Wendell: [Viewing the desert crime scene] It’s a mess, ain’t it, Sheriff?

Ed Tom Bell: If it ain’t, it’ll do till the mess gets here.

from No Country for Old Men (2007)

Since the post Brexit lows, the Dow is up 1200 points (+6.67%) and the FTSE 100 is +695 points (+11.2%), confounding the apocalyptic forecasts of Mr Carney and Mr Osbourne. But problems have emerged in the UK Property market, in the shape of a concerted sell-off in Open Ended Property funds. Standard Life were the first to announce the “gating” of investors, but they were swiftly followed by 5 other firms, all trying to stem the redemption flows, whilst maintaining that there was nothing amiss. The contagion rapidly spread to Home Builders and even REITs, as investors panicked. Some are already drawing parallels with 2007, when Bear Sterns halted redemption’s from 3 of their mortgage hedge funds, which some say precipitated the mortgage crisis of 2007-09. Going further back, it is reminiscent of the Split Capital Trust debacle of 2001-2002, particularly in view of the cross-holdings both within and between them. Analysis by the FT[1] suggests that two Multi Asset funds run by M&G have 4-7% of their assets in the M&G Property fund, and three of SL’s products have 5-8% of their assets in the SL Property fund. Investors in Aviva and Henderson Multi Asset funds are in a similar situation. The (il)liquidity chain extends further – according to the same FT.com article, Architas, the Investment manager, has 7 funds with 8% stakes in the L&G Property fund; what happens if they receive redemption requests?

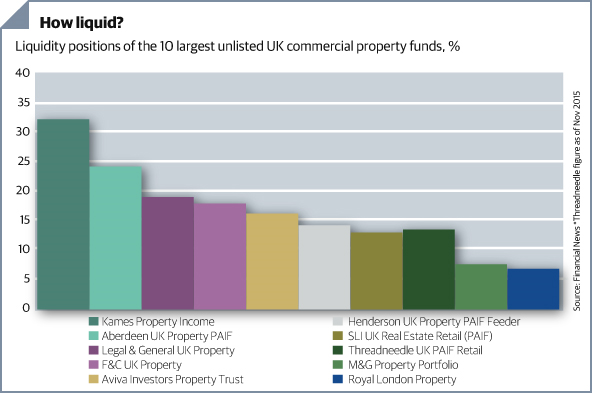

What is less well-appreciated is that the redemption pressures had been building for months. According to this article, in May, £360 million was withdrawn from Property funds, leaving the net outflow at £626 million for 2016. For example, Henderson had, in May, shifted to “Bid” Pricing, implying a 5% reduction in the proceeds investors would receive from selling their units. The chart below shows the pre-Brexit cash position of the largest Property funds from November 2015.

By May, the situation had changed dramatically: the Investors Chronicle, as of 6/7/16 stated that the Aviva Property fund and M&G Property Fund had 9.3% and 7.7% respectively in cash as of the end of May – funds tend to look for 13-15% typically. This may explain the reaction from the Property funds – outflows left them with a sudden shortage of liquid assets, precipitating the need to halt redemption of their units.

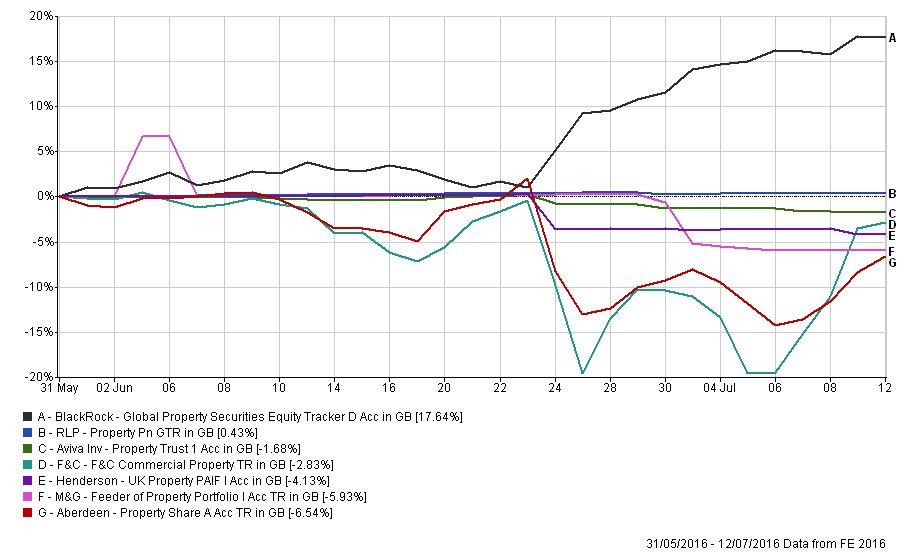

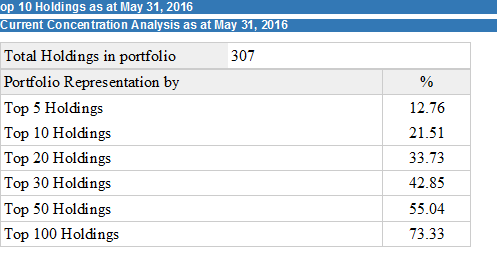

The chart below highlights the effect so far: notice the dramatic out-performance of the Blackrock REIT since May. The REIT invests in Property companies rather than Property itself, and it is thus NOT so subject to the vagaries of market liquidity. It is Global in nature, and thus relatively unaffected by these UK price convulsions, as well as being truly diversified – it has 334 different holdings according to their website. (See below). It is our core Property holding.

What of the future?

Is this the beginning of the end for Commercial Property as a viable asset class? Open-ended funds own 5% of UK real estate, up from 2% in 2007. Opinion (as usual) is divided on the subject – the danger is that the redemption requests will create a market freeze, as potential buyers await discounts that sellers are unwilling to give. It may put a ceiling on prices as future investors anticipate potential selling pressure into any price rises. Given the long lead time before sale completions, (according to one magazine, the New Star International Property fund was suspended in November 2008. By the time trading was resumed, in February 2010, it had been bought by Henderson), it is too early to say what effect it may have.

But investors have been taught a harsh lesson: price smoothing has given the impression that Property investments are low risk. Just because risk is not immediately visible, does not mean it isn’t there.

The main issue is a liquidity mismatch – investors demand daily pricing on an asset that cannot be traded that frequently. The FCA (late to the party as usual) has suggested that Open Ended structures are not suitable for Property investments. That may (or may not) be true, but what is undeniable is that risk and reward are still tightly entwined – in this case, higher yields in return for a lack of liquidity.

We are in a “Sell first, ask questions later” market, with investors extremely un-willing to tolerate any losses. Thus markets have entered into a Bubble, Crash, Bubble, Crash mind-set, which appears to be feeding upon itself. This manic investor psychology will ultimately pass – at EBI we have always preferred more liquid assets, and to stay out of the fray. A well-diversified portfolio is the best (and probably only) defence in this environment. It isn’t clever, it isn’t complicated, but that is the point. Occam’s Razor applies here. If there are too many moving parts to any system, it is more likely to break down. It seems investors once again needed a reminder of this reality.

P[1] FT article 10/7/16. No link available due to their paywall.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.