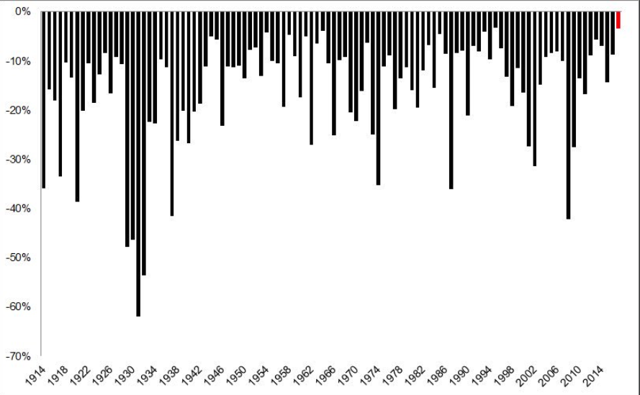

Records galore in Equities as Bloomberg reports, prices melt up, whilst volatility collapses. We are now in the second longest period without a 3% peak-to-trough draw-down, as (some) investors continue to take positives from almost all news. As we spoke about last week however, not all are feeling the love, as Professionals continue to look to sell/short markets, warning investors of crisis to come. They will be right eventually of course (as is a broken clock), so it may be time to examine risk tolerances in preparation for a correction (that may not occur, if at all, for a while). After all, forewarned is forearmed…

But what exactly are we talking about when we use the term risk? It means different things to different people and so it is important to be clear on your own definition, so as to avoid investment errors – using the wrong definition could lead to investors changing their investment strategies either unnecessarily or too profoundly, leading to investor regret.

Lets us start with some definitions to demonstrate the point; there are as many definitions as there are investors, so it is important to be clear on what one means by “risk” in the context of investments.

For Professionals, [1], risk often means volatility (as per Modern Portfolio Theory); the more volatile the asset, the bigger the potential range of returns, leading to uncertainty as to investment outcomes. For example, an asset with annualised volatility of 14% can be expected to spend two thirds of its time over any given period +/- 2% on a weekly basis. Another asset with a volatility of 21% can expect to be +/- 3% on a weekly basis for two thirds of the time. Looked at in this way, the larger the dispersion of returns the more chance there is of a loss and the greater that loss may be.

Of course, some Investors (Insurance Company’s, Pension funds etc.) see risk as the possibility that they will be unable to pay out future claims from policyholders or pensioners; for others it will be the potential loss in purchasing power as a result of inflation. For institutional investors, another (cynics might say far more important) risk, namely career risk, the potential to lose ones job if one under-performs the market for even a short period of time. In this case it is far more specific to the manager and can cause increased risk taking to try to “catch up” with market returns. This may explain the phenomenon of Window Dressing practiced by those who have missed market gains (which we may be seeing now). Investors are piling into Technology stocks, despite massive price gains in 2017).

For most Individual investors, the concept of risk is simpler- the potential for permanent loss of capital; but it is not that clear cut. After all, we may buy equities but we also buy insurance; we may avoid stocks but go hang gliding at weekends. To a certain extent, it depends on the circumstances.

If one is given a 50:50 chance of winning £1000, a risk-neutral observer would pay £500 (which is the expected value of the bet -£1000 x 50% = £500). But most would pay less, (and some much less), as a consequence of their own risk (or loss) aversion. This aversion tends to get greater as one ages, which is why financial analysts tend to recommend a greater proportion of bonds in one’s investment portfolio as one gets older. But not all investors see it that way. If one is concerned about out-living ones assets (and as longevity improves, many more may be in that situation), then the real risk is not owning enough risk assets, not too many. It depends on how the investor “frames” the decision, or how they see the balance of risks and returns [2].

To that extent therefore, the concept of Conservative, Moderate or Aggressive investing portfolios are not useful, since it may not be measuring what the investor sees as risky, and in any case, these views can change according to circumstances; that is not to say that risk questionnaires are irrelevant, but that they may not be telling the whole story.

The bottom line is that ALL investments have some risk (in whatever form you choose to see it). It cannot be eliminated, but it can be reduced, through including non-correlated assets in a portfolio to improve diversification, ensuring that a major loss does not destroy your investment strategy. By eliminating non-systemic risk (those affecting parts of the economy, rather than the whole thereof), a portfolio should be better able to withstand the systemic risks associated with markets in general. leaving them better able to ride out the market rises and falls, thereby avoiding the need to be selling into declines. That is in fact the greatest risk of them all.

[1] Not all subscribe to this, however, it is commonplace to use the term as an expression of risk. Market pundits often refer to “market volatility” as a euphemism for declines, as do Companies when explaining poor results.

[2] According to most post-Brexit analyses the young voted overwhelmingly in favour of “Remain” in the EU Referendum, which one might have thought would be the “safety first” position of the risk averse; unless you first remember that only 36% of them actually voted and that for 18-24 year old, the “risky” option would be to leave the Globalism they have lived under all their lives and for the UK to go it alone. For (some of) them, “Leave” was potentially the really risky option…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.