Our latest market commentary covers the drivers of market conditions across Q3, along with factor, asset class, and portfolio returns.

Key Events

Overall Market Backdrop

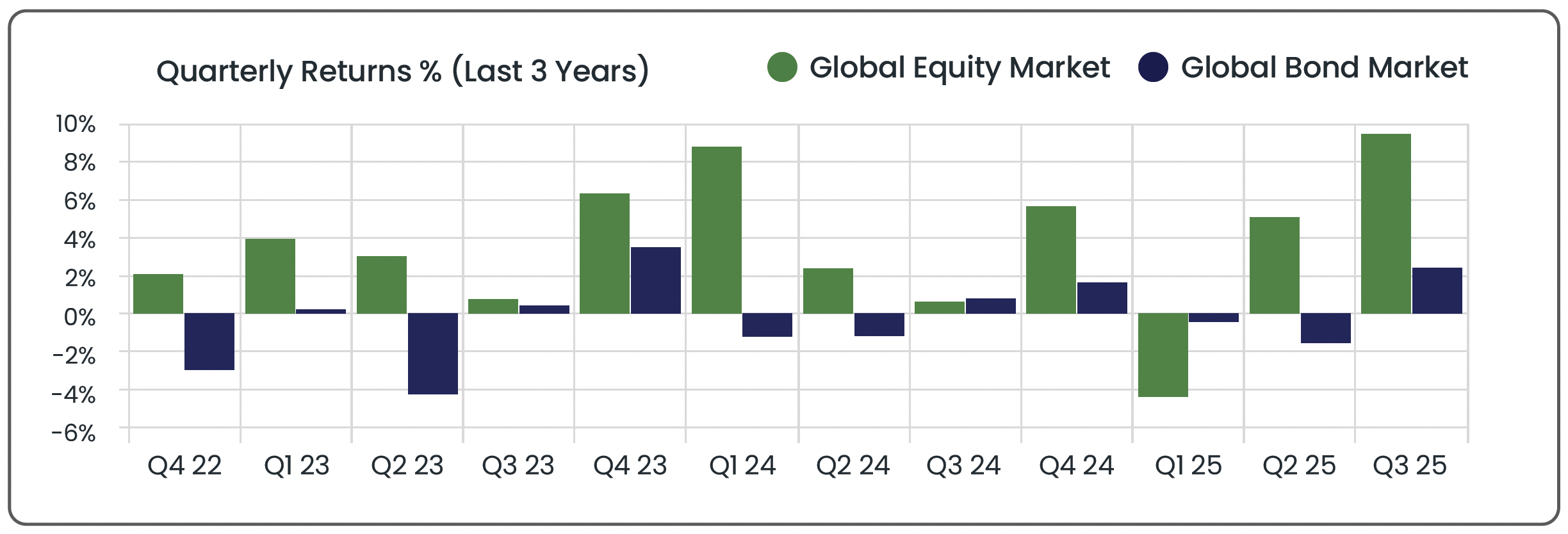

Global markets delivered strong returns in Q3, with broad-based gains across both developed and emerging equities. While trade tensions and Trump tariffs remained present, they were less dominant than in earlier quarters, allowing investors to focus on key growth drivers such as AI development. Emerging markets, which had lagged in previous quarters, benefited from more attractive valuations and a weaker US dollar, while geopolitical developments, including rising defence spending in Europe and US-India trade disputes, added complexity without derailing momentum.

Bond markets also advanced, as early signs of easing inflation, combined with central bank rate cuts and expectations of continued policy support, encouraged demand for fixed income assets. While inflation remained above target in some regions, the outlook allowed for measured monetary easing. Policymakers remained cautious, keeping investors mindful that future rate reductions are likely to be gradual, supporting steady but modest returns across global bond markets this quarter.

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 30/09/2025 in GBP terms.

Source: Morningstar. Data from 01/10/2022 to 30/09/2025 in GBP terms.

