Bonds have traditionally been a reliable asset class in periods of market stress. In the current economic environment, bonds have been falling alongside equities and this blog takes a deep dive at why this is happening and do bonds still offer protection to your portfolio.

Topics we cover:

• Why are bond prices falling?

• Bonds are supposed to protect you on the downside so why are both equities and bonds falling?

• How much protection are bonds providing?

Current Situation

The current situation is rare in that both equities and fixed income have been falling. High inflation and fears of a slowing growth rate have been headwinds to both asset classes and headaches to central banks.

Inflation concerns have rapidly increased in the first half of the year. While central banks thought inflation would partly normalise and take care of itself in 2022, they were blindsided by the sudden Russian invasion of Ukraine. Russia is also a major energy and commodity producer with it providing roughly 10% of the global supply of oil and supplying Europe with around a quarter of its crude oil imports and 40% of its natural gas imports. The sanctions put in place have therefore affected energy and commodity prices, pushing them exponentially to extreme levels. This has intensified the surge in inflation, supply chain disruption, and the risk to global growth. The biggest issue we are seeing is when certain industries can pass off inflationary pressures to the consumers: prime examples are the energy, automotive and retail industries.

Why are bond prices falling?

The main narrative is the shift in gears by the central banks on hawkish stances which has led to further downward pressure on bond prices. The market environment is rare in that bonds and equities are falling in the same direction due to inflationary pressures. The unfortunate events taking place in Ukraine have exacerbated inflationary pressures due to the unexpected inflation created.

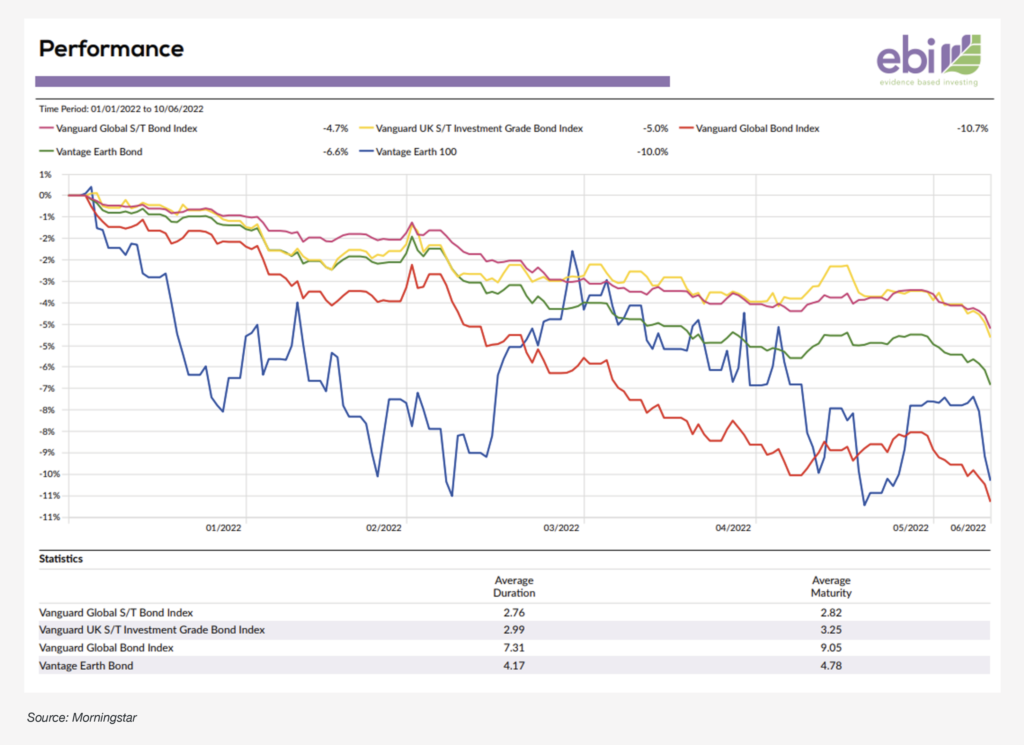

For a bond, one of the risks incorporated into a bond’s price comes from interest rates. Since we are currently in a high inflationary environment or heading towards a period of higher inflation, the increased inflation will tend to be countered by an increase in interest rates in an attempt to steer the economic growth rate to a sustainable level and soothe inflationary pressure. Bond prices have an inverse relationship to interest rates, therefore when the cost of borrowing money rises (when interest rates rise), bond prices usually fall, and vice-versa. The Bank of England has recently increased the base rate multiple times within a short period, with the market pricing in further increases expected throughout the year. ebi portfolios are well-positioned to weather this type of environment due to the effective duration of our bonds. Our average effective bond duration is short-dated (4.3 years compared to 7 years of the Bloomberg Global-Aggregate) and duration can be interpreted as the measure of the sensitivity of a bond’s price to changes in interest rates. Therefore, the bond portion of our portfolio has reduced risk stemming from interest rate rises compared to longer-duration bonds. Short-duration bonds are closer to maturity and have fewer coupon payments remaining, nevertheless, they are not immune to market events.

Bonds are supposed to protect you on the downside so why are both equities and bonds falling?

While bonds do offer protection on the downside we are in an unfortunate market backdrop where equities are facing downward pressure due to growth and geopolitical tensions. While equities have their own battle on one side, bonds are also feeling the pressure due to the increase in inflation and interest rate hike prospects. This is why we have recently seen a spike in gold prices with investors scrambling to find some sort of safe haven. Nevertheless, this does not deter from the fact that bonds have been offering protection against the full blow of the economic downturn.

How much protection are bonds providing?

In times of chaos, it’s worth taking a step back and asking what protection means for your portfolio. If you enter a phase where equities fall 20% and bonds fall 4% it’s easy to say they both fell in the same direction but bonds fell materially less than stocks and offered somewhat of a cushion; In a 50/50 portfolio, this means your portfolio would have suffered a 12% loss rather than 20%.

The last few months’ performance data is not a sufficient time period for concluding that bonds are no longer providing downside protection. Developed equities have seen a decline starting in 2022 and if we look at the graph below we can see a comparison between short-duration bond indexes, longer-duration bond indexes and equity markets. Now we can appreciate the protection the bonds have offered when looking at the MSCI ACWI IMI in comparison to the FTSE WGBI 3-5 years[1]. Bonds are not only offering protection but the investment journey is smoother and less volatile. In addition, you can see the effect mentioned in the first question; there is a direct correlation between duration and bond performance (the lower duration bonds have performed better due to risk coming from inflation and interest rates).

Conclusion

With the current economic climate, it’s easy to be sucked into flashfire reporting using a short-term lens. It’s important to remember the primary role of bonds in a well-diversified portfolio, the bond portion of the portfolio is there to offer stability against the increased volatility of equity markets over the long-term, and shorter-duration bonds inherently have less inflation and interest rate risk and provide better protection and a smoother path.

References

[1] The FTSE World Government Bond Index (WGBI) is the recognized leading benchmark for global treasury exposure followed by major fund managers and large asset owners around the world. The FTSE WGBI measures the performance of fixed-rate, local currency, investment-grade sovereign bonds from over 20 countries, denominated in a variety of currencies, and has more than 30 years of history available.

Blog Post by Joshua Clarke & Raj Chana,

Investment Analysts at ebi Portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- Q2 Market Review 2025

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025