“All markets look liquid during the bubble (massive uptrend), but it’s the liquidity after the bubble ends that matters.” J. Schwager, Market Wizards.

Anyone who is looking at Global Investing is now (post Brexit) having to confront the currency issue. To hedge or not to hedge? Let’s see if we can make any sense of the issue…

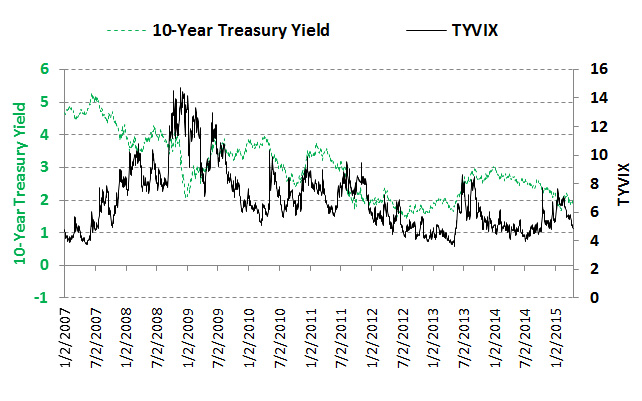

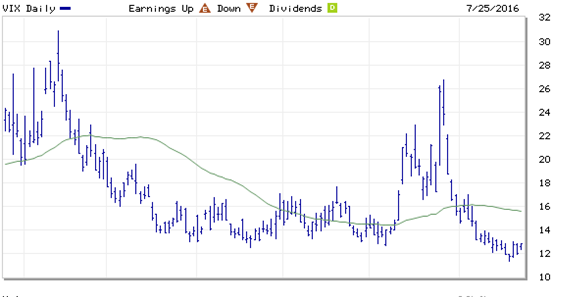

The purpose of hedging currency risk is to isolate returns on the asset class from that of the currency in which they are denominated. It is vital to ensure that asset returns are not overwhelmed by adverse currency movements. The charts below show the Implied Volatility for the (U.S.) Bond and Equity markets respectively (both are annualised figures).

Meanwhile, currency volatility levels are shown below. As can be seen, looking out 1 year, the top currency pairs (Dollar vs Yen, Euro and Sterling) are all trading way above Bond market volatility, but below that of Equity markets. This implies that there is a strong possibility that Bond market returns could be completely eroded by adverse currency moves, whereas the reverse is true for Equities. [Which of course, assumes that one could accurately analyse and interpret the correlations between a Company’s overseas operations, their own internal hedges, and the related effects on its balance sheet and cash flows on a regular basis. Good luck!]. Bonds by contrast have only one currency and a finite stream of lifetime cash flows, from which its yield to maturity follows.

Thus, it makes much more sense to hedge currency risk for bonds rather than for equities.

How do we achieve this?

Assume a client invests $1,000,000 in the Varius Bond Fund:

Step 1: Convert $1 million into Euros at the prevailing exchange rate of €1.105.

This yields a total of €907,957.

Step 2: Sell €817,978 for U.S. Dollars 6 months forward at a rate of 1.11, locking in that rate [907,957/1.11= 817,979].

Step 3: Invest the proceeds of the initial Dollar sale into the Euro denominated Bond portfolio.

Scenario one:

In 6 months’ time, the Bond portfolio has gained 1%, whilst the currency (the Euro) has lost 10%.

The Bond portfolio is now worth €917,037. The value of the currency forward is now (on the date of delivery) +€94,476.

Total portfolio value is €1,011,513. Converted back into U.S. Dollars, the investment is now worth $1, 017,107 (+1.71%).

Scenario two:

In 6 months, the Bond portfolio is up 1% and the Euro is +10%.

The Bond portfolio is still worth €917,037, but the forward rate is now at €1.2155, so has lost 0.1055 x 817,978= -86,297.

Total portfolio value is €917,037, minus €86,297 = €830,740. Converted back into U.S. Dollars = $ 1,009,764 (+0.98%).

This is an extreme example – for instance, the overall portfolio profit and loss on a +/- 3% currency move over that period is +1.638% (Scenario one) and +1.29% (Scenario two).

[Note: the reason for the asymmetric profit/loss profile is that the Forward is sold at the bid price (which is below the current Spot Forex rate). Thus losses on the Euro rising are slightly higher than corresponding gains on Euro falls].

Taking the two examples above but NOT hedging, changes the risk profile: the profit and loss for the two scenarios above are -9.30% and +9.76% respectively. The range of potential returns is large, and is not consistent with the stated aim of owning Bonds to reduce overall portfolio risk, rather than as a source of return.

Thus, the hedging process is itself another layer of risk reduction. No-one can predict currency direction with any accuracy, as this article (and this one from the previous year) shows clearly, especially so in a marketplace that is so intensively analysed and traded. We make no claims to being able to predict market movements of any kind, so it makes no sense to take on this extra layer of un-compensated risk. The overall aim is to have as wide a global spread of investment assets as possible, and currency hedging is a necessary tool to allow this . We thus achieve exposure to Global Investment assets without being forced to take currency risk.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.