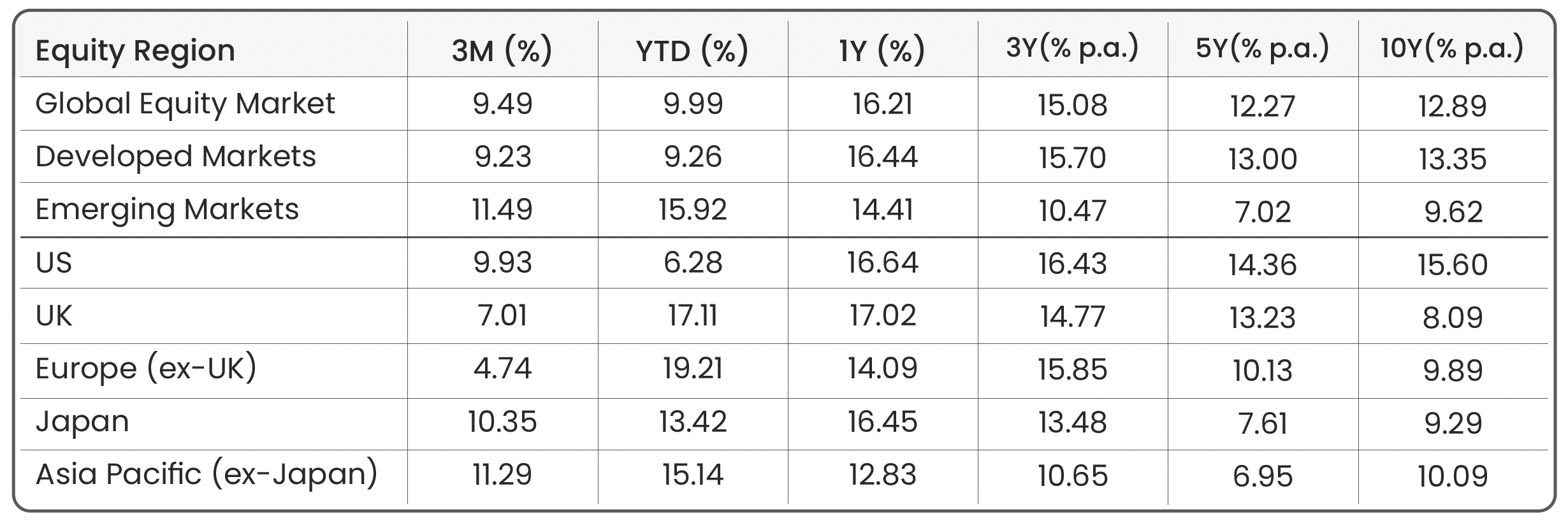

Equity Markets

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 30/09/2025.

U.S. +9.9%

US equities delivered strong returns in Q3, gaining +5.9% in July as stocks entered the quarter recovering from April’s tariff-driven selloff, with sentiment buoyed by the scaling back of Trump’s most severe tariff threats and signs that the US economy remained broadly resilient. The ongoing AI boom further supported the market, as major investments in technology infrastructure lifted tech stocks and drove broader equity gains. Progress in trade talks with the EU and Japan also helped ease investor concerns, contributing to lower market volatility and enabling equities to trade near record highs.

The economic outlook grew more uncertain through August (0.0%) and September (+3.9%). Downward revisions to job growth and the addition of just 22,000 jobs in August highlighted a softer labour market, while inflation edged higher as Trump’s tariffs passed through to consumer prices. At the same time, Trump’s escalating attacks on the Federal Reserve unnerved investors, raising concerns over central bank independence and weighed on the US dollar, which tempered gains. Yet the softer labour market also provided a tailwind for equities, as it raised expectations that the Fed would cut interest rates to stimulate spending and investment, providing some support to stock markets as the quarter drew to a close.

UK +7.0% | Europe (ex-UK) +4.7%

UK equities delivered a robust +7.0% return in Q3, outperforming the rest of Europe as resilient market drivers outweighed lingering fiscal and political concerns. July’s milestone saw the FTSE 100 breach 9,000 points for the first time, supported by progress on the UK-India trade agreement and optimism over a US-EU tariff deal. Shifts in market sentiment also supported performance, as investors rotated into non-US assets. While US equities delivered strong gains in Q3, their year-to-date performance has lagged behind other regions when measured in pound sterling terms, making markets such as the UK appear more attractive from a valuation perspective. Domestic political uncertainty, including the resignation of Deputy PM Angela Rayner, weighed on confidence, but longer-term investment opportunities and progress on trade ties offered a counterbalance. This backdrop allowed UK equities to notch steady monthly gains, culminating in a strong quarterly return.

