Introduction

The last couple of weeks have seen further pain in the UK open-ended property fund market.

On 19th October, fund manager M&G announced that it would be closing its £565m Property Portfolio fund, due to “declining retail investor interest across this fund structure”. This means that daily dealing into and out of the fund has been halted, and the fund will enter the winding-up process – selling underlying assets and returning the AUM remaining at the end of this to investors.

While such a step may be the right move for the fund, it kicks off what is typically a fairly drawn-out process of the selling of the fund’s underlying property assets – with investors unable to access their capital for what could be as long as 18 months. Alongside this, management fees will still be payable on holdings in the fund (but not applied to cash holdings), providing a double blow to investors who find themselves in this unfortunate position of not being able to access their assets, while still paying fees.

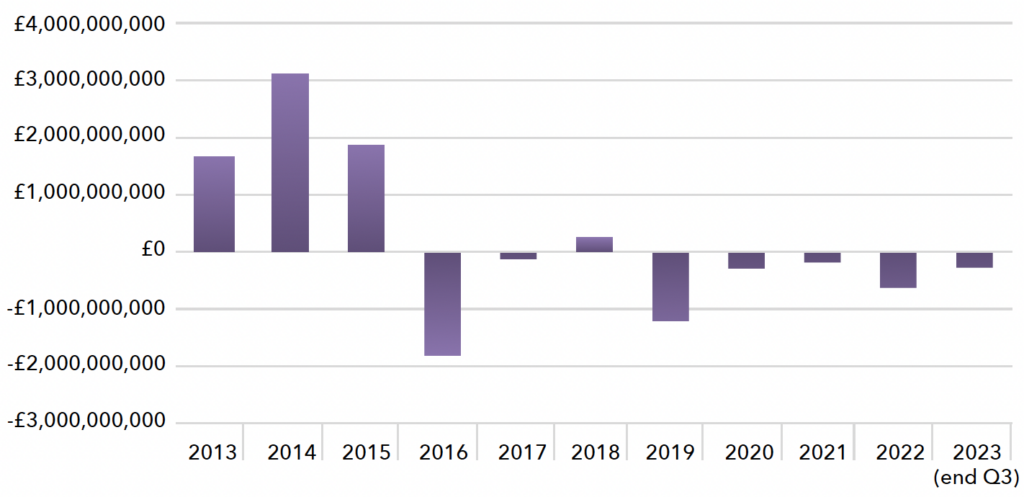

This comes off the back off a number of challenging years for the retail property fund market in the UK, which has been struggling from one blow to the next. The chart below shows net retail property fund sales in the UK – as we can see, following a number of strong years leading up to 2015, the events surrounding the Brexit vote of 2016 led to large outflows from property funds during this period. Withdrawal demand was so strong that it led to a number of funds (including those managed by M&G, Aviva and Standard Life) suspending investor redemptions, gating their funds in order to avoid becoming forced sellers of illiquid assets at unfavourable prices.

Net Retail Property Fund Sales

Source: Investment Association, data to 30/09/2023.

This event highlighted one of the core inconsistencies with such fund vehicles; offering illiquid assets (large real estate investments) in a liquid (typically daily) dealing vehicle. While these funds can operate well in favourable market environments, when concern and panic sets in and investors rush to the door, there is simply no way to satisfy all redemption requests in time; suspending further redemptions from the funds can be the only way to manage the short term illiquidity situation.

While 2016 was a warning shot, we then saw similar events transpire during covid-19 pandemic – with a range of funds suspending trading once again, as investor confidence in the real estate sector took a further blow over the impact of the pandemic, with investors again running to the exits. The failed Liz Truss and Kwasi Kwarteng mini-Budget last September was again another moment in which withdrawals were restricted from a range of funds, in response to investor panic setting in.

Alongside this, due to the inherent underlying confidence (or lack thereof) required for these open-ended vehicles to operate, a number of times we’ve seen funds re-open following suspended trading, only to have to close once again as investors demanded their money back, without any specific event triggering this. As such, one could argue the writing has been on the wall for a number of these funds ever since the 2016 suspensions, and it’s just been a matter of waiting until the point in which the underlying fund managers decide to throw in the towel.

We can see these dynamics continue to play out in the market today; following M&G’s announcement, St James’s Place announced it has suspended trading in its property fund, following a large increase in investor redemption requests, with the confidence trick inherent in this asset structure being exposed once again.

Here at ebi, property is viewed as an asset class that does not provide any additional diversification (risk-reducing) benefits or risk-adjusted returns to a portfolio when held above the market-cap weighting.

We sympathise with any investors caught up in this situation, however would also note that the announcements outlined above unfortunately mean another hit to investor confidence, which may lead to a further round of redemption requests from investors across the openended property space. As such, for any investors still holding open-ended property fund allocations, it may be worth reconsidering the risk-adjusted return merits of such a holding (with a focus on the risk surrounding a wave of redemption requests), or whether this capital might be better deployed elsewhere.

If you would like more information on any of the areas covered above, then please don’t hesitate to get in touch with us through your usual ebi representative, or by emailing us at: enquiries@ebi.co.uk

Blog Post by Jonathan Griffiths, CFA

Investment Product Manager at ebi Portfolios

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025