Sustainability Disclosure Requirements & Investment labels – Final Policy Statement released by the FCA – ebi’s response

Watch our webinar ‘Labels to enable’ SDR and what it means for advisers with Rebecca Kowalski

On Tuesday 28th November, the FCA published their long-awaited final Policy Statement for the Sustainability Disclosure Requirements (SDR) and Investment Labels regime. This followed their previous October 2022 Consultation Paper, on which widespread feedback was provided by the industry in a range of areas across almost 250 responses.

The following summarises some of the key aspects of the Policy Statement, including providing insight on where changes have been introduced in comparison to the previous Consultation Paper.

Anti-greenwashing rule

As previously communicated, the FCA will be introducing an anti-greenwashing rule (applicable to all FCA authorised firms who make sustainability-related claims about their products and services), reinforcing that sustainability-related claims must be fair, clear, and not misleading.

The FCA expects sustainability references to be:

• Correct and capable of being substantiated through evidence.

• Clear and presented in a way that can be understood.

• Complete: considering the full life-cycle of the product or service and not obscuring important information.

Fair and meaningful in relation to any comparisons to other products or services.

Originally, the FCA had indicated that this rule would be implemented immediately after the publication of the Policy Statement, however they are now consulting on this (until 26 January 2024), and the rule will come into force in the FCA’s handbook on 31 May 2024.

There are some interesting examples of greenwashing providing in the Guidance to the Consultation, including a company making a promotional statement that an investment fund is ‘fossil fuel free’, however, the terms and conditions noting that the fund includes investments in companies involved in the production, sale, and distribution of fossil fuels where the company’s revenue earned from those activities is below a certain threshold. This claim is seen as not factually correct and not capable of being substantiated, therefore making the claim potentially misleading.

Portfolio management

The FCA have also decided to delay introducing rules on ‘portfolio management’ (including MPS/DFMs such as ebi), but instead will consult on this in early 2024 – following concerns that the guidance previously proposed would be unworkable for the industry (for example the situation regarding portfolios holding overseas funds).

This consultation process will address how the new labelling rules impact MPS and other discretionary wealth services where retail money is managed. Some of the issues they’ll be working through include the minimum threshold required for a portfolio to be classified with a label. For example, in the previous consultation paper it was proposed that 90% of a portfolio’s assets needed to be awarded a label in order for that portfolio to achieve the same label, which raised obvious queries regarding portfolios investing across a mix of labels, and in diversifying assets such as cash.

As we can see from the changes in the Investment Label section of SDR below, the FCA has addressed this in the funds space through introducing a fourth label (which presumably will be part of the future rules for portfolio managers), and a looser requirement of 70% assets being given a certain label in order for a (e.g. multi-asset) fund holding those funds to achieve the same label.

They’ll also be working through the situation in relation to overseas funds – the SDR applies to UK funds only, and overseas funds are not in scope. For portfolio managers such as ebi who invest across both UK-domiciled and overseas funds, a well-thought out approach is required in order for the regulation to be effective and proportionate.

In light of this, ebi welcome the FCA delaying the implementation of new rules for portfolio managers in order to consult and put appropriate regulation in place, as opposed to rushing the process and putting in place poor or unworkable regulation.

Investment Labelling

The FCA has made a number of changes to the Investment Labelling regime outlined in the previous Consultation paper. As mentioned above, this includes the FCA confirming that overseas funds are not in scope (with the FCA stating: “We will continue working with Her Majesty’s Treasury to understand the options for extending the regime to overseas recognised funds, including those marketing under the Overseas Funds Regime.”).

The most significant change is the introduction of a 4th label (in addition to the 3 previously proposed); Sustainability Mixed Goals. This has been introduced to cover funds that invest across a range of sustainability strategies. There have been small changes to the naming of the other labels, changing the word ‘Sustainable’ to ‘Sustainability’ – to reflect how some assets are on “a journey to becoming sustainable”.

The 4 labels are:

1. Sustainability Focus:

Applicable to products investing mainly in assets that are sustainable for people and/or the planet.