European (ex-UK) equities posted gains in Q3, though more modest at +4.7%, reflecting a fragile regional backdrop. Early in the quarter, markets were supported by progress toward the 15% US-EU tariff deal, Germany’s “fiscal bazooka” stimulus announcement, and increased EU defence spending, which collectively bolstered investor confidence. The tech sector was a notable bright spot, with the €1.3bn ASML-Mistral AI deal highlighting Europe’s ambition to compete in the global AI race. However, performance lagged the UK, as investor caution around fiscal sustainability intensified. Germany gained just +0.7% in Q3 despite a strong YTD run of +23.6%, with concerns that aggressive spending could exacerbate long-term debt risks. Political instability in France also weighed on sentiment, with sovereign yields hitting 16-year highs following the ousting of Prime Minister Francois Bayrou, raising fears of political unrest.

Looking ahead, Europe may benefit from cheaper Chinese imports, as rising US tariffs on China create incentives for Beijing to deepen trade ties with the region. However, uncertainty persists after Trump urged the EU in September to impose 100% tariffs on China and India to pressure Vladimir Putin, highlighting the fragility of trade relations. For consumers, greater access to lower-cost imports could provide a tailwind; for example, the UK has become BYD’s largest market outside China, with sales nearly tenfold higher in September despite the EV-maker’s exclusion from subsidies. But European manufacturers, particularly in auto and industrial sectors, face intensifying competition from Chinese rivals, which capped equity gains in Q3 and left markets highly sensitive to global trade developments.

Japan +10.4% | APAC (ex-Japan) +11.3%

Japanese equities surged +10.4% in Q3, among the strongest regional performers. Confidence in an earnings recovery and momentum behind structural reforms supported the market, as companies improved profitability and transparency, implemented stronger corporate governance practices, and adopted shareholder-friendly policies. Gains were tempered at times by yen volatility and uncertainty over Bank of Japan (BoJ) policy, but overall sentiment held firm. July also brought relief from global trade tensions after the US agreed to lower its threatened tariff rate from 25% to 15%, providing reassurance for Japanese exporters. Coupled with strong capital inflows and a favourable valuation backdrop, Japanese equities advanced sharply as investors leaned into the region’s reform and growth story despite intermittent policy headwinds.

Asia-Pacific equities (ex-Japan) delivered +11.3% in Q3, led by China (+22.2%) and Taiwan (+15.8%). China’s rally was driven by stronger-than-expected exports, targeted policy support, and optimism that Beijing’s stimulus measures would stabilise growth ahead of the tariff truce expiry with the US. Chinese chipmakers also announced plans to triple AI processor output next year, intensifying the global race in advanced technology. Taiwan benefited from surging global demand for AI semiconductors, with leading chipmakers central to the AI supply chain. Despite lingering trade risks, optimism around AI, exports, and policy support underpinned strong gains across the region.

Emerging Markets +11.5%

Emerging markets delivered the strongest regional return in Q3, gaining +11.5%, led by China, Taiwan, and South Korea. Progress in US-China trade talks eased investor concerns over escalating tariffs, while the Fed’s September rate cut supported risk assets globally. Strong demand for AI-related stocks further boosted returns, particularly in technology-focused markets. Investor interest was also bolstered by EM equities’ relatively attractive valuations versus richly priced US stocks, prompting investor rotation into the region. A weaker US dollar provided a tailwind, easing the cost of dollar-denominated debt, while local currency strength enhanced returns for foreign investors. Most EM markets posted gains, but India fell -4.9% over the quarter. President Trump sought to pressure India to cut its purchases of Russian oil, but Prime Minister Narendra Modi stood firm, refusing to compromise on India’s national interests, including energy security and domestic economic priorities such as keeping energy and fertiliser affordable for farmers and supporting the broader agricultural sector. In response, the US imposed 50% tariffs on targeted Indian imports, citing frustration with India’s refusal to adjust its Russian oil purchases, which added further uncertainty to the country’s equity market.

