“I can calculate the motion of heavenly bodies, but not the madness of people”. – attributed to Sir Isaac Newton.

“To every action there is always opposed an equal reaction”. Newton’s Third Law of Motion

August is supposed to be a quiet month, as dealers go off to the beach, but it is not turning out that way so far – Turkey has seen a nasty decline in both its currency (the Lira) and it’s asset markets as investors look to get out at almost any price. It seems that it is becoming increasingly difficult to distinguish between the Lira and Bitcoin on volatility terms and is in danger of starting a self-reinforcing bout of contagion in global asset markets. How did this happen and what does it mean for investors ?

The timeline is strikingly similar to past occurrences in Emerging Market countries – since becoming President in 2014, Recep Erdogan has cut an increasingly authoritarian figure, as he aggressively micro-manages the economy, even appointing his son-in-law as the country’s Finance Minister and railing against both high-interest rates AND the consequently lower Turkish Lira. Unsurprisingly, foreign investors did not like much what they saw, pushing the Lira and thus Turkish bonds sharply lower and 5-year Credit Default Swap rates up from 166 points in February to as high as 538 as of the middle of August (almost without a pause). Things came to a head when the Turks placed a US religious preacher, Andrew Brunson under house arrest (after charging him with spying and terrorism offences); Trump retaliated by doubling the already announced metals tariffs on the country, (in part to counteract the previous devaluation of the Lira, which had had the effect of wiping out the impact of the original tariffs), causing widespread panic in dealing rooms across the globe.

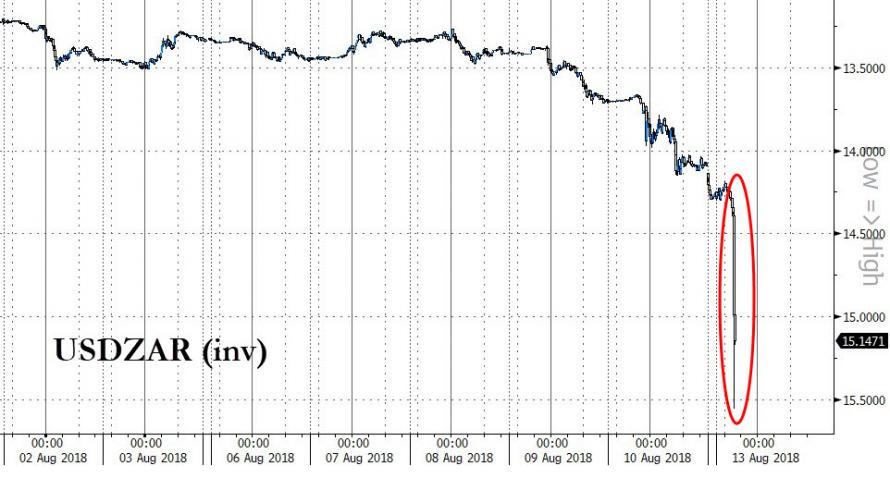

As of 13/8, the Lira was down c .45% against the US Dollar this year, 10-year bonds are now yielding 21% and the contagion is spreading. Reports that the ECB was concerned by the exposure to Turkey of European banks led to steep falls in both Spanish and Italian banks and to top it off, the currency woes spread to South Africa, with the Rand falling 9% or so in a day! Things have calmed down a little since then, but market nervousness persists.

Erdogan’s response thus far has been straight out of the conventional political playbook; make speeches blaming the Media, blame Trump, blame “speculators” (indeed anyone but Erdogan himself), call on the populace to sell Dollars for Lira, claim that all is well (10-15% falls in a nation’s currency are, apparently, mere “fluctuations”) and if all that fails, there is Plan B or C (according to a speech given over the weekend). Some are wondering if B is “Block” capital from leaving (i.e. capital controls) and C is “Confiscate” Gold and US Dollars – by the end of the week, they had done both. They are also making it harder to “short-sell” shares on Turkey’s stock exchanges, though to be fair, Europeans have form in this area too.

