September Economic Background

• Federal Reserve cuts interest rates, but European Central Bank and Bank of England hold steady

• Sovereign debt pressure builds as gilt issuance hits record levels in UK

• US tech giants announce landmark investments in UK

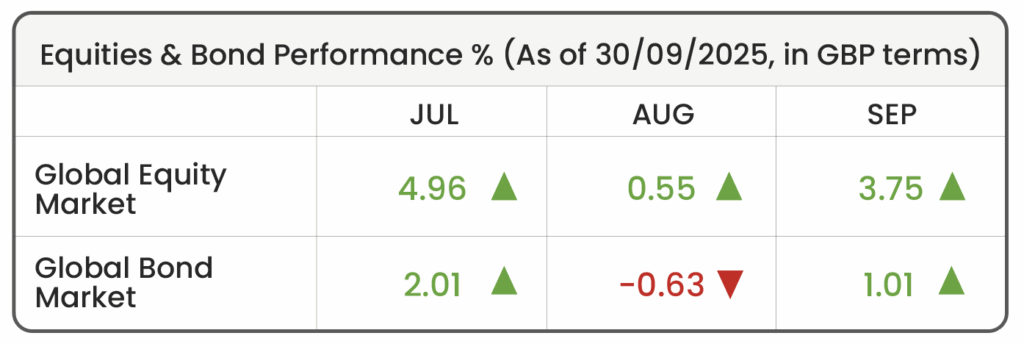

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Diverging Paths – Fed Cuts as ECB and BoE Hold Rates:

In September, the US Federal Reserve (Fed) cut interest rates by 0.25%, largely because available data pointed to a cooling US economy and a stalling fight against inflation. Growth had been resilient earlier in the year, but by late summer, softer job creation, a rise in unemployment, and signs of weaker consumer spending raised fears of a sharper slowdown if policy remained too tight (i.e. if rates were left too high for too long). Inflation was still above target, but falling, giving the Fed cover to act. Though President Trump has long sought to pressure the chairman of the Fed, Jerome Powell, to cut interest rates, the Federal Open Markets Committee (FOMC) framed their decision as a data-driven move, justified by slowing job growth, softer demand, and easing inflation.

In contrast to the Fed, both the European Central Bank (ECB) and Bank of England (BoE) decided to hold interest rates steady at 2.15% and 4%, respectively. In Europe, inflation in the eurozone remained sticky, especially in services and energy, while GDP growth was weak. The ECB is concerned that cutting too soon could reignite inflation. Their strategy emphasises “data-dependent caution,” preferring to wait for clearer signs of sustained disinflation. Inflation in the UK, though falling slowly, remained above target, and the highest in the G7, while manufacturing and industrial activity are contracting. The BoE signalled that premature rate cuts could risk fuelling persistent inflation, and their labour and wage data suggested the economy could tolerate rates being “higher for longer.”

In short, both the UK and EU face higher persistent inflation, and the slowdown in economic growth wasn’t enough to cut rates, in contrast to the slowdown in the US.