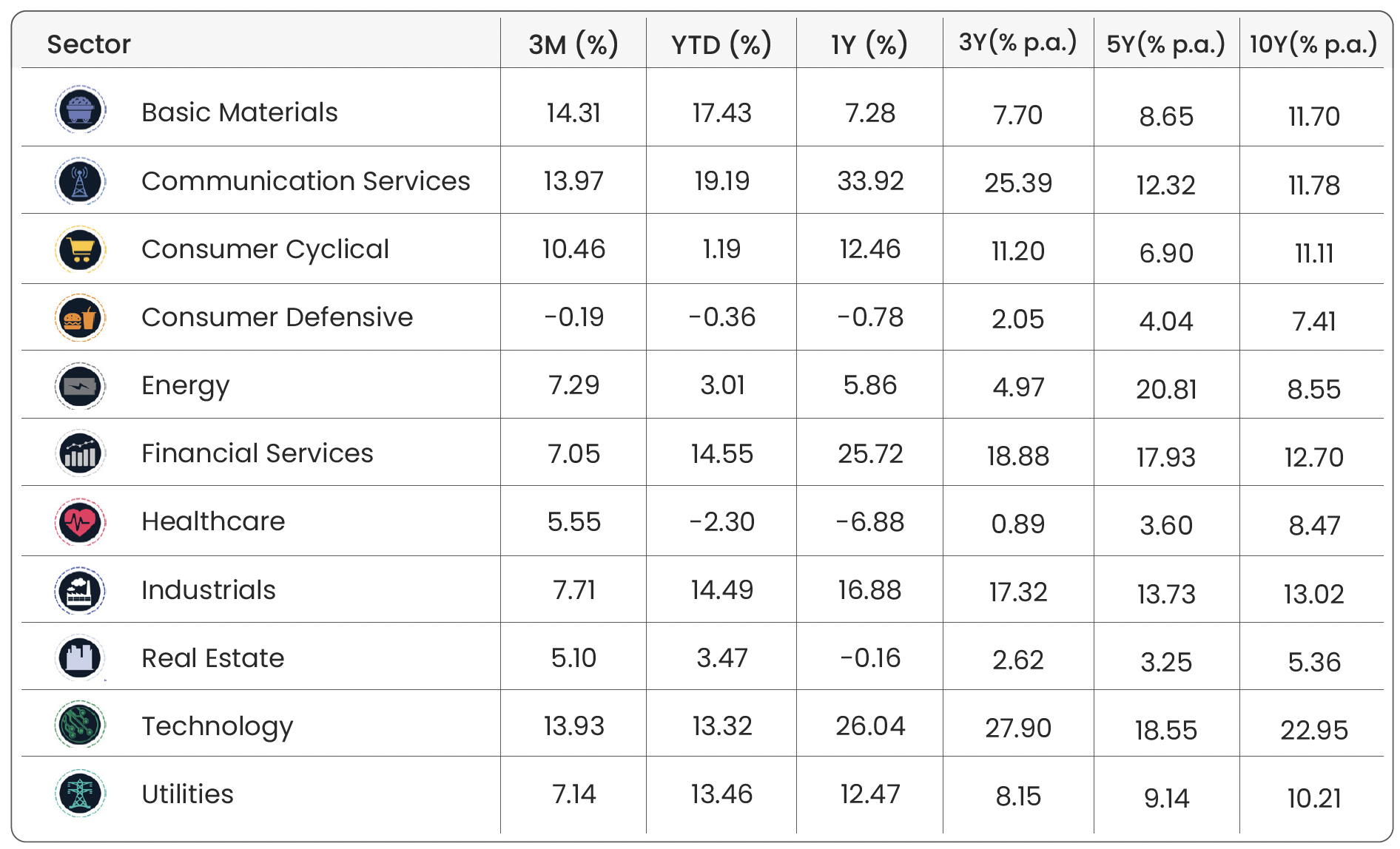

Sectors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 30/09/2025.

