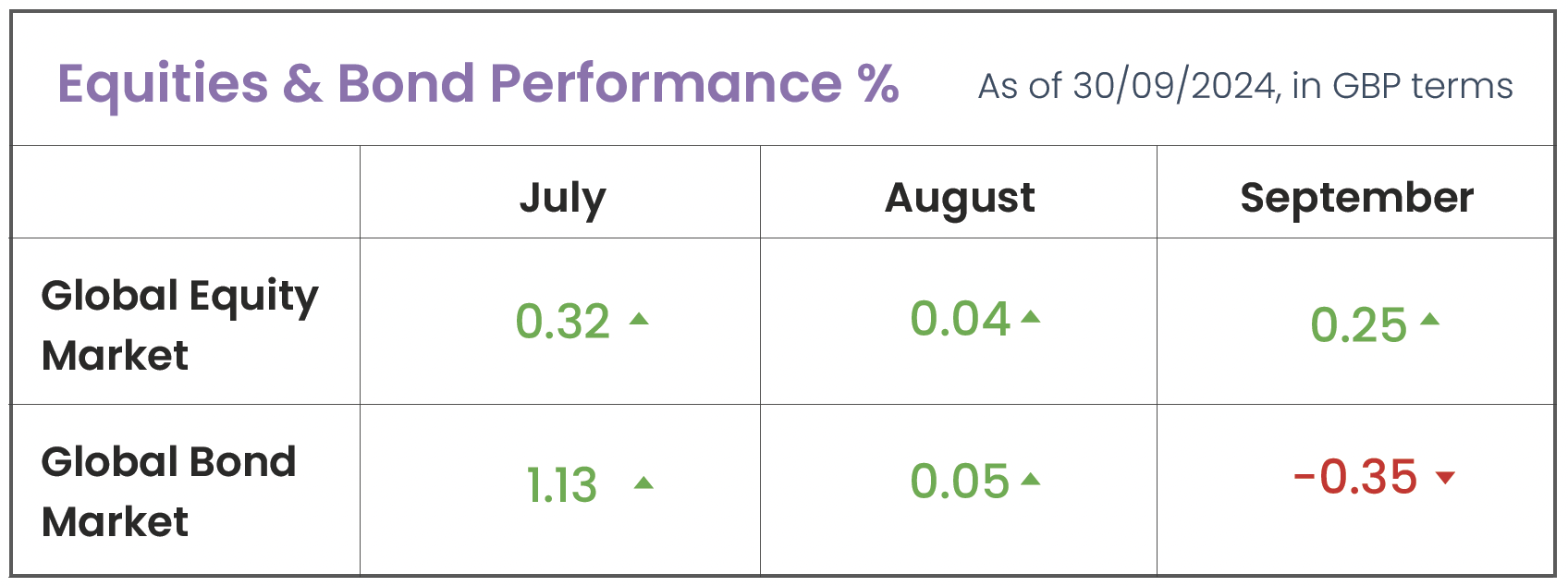

September Economic Background

- UK interest rates remain unchanged, while US rates fall by 0.5%.

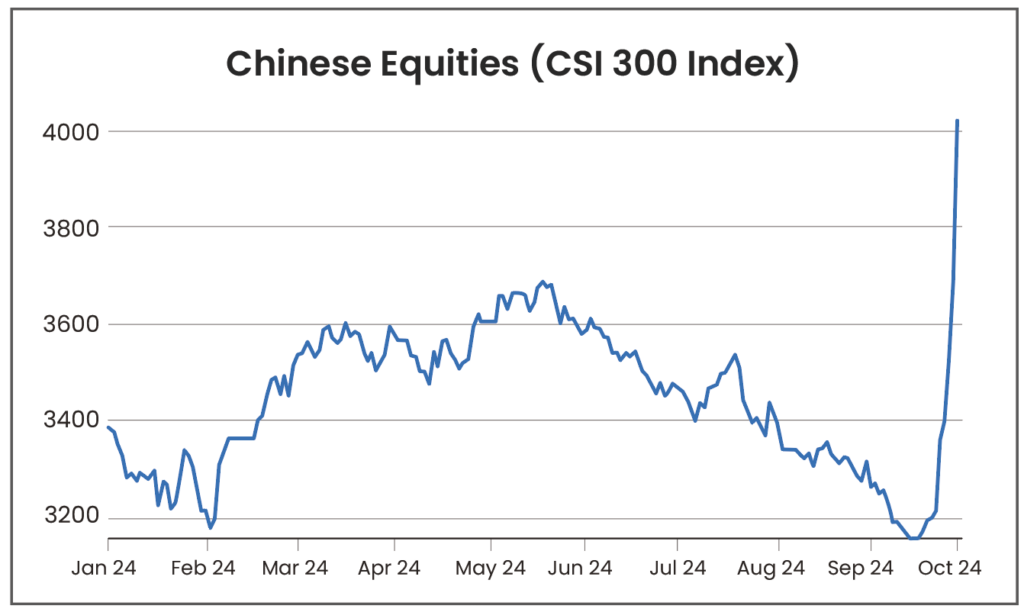

- Chinese equities surge after government stimulus package announcement.

- Escalating Middle East tensions pose growing threat to global stability, and energy markets.

