This blog overviews the tried and tested strategy of pound cost averaging. This strategy, combined with self-discipline and sticking to your investment plan can be beneficial for investing – even when markets are volatile.

Topics we cover:

• Pound Cost Averaging

• The VIX (Volatility Index)

• Market volatility

The recent past has shown volatility is something that investors have to live and deal with. Brexit, Covid-19 and the Russian invasion of Ukraine have caused spikes in volatility and put downward pressure on portfolios. These situations have, at times, startled investors who then begin to question their long-term investment strategies.

During the start of the pandemic we saw the majority of the population adhering with the lockdown restrictions, albeit without much enthusiasm. Notably, this enthusiasm wore thin as the number of lockdowns and restrictions grew. Meanwhile, a minority, not just rebellious teenagers, discard self-control and were tempted to breach the regulations, risking fines.

Saving with stock market investments for any objective is just as difficult because it needs willpower, self-control and discipline to stay with your investment strategy to achieve what may seem like an abstract and distant objective.

Life is teeming with examples of how willpower is tough to maintain. Gym memberships and diet clubs such as Weight Watchers, alcoholics anonymous and substance abuse clinics are typical ways people reach out for help with problems of self-control.

Most investors would much rather have £1000 now than £1000 the year after next. People prefer to have instant gratification, and treat losses differently to gains even if they have the same value. These behavioural biases are a particular problem during market turbulence. According to two distinguished behavioural scientists: “Three years of losses often turn investors with thirty-year horizons into investors with three-year horizons”(1). Fortunately, regular saving, technically known as pound cost averaging, is available as a cure to control behavioural challenges as damaging as these.

Pound Cost Averaging

Pound cost averaging (PCA) invests an equal amount at regular intervals which reduces the average cost of units per investment bought, by buying more units when their price is low and buying fewer when the price is high.

Saving for retirement or any other long term objective is hard work precisely because it requires the suspension of desires to consume things right now. Saving regularly helps overcome indecision and procrastination by setting a plan. Pound cost averaging means following a strict investing rule to save mechanically regardless of adverse stock market conditions or the ups and downs of personal incomes.

Some of the most popular regular savings vehicles, with added tax incentives, are pension savings plans, but any investment objective can benefit from the pound cost averaging technique, across time and different market conditions. Of course, it can seem so much more difficult to save regularly from a monthly salary, than from a year-end bonus or windfall, even if the invested amounts are identical.

When stock markets are unusually volatile, for example during the recent humanitarian crisis in Ukraine, rules about investing have even greater usefulness. Following an investing rule overcomes the temptation to try and time the markets, which can go disastrously wrong if markets whipsaw, as well as incurring trading costs and fees. Pound cost averaging can be a disciplined way to take advantage of volatile markets.

The VIX (Volatility Index)

Commonly referred to as the fear index, the VIX is a real-time market index that measures the 30-day forward-looking market volatility. The index is derived by looking at the price of S&P 500 index options.

Market volatility, often measured by the VIX index, recently tested record highs. Volatility means stock markets are headline news. Investors are tempted to look at their investment accounts more frequently, and some investors feel an irresistible urge to place trades. Research(2) suggests risk-taking and stress transform our body chemistry and drive us to irrational exuberance or pessimism.

Studies(3) suggest female investors outperform male investors and researchers trace this outperformance to the fact that women trade their accounts less frequently than men and suffer less damaging overconfidence. So rules are very useful when the first lines of defence of your investment plan in enforcing self-control are in danger of failing. Pound cost averaging offers a rule to bypass many common investing missteps.

Explainer: Pound Cost Averaging

Investing should always be for the long term. Particularly in volatile markets, drip-feeding investments can be a more successful approach than a one-off investment.

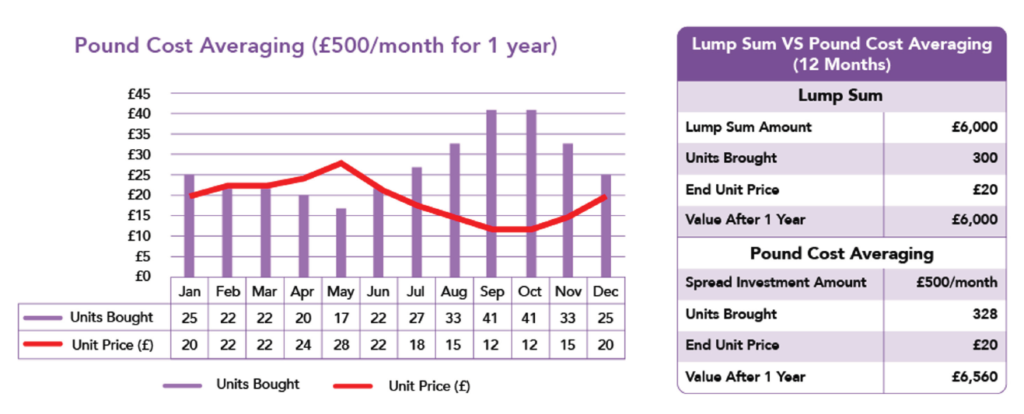

In our example table, you can see a comparison between investing in units of a notional investment with a lump sum of £6000 and investing £500 per month over 12 calendar months. Even though the underlying price of the units ends the same as at the start of the year (£20) because of market volatility the pound cost averaging approach beats the lump sum approach hands down. Diversifying across time in this way should allow your investments to dampen the impact of market volatility with ease.

(1) A Behavioral Framework for Time Diversification, Financial Analysts Journal, Kenneth Fischer and Meir Statman, May/June, 1999.

(2) The Hour between Dog and Wolf: Risk Taking, Gut Feelings, and the Biology of Boom and Bust, John Coates, 2013.

(3) Boys Will be Boys: Gender, Overconfidence, and Common Stock Investment, Brad M. Barber and Terrance Odean, The Quarterly Journal of Economics, Vol. 116, No. 1 (Feb, 2001), pp. 261-292.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Raj Chana

Investment Analyst at ebi Portfolios.

What else have we been talking about?

- Q2 Market Review 2025

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025