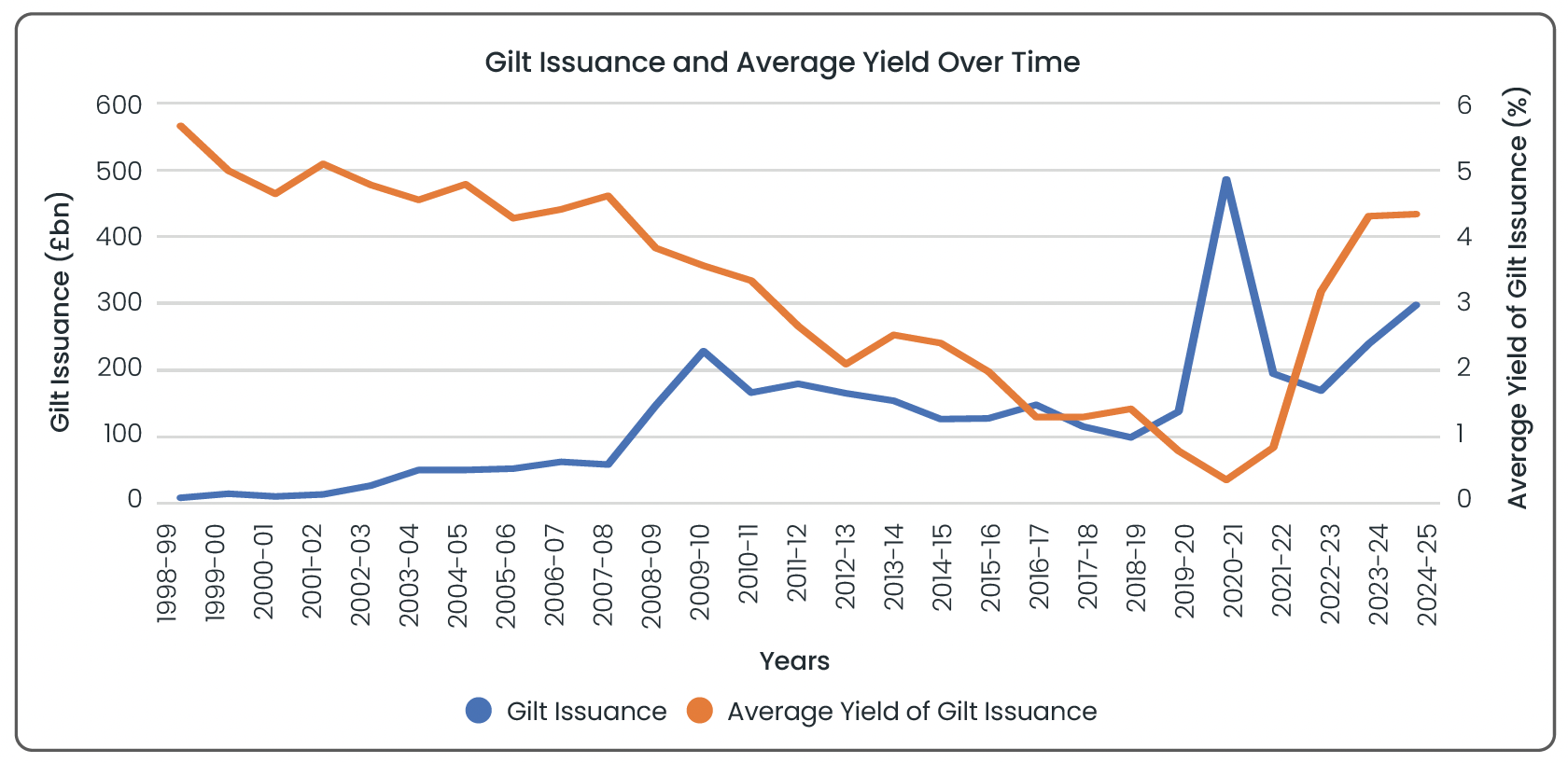

Record Gilt Issuance Tests UK Fiscal Strategy:

The Debt Management Office (DMO) issued a record £14 billion of 4.75% ten-year gilts on 2nd September, the largest single long-dated issuance of UK sovereign debt in recent years. Demand for the debt was relatively strong, but yields reached elevated levels, as investors remained concerned about high debt issuance, persistent inflation, and the UK’s fiscal trajectory.

The BoE also conducted its largest repurchase agreement operation (a monetary mechanism where the central bank purchases government bonds from banks with a promise to sell them back at a higher price in the future) since 2020. The move was intended to inject sufficient cash into the gilt market to absorb the sudden issuance of gilts, in effect softening its impact in the bond markets. Such a large issuance of gilts did nothing to assuage economists’ concerns about the government’s dependency on the debt markets, and the issue of fiscal policy had to be addressed directly by chancellor Rachel Reeves at the Labour party conference at the end of the month, telling the attendees that ‘hard choices’ would have to be made, seemingly softening the ground for tax announcements in her November Autumn statement, in an attempt to lower the UK’s reliance on debt.

Figure 1 – Rising debt obligations over time: a chart showing the magnitude of gilt issuance per year and average gilt yield since 1998. Source: The Debt Management Office. Source: The Debt Management Office.

US-UK Technology Prosperity Deal Boosts AI and Innovation Ties:

On 18th September the US and UK jointly published a Memorandum of Understanding – the Technology Prosperity Deal, which announced a deepening cooperation between the two countries across a range of high-tech sectors including artificial intelligence (AI), nuclear innovation and quantum technologies.

The Memorandum was announced in parallel with the state visit of President Trump and was supported by individual declarations of UK-based investment by US tech giants Microsoft ($30bn/£22.3bn), Google ($6.8bn/£5bn) and Nvidia ($11bn/£8.2bn). The announcements are a significant boom for the UK, which has long sought to position itself as a key hub for AI outside the US. UK Prime Minister, Keir Starmer, lauded the agreement, stating it would: “…shape the futures of millions of people on both sides of the Atlantic”.

This deal highlights the UK’s growing importance as a hub for cutting-edge technology. For investors, this presents a range of opportunities. Large-scale investments from US tech giants such as Microsoft, Google, and Nvidia can stimulate economic growth by creating high-skilled jobs, boosting productivity, and driving innovation. These developments can support stronger corporate earnings and overall market confidence over time. The direct infusion of capital into UK-based tech projects may create new growth avenues, while the involvement of major US tech companies highlights the continuing influence of the global technology sector on portfolio performance.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Simpson, MSci

Investment Oversight Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025