“Dear Optimist, Pessimist, and Realist. While you guys were busy arguing over the glass of water, I drank it. Sincerely, the Opportunist.”- Unknown

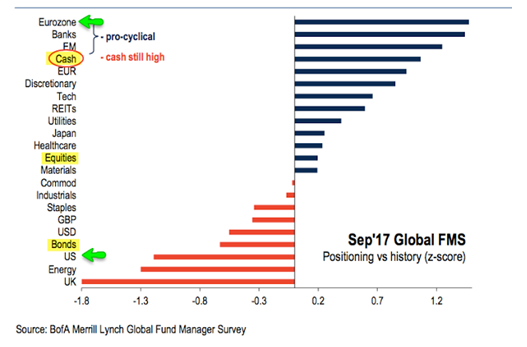

In the last few weeks, all sorts of records have been set across the world as markets react euphorically to almost everything; one might imagine that sentiment would be hyper-bullish, but you would be wrong, at least as far as the “professionals” are concerned. The latest Bank of America fund manger survey (September 2017) shows why; the lowest US Equity allocation amongst fund managers for nearly a decade (see below); worse still they have been underweight US shares since March 2015, and the S&P 500 (for example) has risen 29% in Dollar terms in that time. Their preferred regional pick, (Europe) has, over the same period risen only 21%, adding further insult to injury. As a result, whilst sentiment of the major players sinks further into the doldrums, the non-pro is doing extremely well (providing they are Indexing of course!), which for many is the last straw.

A good indicator of the malaise felt by those participants can be seen via a Google search of the term “the most hated bull market in history” which returns 1,080,000 results, a sign of the intense frustration experienced in the last 3-4 years, as Indices seem to go up and up like a Duracell bunny that just will not stop.

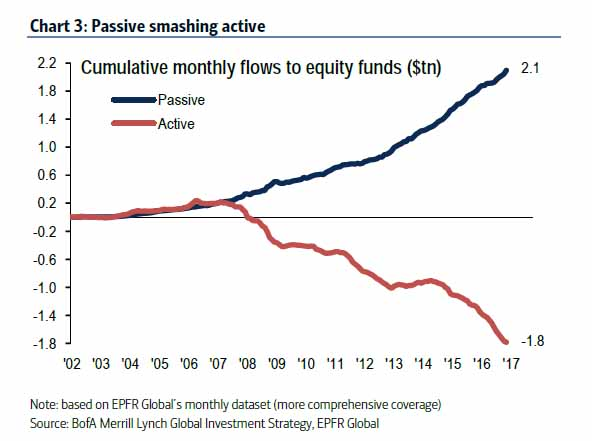

The discrepancy between the attitudes of the investment Institutions and those of ordinary investors is marked. Possibly because brokers have seen extremely low levels of trading (and volatility) for an extended period, (i.e. lower commissions) whilst fund managers have experienced performance fall further and further behind their Passive peers, which has led to a wholesale exodus from Active funds and consequent extreme pressure on their fees, (I never seem to tire of using the chart below). Meanwhile, Hedge Fund closures continue to sour the professional mood, as the Implode O Meter continues to whirl.

Of course, those selling financial products and services have not thrived either in the current situation and so are also understandably unhappy (viz. Wall Street and the City of London) and the advent of MIFID II next year is likely to accelerate this process still further. If you have tears, prepare to shed them now) or soon!)

This article summarises the main bearish consensus opinions regarding the current state of (US) markets, warning darkly of the inevitable cataclysmic collapse to come, (though carefully avoiding setting a date on it); the usual suspects, ETF and Passive investing are the cause, causing “dumb money” to pile in at what the pro’s assume is the high. The latest CFTC [1] report shows that Professional investors continue to sell the US Indices, while at the same time Individual investors remain of the opposite view. 69% of Hedge Fund investors believe that market returns will be worse than those of the first half of 2017 in the second according to a Reuters survey. Why are they all so negative?

There are several distinct groups of investors; long term strategic investors (global pension funds, sovereign wealth managers), professional traders, including arbitrage traders (think Quantitative funds etc.), the average retail investor (who regularly invests, in whatever type of fund) and the person who buys because everyone else is getting rich doing so (the Internet day trader etc.). It is the first two groups that, until recently, imagined that they determine market direction, though this is becoming less true with each passing month. Many either have not noticed the changes afoot, or are refusing to accept them-why?

The problem comes with over-exposure to markets; as they are involved every single day, professionals develop tunnel vision, (a form of Shared Information bias), which means that they fail to recognise market developments that do not arise from their own experiences. Thus, in vertical markets, they feel uncomfortable, as it is a very non-normal occurrence and outside of their experience. Focusing as they do on “fundamentals” (earnings, balance sheets etc.) they keep trying to sell the highs – only to watch prices rise still higher. Along with the fund management community, they are the people that have been bearish almost continuously since 2009 – they believe that they are correct and that Individual investors are the fools, a rather self-gratifying conceit, but one that has been confounded, as the latter have seen things for what they are, not what they should be. Thus, traders and fund managers have continually failed to “beat the market”, as they have been constantly fighting against the trend, which is undeniably up.

“The time to turn miserable is when everyone else is euphoric. We think it’s too early to make that call”, opines Robert Buckland, chief global equity strategist at Citibank, quoted in the FT (25/10/17). But is he missing the point? The downbeat atmosphere has little to do with market movements (or economic developments) and a lot more to do with some people’s concern over their future place in the business! If Passive investing was made illegal, I am sure “professional” sentiment would perk up considerably, but that would not help most end-users of capital markets and should have no influence on asset pricing whatsoever.

The greater irony of course is that we now hear from fund managers how now is the time for active management to prevail, though they have been saying that for quite a while; I am sure 2017 will be such a time though… (except that it hasn’t been, again). But if they failed to spot the rise of passive investing for the best part of a decade, which was occurring right under their collective noses, what hope is there that “professional” money managers will spot the next turning point? (Spoiler alert: none).

[1] The Commodity Futures Trading Commission publishes the net positions of various traders in a variety of financial, agricultural and Industrial futures markets. This gives us all an insight into the sentiment of a variety of futures traders – the more they buy of a particular asset, the more bullish collectively they are (and vice versa).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.