Source: Morningstar (Morningstar Global Markets, Bloomberg Global Agg)

Market Review

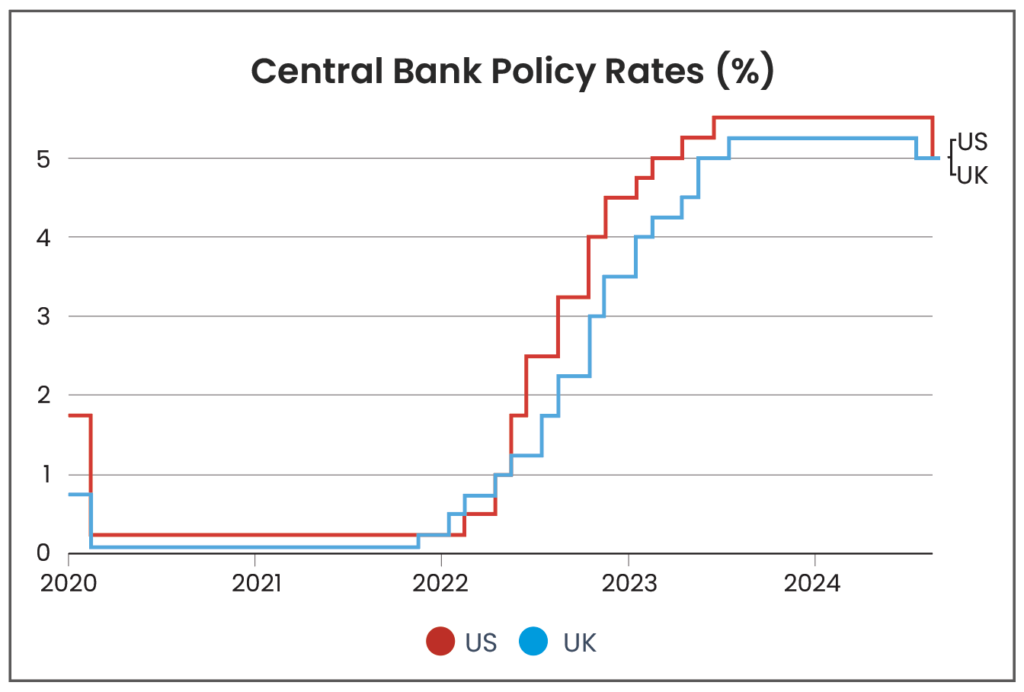

Interest Rate Cuts: In September, the Federal Reserve (Fed) made a significant move by cutting the target range for the federal funds rate by a substantial 0.5%, lowering it from 5.25%-5.5% to 4.75%-5%. This marked the first reduction in borrowing costs since March 2020. Although the rate cut grabbed headlines, it was widely expected, with markets already pricing in the outcome well in advance. For example, back in July, small-cap stocks posted their strongest monthly performance in 20 years, driven by expectations of the Fed’s impending rate cuts. Small-cap companies, which tend to have smaller cash reserves and higher borrowing ratios, are more sensitive to changes in interest rates. When borrowing costs are high, these companies face more financial pressure, so the expectation that the Fed would soon lower rates gave them a boost. While a rate cut was anticipated, there was some uncertainty around whether the Fed might opt for a smaller 0.25% reduction. Fed Chair Jerome Powell described the larger-than-expected cut as a “strong start” to recalibrating monetary policy, expressing confidence that inflation is on course to reach the 2% target.

Source: LSEG

Across the pond, the Bank of England (BoE) kept its interest rates steady at 5% during its September meeting, following a 0.25% cut in August (the first in over four years). The decision was in line with market expectations, although one policymaker advocated for an additional 0.25% cut to bring rates down to 4.75%. Annual Consumer Prices Index (CPI) inflation for August was recorded at 2.2%, and it is projected to rise to around 2.5% by the end of the year as declines in energy prices last year fall out of the annual comparison.

China Recovery: China has introduced a series of stimulus measures, including cuts to its benchmark interest rate, as Beijing attempts to counter a slowdown in the world’s second-largest economy. In a rare public briefing, the People’s Bank of China also unveiled plans for government funding to support the stock market and encourage share buybacks, alongside additional assistance for the struggling property sector. These moves sparked a swift rally in Chinese equities, which surged 8.5% on the final trading day of September—their best performance since the 2008 global financial crisis. This sharp reversal in the Chinese market follows a prolonged downturn over the past three and a half years, during which foreign investors pulled out due to concerns over the slowing economy and ongoing challenges in the real estate sector. The sharp reversal highlights the importance of staying invested to avoid missing out on potential gains, as demonstrated by the recent surge in China.

Source: LSEG

The recent rally stood in stark contrast with the negative sentiment in other major Asian markets. On the same day, Japan’s Nikkei 225 index plunged 4.8% in a volatile session after news broke that incoming Prime Minister Shigeru Ishiba plans to call a general election for 27th October 2024. Traders attributed the sell-off to investor unease over Ishiba’s prior statements supporting higher taxes on corporations and investment income, which weakened market confidence.

Middle East Conflict: As the conflict in the Middle East intensifies, analysts are raising concerns that any involvement of Tehran could jeopardise oil and gas exports from the Gulf, particularly through the Strait of Hormuz – a crucial passage bordering Iran that handles 20% of the world’s crude supply. Shortly after month end, Iran launched a missile attack on Israel, driving oil prices up by 5% to $75.40, amid fears of a broader regional conflict in an area that accounts for nearly a third of global oil production capacity. Any further increase in fuel costs would be problematic for the Biden administration, particularly for Vice President Kamala Harris, who is running for president on a platform that includes reducing the cost of everyday goods. The spike in oil prices following Russia’s invasion of Ukraine caused a global surge in fuel costs, and with similar tensions now unfolding in the Middle East, many investors warn that the U.S. is particularly vulnerable to another oil shock. This vulnerability is exacerbated by the administration’s energy policies, which while broadly favourable to sustainability-minded investors, have been labelled by some critics as “short-sighted,” citing restrictions on new drilling and a pause on liquified natural gas projects.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025

- October Market Review 2025