Everyone has a plan ‘til they get punched in the mouth.

Analysts have got off to an inauspicious start in 2016: “The current stock market level is disconcertingly well below not just the Wall Street forecasts for 2016 (made a couple months ago), but also below those made for 2015… or for even 2014!” (via Zero Hedge).

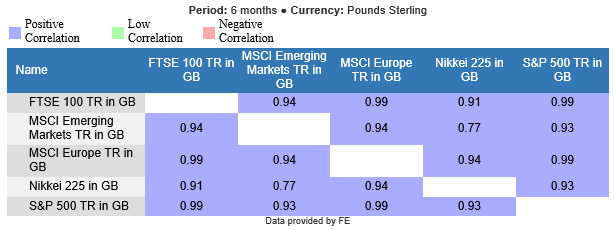

All investors, including those in EBI Portfolios, have taken a bit of a beating recently. Nearly everything has fallen sharply in the last six weeks, and equity market correlations are once again approaching one, as the table below highlights.

The chart below shows an idealised version of the emotional cycle investors go through in the course of their decision-making. The current question is where we currently lie – I am assuming we are somewhere in the middle, though we don’t appear to have reached the desperation/panic stage. But this is not stopping the “experts” from opining, and the market falls have only increased their intensity. The thinking behind these views, however, is fundamentally flawed, as it rests on (at best) dubious assumptions.

The most obvious example of these problems lies in imputing a “character” to the markets – it is depressed, wild, emotional, irrational etc. as if it is a person (or animal -bullish, bearish and so on). But market prices are the result of a myriad of factors, none of which can be a priori predicted, or ex-post explained, except in simplistic terms. Share X rose because of Y does not begin to do justice to the variability of processes and inputs involved. Indeed, the oil market moves of the past year have seen analysts go from “it’s good news for consumers“, to “it’s bad news“, something that has caused large price declines in shares in the past six weeks or so, and back again: “to our eyes, lower oil prices are good news, albeit good news the market is unwilling to acknowledge in its current frame of mind” (1). Bear in mind that equity (and property) prices fell sharply in the 1970s as oil prices doubled. Now we have prices of equities falling sharply on the exact opposite reasoning. It seems that the context of events is as important as the actuality in determining market outcomes. The difference now may be the concurrent Chinese slowdown, but there is no way to tell with anything like the precision assumed by market analysts and the media. Similarly, low interest rates were seen as bullish for equities in the 1990s and 2000s (the so-called “Fed Model“), but are now seen as a worrying sign of deflation, and central bank failure.

Of course, if a market’s behaviour can be likened to that of an animal, the implicit assumption is that it can be understood and predicted (which is where the “experts” come in, claiming a right to power and influence). But over and above assigning a degree of probability to any given event occurring, and any attempt of prediction is doomed to failure, due to the almost infinite number of variables involved. It is futile to try to assign cause and effect to complex, self-adapting mechanisms such as markets.

As this article points out, “In any complex system, there are typically two types of feedback loops at work. Some feedback loops are balancing, so that deviations from some desired target are followed by actions to push the system back to that target. Your body has lots of these, which keep your temperature, blood sugar, and other vital processes in check. Other feedback loops are self-reinforcing, so that deviations from some starting point are followed by changes that push the system even further from that point. Cancer and viral replication are among those self-reinforcing feedback loops, and can be fatal if left unchecked by a balancing loop.” Markets can contain the former (i.e. “normalcy”) the latter (momentum trading, leading to bubbles), or some combination of the two, with one dominant at each given point. How on Earth is anyone able to distinguish between the two states at any one time with any degree of accuracy? (2)

Market analysis (like that of economics, politics and football matches) is inherently uncertain, with no applicable “laws” to guide us. Some fund managers “beat” the market, but that in itself does not invalidate the Efficient Markets Hypothesis – it merely indicates that no theory is 100% true all the time (3) and in all situations. A theory does not have to be universally true to be useful – we just need to assign the context in which it is true enough to work for us. Thus, the EMH may not be irrefutable, but for long term investors, it makes sense to act as if it were. As Burton Malkiel said, “Most investors would be considerably better off by purchasing a low-expense index fund than by trying to select an active fund manager.” (4)

This principle can be further extended; in the recent turmoil, investors have fled equities for the “safety” of bonds and high quality shares (see RBS‘s recent “advice”). But as more and more investors adopt this position, it becomes more, not less risky. A neat encapsulation of this paradox can be seen in the following Schroders observation: “In equity investment, valuation always triumphs over quality because, as their valuations rise, stable businesses can become very dangerous investments. In our view, many investors are already paying too much for perceived ‘safety’ and ‘certainty’ of growth, dislocations have become extreme and the market’s eventual snap-back to its typical function as an arbiter of value should be profound.” This may seem counter-intuitive, but it holds true in practice (just how “safe” are government bonds yielding 1.88% (US) or 0.3% (German Bunds)? German two-year bonds are worse still!

(1) US Premier Asset Management – Oil , why the Long face? January 2016.

(2) As this article suggests, even with perfect foresight, one would under perform the market index massively from time to time – even God would probably have been fired!

(3) Which is of course a 100% true statement…and thus false.

(4) Returns form investing in equity mutual funds 1971 to 1991, B. Malkiel, Journal of Finance, June 1995 (available in our file repository for registered users).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.