Technology (+13.9%), Communication Services (+14.0%), and Consumer Cyclical (+10.5%) continued to lead Q3 gains, with Nvidia, Alphabet, and Tesla delivering standout performances. Investor optimism around AI innovations and improving trade conditions supported these sectors, as clearer supply chain visibility boosted confidence. At the same time, soaring valuations in tech and growth stocks have raised caution among market participants, with the Bank of England noting that prices are approaching levels seen during the dotcom era, highlighting the potential risk of a sharp correction.

Energy (+7.3%) and Utilities (+7.1%) delivered positive gains in Q3. Energy stocks were supported by stabilising oil prices, while utilities benefited from steady investor demand for defensive, income-generating assets. The expansion of AI and digital infrastructure is expected to boost electricity demand over the long term, providing an additional tailwind. Overall, both sectors advanced steadily, reflecting resilience amid broader market volatility.

Consumer Defensive (-0.2%) was the only sector to post a negative return in Q3. Weaker labour markets in the US and UK, alongside European political uncertainty and US-Asia geopolitical tensions, weighed on global consumer sentiment. Inflation trends were mixed; China slipped into deflation in August, signalling a slowdown in consumer demand, while UK consumer price inflation (CPI) held steady at 3.8% due to higher food, restaurant, and hotel prices, reinforcing expectations that the Bank of England would keep interest rates unchanged at 4%. Rising costs and tighter household budgets constrained spending on everyday essentials such as food, household goods, and personal care products, which weighed on sector returns.

