It’s been another busy year…

…here are some of ebi’s top highlights from 2023.

The Bigger Picture

September – A successful year with Parmenion

After being acquired by Parmenion in September 2022, teams across both firms have established collaborative ties, and some key technology projects have been kick started.

Did you see Craig debating Active vs Passive investing at Parmenion’s ‘Let’s Grow ‘event in November?

New Portfolio Suites

February – Launch of Core Portfolios Suite

Core is a passive, globally diversified portfolios suite designed by our investment team specifically for cost focused clients who prefer to simply track the market.

March – Launch of Core ESG Portfolio Suite

ebi continued to broaden its investment offering with its Core ESG suite, a range of market-indexed portfolios with an Environmental, Social and Governance (ESG) overlay.

April – Launch of World Portfolio Suite

ebi’s World portfolio suite is another exciting addition to its investment range, which seeks to combine a globally diversified strategy with a factor tilted approach. World aims for factor diversification through exposure to five key factors, which evidence suggests may deliver premiums in excess of the global market.

Price Reductions

ebi secured a reduction in the annual management charge of the following funds.

August – GSI’s Global Sustainable Focused Value Fund

GSI’s Global Sustainable Focused Value Fund

September – Arabesque’s Global ESG Momentum Fund

Arabesque’s Global ESG Momentum fund

New Tools

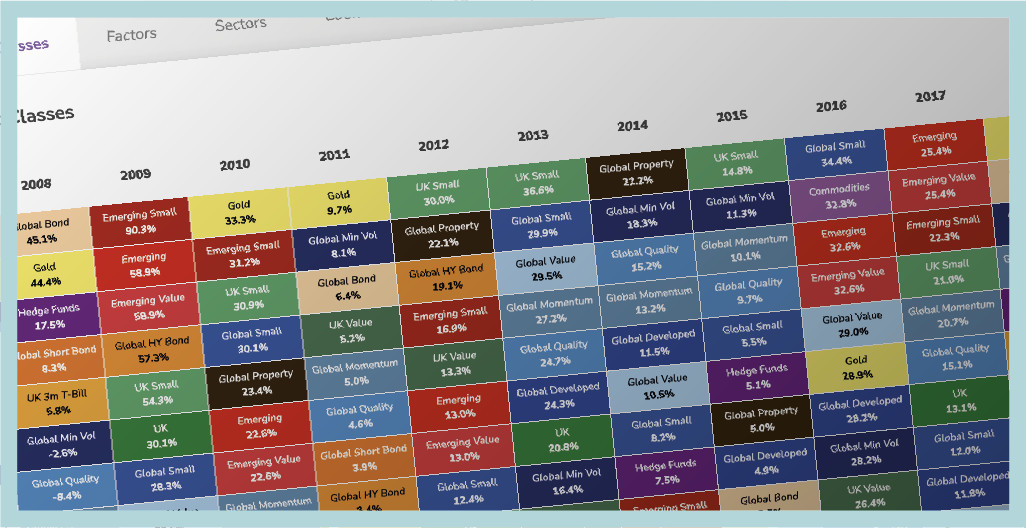

April – Randomness of Returns

ebi introduced Randomness of Returns, an application that visualises how returns are uncorrelated between annual periods, using interactive tables. A useful tool to demonstrate to investors the benefits of a well-structured globally diversified portfolio.

July – Over 1,000 InSight Reports delivered

Not exactly a new tool but certainly a milestone to celebrate, with advisers submitting over 1,000 requests completed by July. Not one to rest on their laurels, our investment team introduced some exciting enhancements such as new scenario analysis to see how your portfolio would perform during past market events, expanded factor, sector, and currency analysis and integration of new and improved ESG data for a comprehensive assessment.

October – Upgraded Vault dashboard

Our upgraded portal dashboard provides a more personalised and streamlined experience for members. The enhancements included the ability to customise the dashboard including company branding.

Member research, analysis and client tools

June – World Portfolios mapped to Oxford Risk

ebi’s World portfolios were officially mapped using Oxford Risk’s rating service and added to ebi’s risk profiler (built within the Turnkey cash flow modeler).

August – Core, Core ESG and World Portfolios available on Lang Cat

Allowing advisers to undertake completely independent research and due diligence on the portfolios, based on suitability, and compare them to the rest of the market.

ebi in the News

Just some highlights of ebi in the news.

“ebi’s CEO: Great stock-picking is more luck than skill“

“In an uncertain macroeconomic climate, the passive versus active debate rages on. Evidence Based Investing CEO Craig Burgess told NMA reporters why his firm favours passive investing in this climate, and just how low ebi’s prices will go.

“The factors investors should use if they fear a recession“

“Minimum volatility and quality assets best to protect against UK’s lacklustre economic environment.“ by Jonathan Griffiths, CFA. Investment Product Manager at ebi.

“Parmenion-owned ebi enhances adviser portal in major tech upgrade”

“Parmenion-owned discretionary fund manager ebi has upgraded its online portal as part of a major overhaul of its adviser-facing technology.”

“Positive change: Assessing the regulator’s SDR policy statement“

“In light of the Financial Conduct Authority’s (FCA) publication of its Sustainability Disclosure Requirements (SDR) policy statement, Jonathan Griffiths summarises key aspects of the regulation, including the changes compared to the regulator’s previous Consultation Paper on the regime.”

Events

September – Nottingham Insurance Institute Education Conference

Craig, Debbie and James represented ebi, with Craig giving talk on his journey as an IFA and a thorough breakdown of what evidence-based investing is.

September – Octo Members Group Prog Plan 23

Ashley and James had a great day at the Octo ProgPlan ’23 event in London, they enjoyed some interesting presentations and catching up with advisers new and old.

New Starters

The ebi team continues to grow

ebi welcomed Alasdair (Junior .Net Developer), Chris (Data Analyst), Gurdeep (.Net Developer), Jack (Junior .Net Developer), Jonathan (Investment Product Manager), and Lateefah (.Net Developer) in 2023.

2024 sets to be an even bigger year for ebi with some exciting upgrades in our adviser technology toolkit, plus a range of new investment products becoming available.

Keep up to date with what ebi is up to by subscribing to our mailing list.