For all his bluster, Erdogan surely knows that things are in danger of spiraling out of control. Turkey’s banks will have to service an unsustainably high amount of bond maturities in the next few years (and there are around $3.5 billion in Turkish bond maturities this year alone). Goldman Sachs has warned that at 7 Lira to the Dollar, bank’s risk capital will be wiped out, which is looking increasinly possible.

Investor over-reaction is par for the course; recent revelations that a fund manager for a Swiss firm GAM, breached internal policies, leading to his suspension also resulted in the ultimate closure of nine funds as investors fled, redeeming their holdings in droves. It also demonstrates that investors are nowhere near as confident as they appear, as the exit doors remain too small to accommodate the sellers. We saw the same fickle behaviour in the aftermath of Brexit in UK Property funds too, indicating, as then, that for all the bulish bravado, investors need no excuse to panic at the slightest sign of trouble.

So far, we only have a few known casualties; it is very early days (and fund flows suggest that we have not the seen the final toll); it will, however, serve as a salutary lesson to some, who appear to have become “risk blind” in recent years; many either did not understand the risks they were taking or didn’t seem to care. The fundamental problem is that analysts and investors can model to a reasonable extent a Country’s ability to pay a debt, but not the willingness to do so. Unfortunately, Investors have confused the two – will Erdogan, still smarting from the EU’s rejection (via permanent delay) of Turkey’s application to join the Single market, really be prepared to allow a massive sale of local assets to foreigners or a crushing recession (by raising interest rates) to “bail out” the EU’s lenders to that country, particularly as it would have major implications for his most cherished possession (power)? Turkey’s total external debt is approaching $500 billion, which means that John Paul Getty’s quote becomes extremely germane. If you are investing in an environment where the rule of law is NOT widely adhered to, one is displaying a faith that ability and willingness to pay are the same – they are not. In a world where inflation has stubbornly refused to ride to the rescue of debtors (by inflating away the debt), the option to repudiate it becomes increasingly attractive. This is why Emerging Markets assets are “cheaper” than those of the Developed World – because they are riskier!

EBI’s exposure to Turkey is extremely limited, both in equities and in bonds; it represents around 0.68% of the MSCI EM Index (which we aim to track via the Vanguard EM Stock Index fund) and is below 0.35% of the Barclays Global Aggregate Bond Index (which we invest in via the Vanguard Global Bond Index fund) – there is a small additional exposure through Value and Small Cap shares, (according to the Dimensional EM Value fund annual report, it has 0.96% invested in Turkish stocks as of May 2018, whilst the Small Cap exposure was 1.37%). Adding this together, EBI 50 (Global) thus has c.0.14% invested in Turkish assets [1].

Of course, it has been higher in the past, because the nation’s weighting in the various EM Indices was also higher, but the main point of Index tracking is to maintain weightings to a sector/country/asset; as it rises or falls, the exposure is adjusted accordingly. So, as the assets’ relative prices move, so does the weighting in the portfolio. Any falls that have occurred, will be reflected in the current, lower, percentage weightings.

Although things look grim at present, it is only one in a series of market “panics”, caused in no small part by Investors’ tendency to “herd” into the same, fashionable positions (a form of groupthink). Once again, lessons regarding risk control and overconfidence will have to be re-learnt. There will be losses for some.

The good news is that investors in EM appear to be defensively positioned already, so the damage may not be so extreme this time around. (Note the extremely bullish positioning in US markets). But contagion is a funny old game…

[1] Simply multiply the assets exposure in the portfolio by the fund’s weight in EBI 50, to get the overall exposure; as above, the calculations are thus 0.68% x 2.94% (0.02%)+ 0.35% x 14.21% (0.05) + 0.95% x 3.96% (0.04%) + 1.37% x 1.89% (0.03)= 0.14% of the total portfolio.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.