Assets will need to meet a credible standard of environmental and/or social sustainability, or be aligned with a specified environmental and/or social sustainability theme (and other assets must not be in conflict with the sustainability objective)

Firms will be tasked to set their own “robust, evidence-based” standards (replacing the previous “credible” wording) to ensure they align with the product’s sustainability objectives.

2. Sustainability Improvers:

Applicable to funds investing in assets that may not be sustainable now, but aim to improve their sustainability for people and/or planet over time, including in response to the firm’s stewardship influence.

This is determined by their potential to meet a robust, evidence-based standard that is an absolute measure of environmental and/or social sustainability (including the use of relevant KPIs).

Firms will need to identify the period of time by which the product and/or its assets are expected to meet the standard, including short and medium-term targets.

3. Sustainability Impact:

Applicable to funds investing in solutions to problems impacting people or the planet to achieve a pre-defined positive measurable impact (in relation to an environmental and/or social outcome).

These products will need to have an explicit objective to achieve a positive and measurable contribution to sustainability outcomes.

Firms will need to specify a theory of change setting out how they expect their investment activities and the product’s assets to achieve a positive impact.

One change is that financial additionality is no longer required, meaning it is not required to invest new capital for underlying products to qualify for the label – this means this label has been expanded beyond primary markets.

4. Sustainability Mixed Goals:

Applicable to funds investing across different sustainability objectives and strategies aligned with the other three categories.

Firms will also need to disclose details of the proportion of assets invested “in accordance with each relevant label”.

The FCA has also introduced a 70% minimum threshold across all labels – 70% of the gross value of assets must be aligned with their respective sustainability objective. They’ve clarified that this has been set at what they perceive to be a pragmatic level, enabling consumers to understand what they are investing in while enabling funds to hold other assets such as for liquidity or risk management purposes. They’ve also clarified that the remaining 30% of assets should be disclosed, with transparency provided on whether they may impact the objective of their respective labels.

Additionally, the FCA has said funds may no longer hold assets that are in conflict with their sustainability objective (defined as what a reasonable investor would consider) – this is a tightening of the rules compared to the previous consultation paper.

Alongside this, the FCA have amended the proposals to allow asset managers to promote non-labelled funds with ESG characteristics – e.g. non-labelled funds can now use terms such as ‘green’, ‘net-zero’, ‘responsible’, however there will be rules as to how these funds can be marketed, and a requirement for consumer-facing disclosures to clearly state how they are invested and why no label is used.

For all labels, independent assessment confirming the standard is fit for purpose may be obtained via either internal processes or third parties, provided that the chosen method is independent from the manager’s investment process.

The FCA have estimated that the introduction of the 4th label will lead to c.630 sustainable funds in the UK marketplace being covered under this regime (up from 450), however that they expect only 45% of these 630 sustainable funds to receive an investment label.

The labelling regime will become effective on 31 July 2024 (earlier than the 12 month implementation period previously communicated)– with firms expected to begin using labels alongside relevant disclosures.

Rules for Distributors (including advisers)

Advisers and platforms fall under this category, in the sense that they are distributing labelled funds, rather than being responsible for the management and labelling of the funds themselves (other than the exceptions where underlying fund management is being carried out alongside distribution).

The Policy Statement clarifies that Distributors must accurately communicate and update the relevant fund labels and disclosures to their clients, and keep them up to date following changes made by the firm. Also, where relevant, Distributors should prepare to add a notice on overseas funds to inform consumers that they are not subject to the regime.

However, while new ESG advisory rules for advisers were expected in the Policy Statement, the FCA has not provided these – instead they have noted that they continue to explore how to clarify its expectations for advisers around taking sustainability matters into account in investment advice and suitability.

In light of this they have stated that they are planning to set up an independent working group for

the financial advice industry to work together to build on existing capabilities in sustainable finance, including how the SDR and labels support their role.

Naming and marketing rules, and Disclosures

The FCA has confirmed that these rules are applicable to UK asset/fund managers and their UK-domiciled products marketed in the UK, along with targeted rules for the distributors of investment products to retail investors in the UK. Overseas funds are not in scope.

