What We Offer

Discover a broad range of user-friendly and innovative technology; Cashflow Simulation, Portfolio Comparison, Custom Branding and more

Awarded Best

Value for Money 2025

ebi’s Earth Suite Awarded Best

Sustainable/ESG Investment Portfolio 2025

Awarded Best

Outsourced Investment Manager 2025

ebi offer a complete technological toolkit to help advisers at each stage of the advice process, from the initial discovery meeting to ongoing client reviews.

ebi supports advisers in:

De-risking their

business

Implementing an

investment solution

Compliance framework

A suite of investor friendly

presentation tools

Co-branded marketing

collateral

What we offer – Helping advisers every step of the way

Step One

Client Onboarding

- Risk profiler – client attitude to risk

- Client facing infographics, video and brochures

- Communication workshop training

Step Two

Research and analysis

- Portfolio comparison reports

- Platform due diligence

- ebi’s cashflow modelling tool

Step Three

Presenting

- Co-branded materials

- Interactive tools to facilitate the presentation of ebi’s portfolios e.g. Randomness of Returns

- Workshops on how to use ‘presenting’ tools during client reviews

Step Four

Implementing

- Choice of Reliance on Others or Agent as Client contracts

- Mapped to leading industry risk profilers

- Available on 20 platforms

- Outstanding support available

- Suitability support wording templates

Step Five

Portfolio Management

- Competitively priced DFM fee of 0.12%.

- Tolerance based rebalancing

- Access to restricted share classes

Step Six

Ongoing review

- Market commentary and educational materials

- Regular coaching roundtables and webinars

- Ongoing support and development

Core benefits of ebi

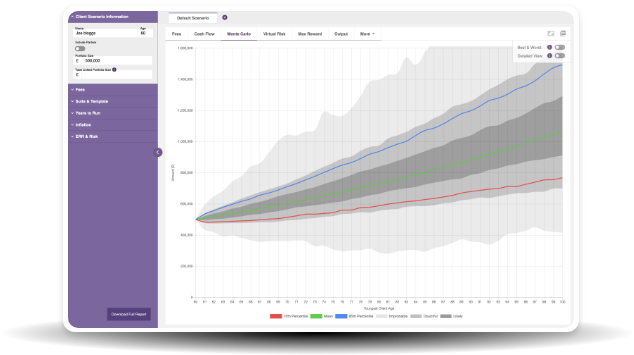

Turnkey – ebi’s risk profiling and lifetime cashflow modelling tool

Turnkey is tied to ebi’s portfolios, and enables advisers to provide peace of mind for clients through an organised plan showing what their finances could look like when projected into the future.

Input key information such

as portfolio risk and

retirement data

Monte Carlo simulations

plot potential client

scenarios

Results of likelihood of

outcomes and best and worst

case scenarios

Risk profiling and cashflow modelling explained

Risk profiler

Clients’ attitude to risk is mapped via a risk profile questionnaire, developed in conjunction with Oxford Risk.

The profiler uses Oxford Risk’s robust methodology for its questionnaire, outputs and weighting, using their expertise in combining behavioural finance, data science, and technology. These outputs are mapped to ebi’s portfolios.

Cashflow modelling

The profiler facilitates advisers in modelling cashflow journeys, using the results to help identify portfolios matching the clients appetite for risk.

Other information inputted into the cashflow modelling software includes the initial investment amount, regular payments, retirement date, and timeline they want to model.

This illustrates a clients financial position relative to their investment objectives.

It then uses a Monte Carlo simulation to plot information into potential scenarios over the period.

InSight – ebi’s portfolio comparison reports

Using the ISIN’s provided, InSight give a detailed analysis of a portfolio or fund performance, equity, and fixed income exposures, and ESG metrics against a comparable ebi portfolio.

They are completed free of charge by ebi’s in-house investment analysts.

Compare client’s portfolio

against ebi portfolio

Save time, and facilitate

client conversations

Compare fund or portfolio

at given valuation date

What do our advisers say?

“The new research is fantastic! It has helped win a new case from a competitor today.”

“There is far more information in those reports than I was expecting to receive. Expectations thoroughly exceeded.”

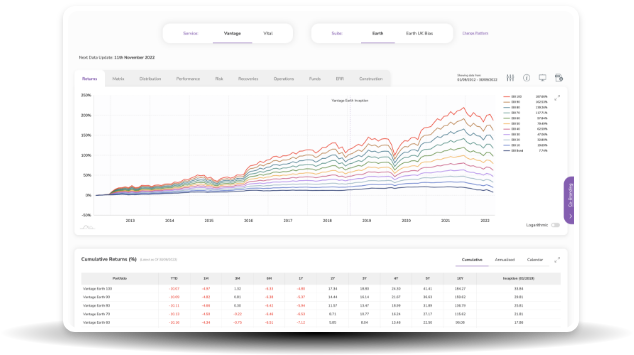

The Vault – interactive tools to present ebi’s portfolios

The Vault, is ebi’s portal, through which ebi’s portfolios can be viewed and analysed. It allows the adviser to prepare for client meetings, address any questions quickly.

The Vault can interrogate ebi’s passive, low cost portfolios across 20 platforms. Advisers can present detailed and complex information, clearly and concisely to investors, leaving them with a greater understanding of what they are investing into.

Visually demonstrate

portfolio performance

Present portfolio funds,

weightings and costs

Customisable styling,

tailored to your brand

The Vault, a suite of interactive tools

- Returns and performance data

- Risk vs reward charts

- Breakdowns of the portfolios’ funds

- Operational information

- Target weightings

Why choose ebi?

Competitively priced DFM fee of 0.12%

Access to restricted share classes

Support Wording

Co-branded marketing materials

Educational materials, webinars and roundtables

Tolerance based rebalancing

ebi has created a range of low-cost, diversified, passively managed portfolios.

Our portfolios are available on

From WRAP platforms, risk profiling software, fund providers and analytical research, ebi are happy to help with partners.