing assets. This is why serious analysts were warning in 1999 (and again in 2007), that long term returns would disappoint investors, which, over the next decade, they duly did. Investors mistook great companies for great investments (book titles such as “Dow 36,000” by Glassman and Hassett was a manifestation of that error) and seem destined to continually repeat this mistake. If there was any doubt of this, the chart below (from Nick Kirrage at The Value Perspective, Schroders Unit Trusts) should dispel it. Thus, value (however one defines it), is crucial to long term returns, and it does not seem to matter which country one chooses – it has worked consistently across markets AND across asset classes.

[4]

How does the Value Premium come about?

The short answer is through the market price mechanism. The price of value (or “distressed” companies) must fall far enough to provide returns that justify the risk of owning them, or investors who are risk-neutral would not own them, since they could own large companies with lower risk or similar returns. It is therefore reasonable to assume that the Value Premium would recur over time, since the risks over and above their larger counterparts are similarly enduring. But it cannot occur on a permanent basis, otherwise it would constitute a risk-free return, which markets are loathe to distribute. Thus, there is a different risk involved in value investing – some of it can be diversified away, but it is still there in the form of a premium over and above ordinary market risks. The catch is that it can be a long time before it is observed, but if it were not present, no rational investor would be willing to bear this risk [5].

Why does it not appear to be working now?

“The central truth of the investment business is that investment behaviour is driven by career risk. In the professional investment business we are all agents, managing other peoples’ money. The prime directive, as Keynes knew so well, is first and last to keep your job. To do this, he explained that you must never, ever be wrong on your own. To prevent this calamity, professional investors pay ruthless attention to what other investors in general are doing. The great majority “go with the flow”, either completely or partially. This creates herding, or momentum, which drives prices far above or far below fair price.” [6]

Since the Great Financial Crisis of 2008-09 Central Banks have instituted QE, which has had the effect of flooding markets with liquidity, exacerbating the “Herding Effect” noted above. In a world of zero interest rates, the incentive to research companies in depth is reduced, as markets appear to be levitating, and the important thing is to be as fully invested as possible. Fund managers who are underweight in a bull market face the risk of job loss, and are therefore reluctant to buck this trend.

This trend is bolstered by the activities of corporations. The most credit worthy companies can now borrow at near zero rates (and in the case of Nestle, at negative rates), but instead of investing in productive assets, many companies are choosing to buy back their stock. As Bill Gross notes, “Corporate authorizations to buy back their own stock are running at an annual rate of $1.02 trillion so far in 2015, 18% above 2007’s record total of $863 billion” [7]. This price-insensitive buying puts further pressure on investment managers to remain fully invested, almost regardless of what it is they are actually invested in.

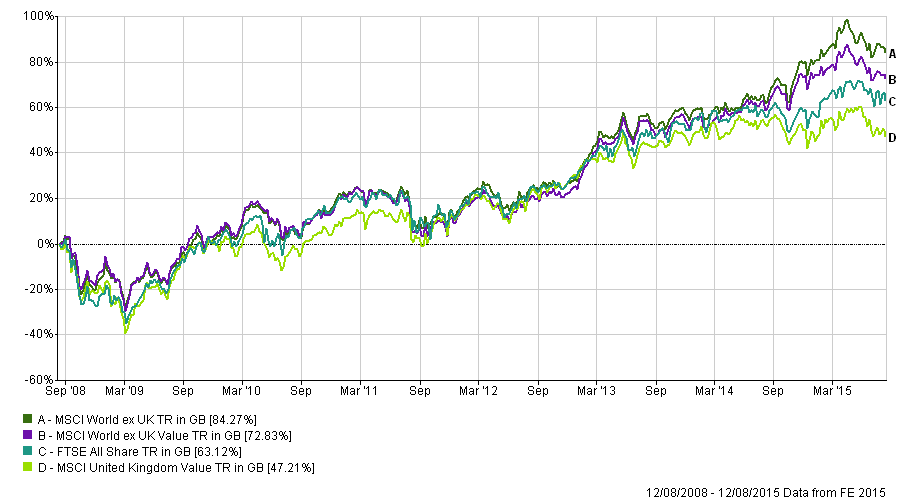

The result can be seen in the under performance of value relative to indices both in the UK and globally.

What of the (immediate) future?

There are signs that increasing numbers of investors are questioning the policy of QE (including gross mentioned above). Two articles provide examples (here and here) of why QE and low interest rates may not be the solution, but the problem, as they are creating and embedding deflation. Of course, the end of the policy may lead to market falls, but it will surely focus investor minds on value, rather than growth. In that circumstance, the Value Premium should re-emerge.

The well-known behavioural biases that lead to investors underperforming their buy-and-hold counterparts (performance chasing, overconfidence etc.) are not likely to disappear either, presenting opportunities for value investors as assets overshoot on the downside. Rumours of the death of the Value Premium appear exaggerated.

Conclusion

“To thrive as a value investor you have to “risk being called a dummy from time to time.”

“In the world of investing, being correct about something isn’t at all synonymous with being proved correct right away.”

No investment strategy works every year (and sometimes for longer than that). Value investing has a much better long term record than almost any other approach. The problem is that it must be earned – as The Reformed Broker points out, losses go with the territory. It is how one responds that determines success or failure. Just as it is darkest before dawn, so the market (and the value) premium tends to return just as it looks as if it has gone forever.

It is undoubtedly a testing period at the moment, but as an individual investor, one doesn’t need to outperform every year. Returns must be judged over many years, not one quarter. In the long term, the Value Premium will return – the task is to survive until that happens.

- [1] Value premium on Wikipedia

- [2] L. Swedroe ETF.com 12/11/2014

- [3] EconomPic

- [4] Source: Global Financial Data and Thomson Datastream, as at 30 June 2015 (Based on UK Equity market – since 1927)

- [5] Investor Solutions

- [6] Fool.com quoting Jeremy Grantham from GMO, 2/6/15

- [7] Janus Capital market commentary 30/7/15

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.