The new naming and marketing rules will centre on consumer protection, in light of the introduction of the Consumer Duty in July 2023. They are designed to ensure the use of sustainability-related terms is accurate, with the FCA expecting firms to be able to “accurately describe their products so that consumers are able to navigate to those that meet their needs and preferences”.

The Policy Statement outlines the detailed information required in pre-contractual, ongoing product-level, and entity-level disclosures, targeted at institutional investors and consumers seeking more information.

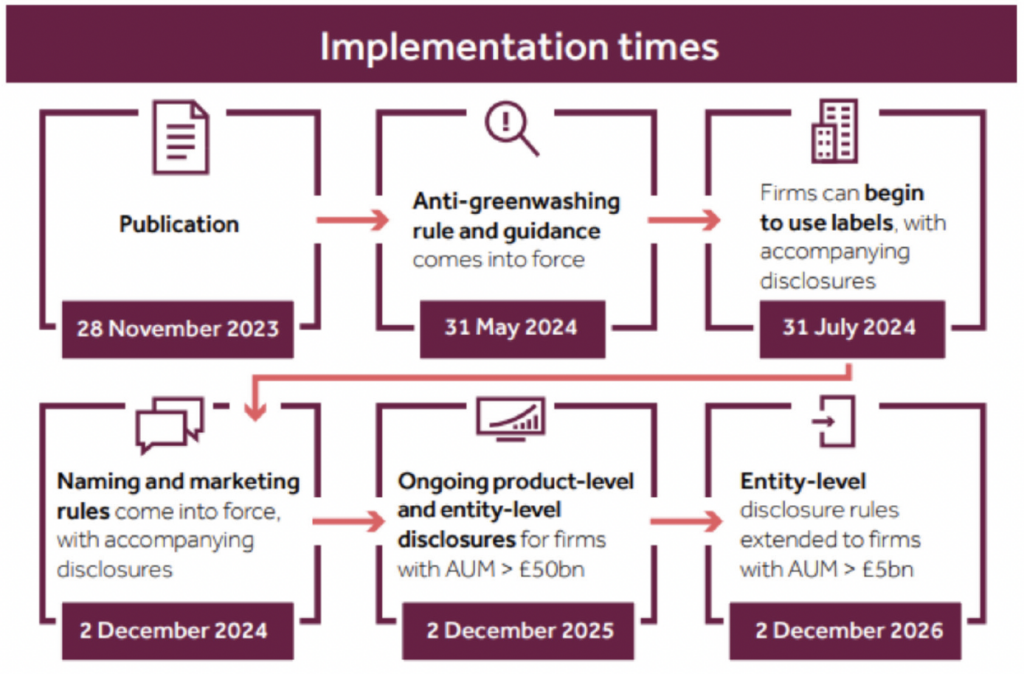

These naming and marketing rules will become effective on 2 December 2024, and ongoing product-level and entity-level disclosures will come into force for firms with more than £50bn AUM on 2 December 2025, while entity-level disclosure rules for firms with more than £5bn AUM will be introduced on 2 December 2026.

Timelines

Here’s a summary of timelines mentioned above, in a graphic provided by the FCA:

In summary, we welcome the publishing of the final Policy Statement by the FCA. We believe that this regulation will bring positive changes to the industry, including through the clampdown on greenwashing, and the greater transparency around sustainable investing that we expect it will lead to.

While we would like regulatory clarity in this area for the portfolio management industry, we believe it is sensible for the FCA to have delayed the implementation of new rules for portfolio managers in order to consult and put appropriate regulation in place (addressing the range of issues raised by the industry), rather than rushing the process and putting in place poor or unworkable regulation. We look forward to the consultation process, and actively participating in this.

We hope the above summary is useful, and we will share further developments with you as and when they arise. If you would like more information on any of the areas covered above, then please get in touch with us through your usual ebi representative, or by emailing us at: enquiries@ebi.co.uk

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk. Our publications do not offer investment advice and nothing in them should be construed as investment advice.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Griffiths, CFA

Investment Product Manager at ebi Portfolios

What else have we been talking about?

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025

- Ruffled Feathers: Exploring Black Swan Events

- Q1 Market Review 2025