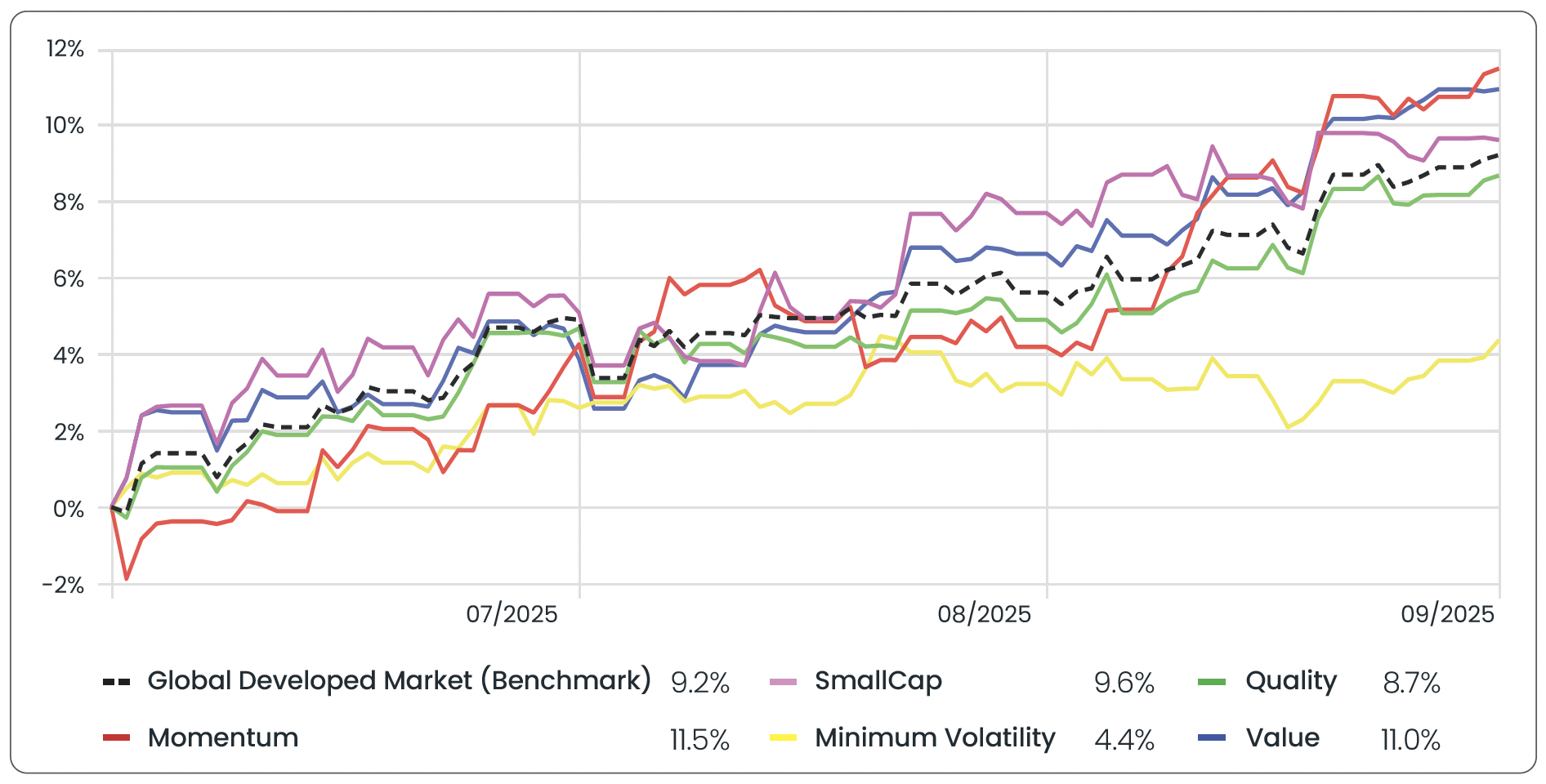

Factors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 30/09/2025.

Source: Morningstar. Data from 01/07/2025 to 30/09/2025 in GBP terms.

Momentum (+11.5%) was the standout factor in Q3, extending its year-to-date gain to +21.9%. It benefited from concentrated exposure to high-growth, AI-related, and technology leaders.

Small-Cap (+9.6%) also performed strongly as earlier tariff-driven weakness eased. Improved trade sentiment, renewed investor confidence, and the Fed’s September rate cut supported smaller companies, while rotation away from large tech stocks lifted demand.

Value (+11.0%) advanced as investors shifted toward attractively priced laggards with upside potential, while Minimum Volatility (+4.4%) trailed given its defensive bias and limited exposure to AI and cyclical rallies.

Bond Markets

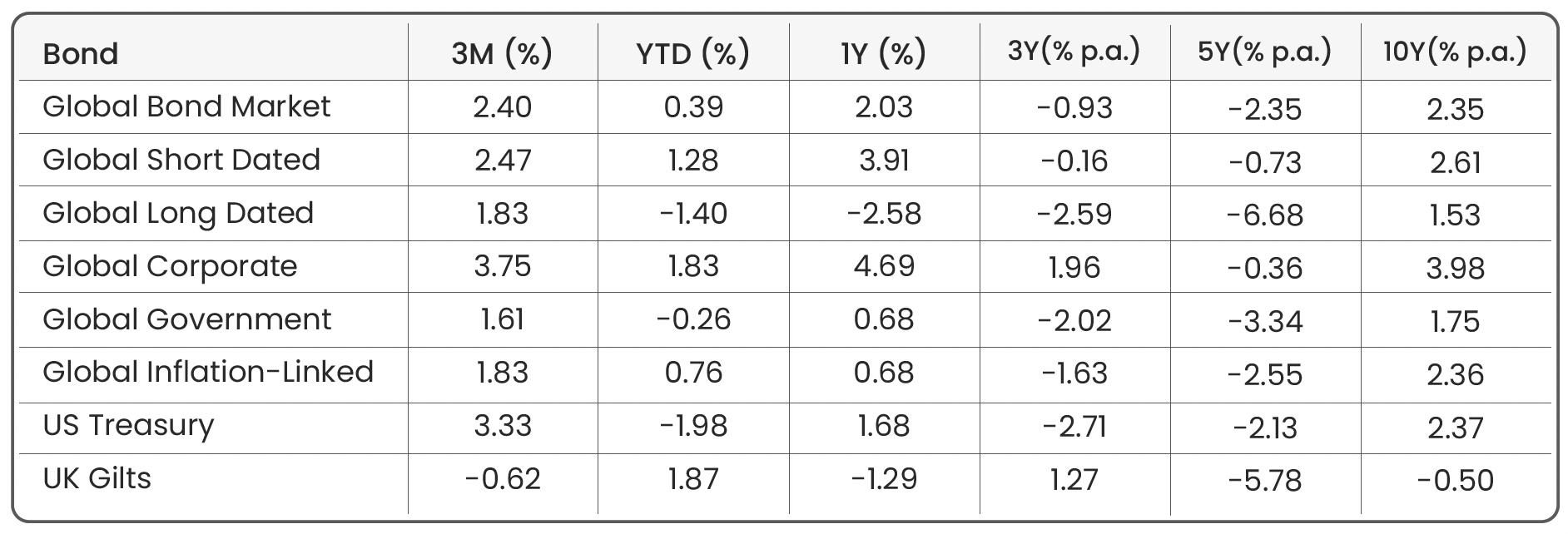

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 30/09/2025.

Global bonds delivered modest gains in Q3 (+2.4%), with short-dated bonds outperforming their longerdated counterparts. In the US, Treasuries rose after the Federal Reserve cut interest rates by 0.25% in September and signalled scope for further easing. When interest rates fall, existing bonds gain value (through higher demand) because the coupon payments that they provide become relatively more attractive than new bonds issued at lower yields. Markets were briefly rattled, however, when Donald Trump attempted to remove Fed Governor Lisa Cook. This unprecedented attack on the US central bank raised doubts about its independence and ability to keep inflation under control, triggering a short-lived sell-off in longer-dated Treasuries that pushed yields higher.

In the UK, gilts fell (-0.6%) as stubborn inflation (3.8% in July and August) and concerns over the country’s public finances dented investor confidence. The Bank of England cut rates to 4% in a narrow vote but signalled that further reductions would be gradual. This, together with uncertainty ahead of the Autumn Budget, prompted investors to sell gilts, putting downward pressure on prices. As a result, yields climbed to their highest level in decades, a sign that investors now demand greater compensation for holding UK government debt, reflecting rising concerns about fiscal sustainability.

Q3 highlighted how central bank decisions, inflation, and political uncertainty shaped bond returns. US Treasuries gained support from Fed rate cuts, while UK gilts weakened as inflation stayed elevated and fiscal concerns drove borrowing costs higher. Other regions, such as Japan, remained relatively stable as the Bank of Japan maintained ultra-loose policy despite inflation running above target, reflecting a commitment to steady economic support. Even with these mixed signals, bonds continued to provide stability and diversification within portfolios, helping to balance risk in a quarter of uneven global economic conditions.

Market Proxies

Equity Indices: Morningstar Global Markets (Global Equity Benchmark) | Morningstar Developed Markets | Morningstar Emerging Markets | Morningstar US Market | Morningstar UK Market | Morningstar Developed Market Europe (ex-UK) | Morningstar Japan | Morningstar Asia Pacific (ex-Japan)

Sector Indices: Morningstar Global Basic Materials | Morningstar Global Communication Services | Morningstar Global Consumer Cyclical | Morningstar Global Consumer Defensive | Morningstar Global Energy | Morningstar Global Financial Services | Morningstar Global Healthcare | Morningstar Global Industrials | Morningstar Global Real Estate | Morningstar Global Technology | Morningstar Global Utilities

Factor Indices: Morningstar Developed Markets (Factor Benchmark) | Morningstar Developed Markets Small-Cap | Morningstar Developed Markets Quality | Morningstar Developed Markets Momentum | Morningstar Developed Markets Min-Vol | Morningstar Developed Markets Value

Bond Indices: Bloomberg Global Aggregate (Global Bond Benchmark) | Bloomberg Global Aggregate 3-5 Yr | Bloomberg Global Aggregate 10+ Yr | Bloomberg Global Aggregate Corporate | Bloomberg Global Aggregate Government | Bloomberg Global Inflation-Linked | Bloomberg US Treasury | FTSE Actuaries UK Conventional Gilts All Stocks

All data is sourced from Morningstar and presented in GBP terms, unless otherwise specified. An appropriate index from the Morningstar database has been selected. For further details about each index, please refer to the corresponding index provider’s official website.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team

- The FCA lifts its ban on Cryptocurrency ETNs

- September Market Review 2025