Our latest market commentary covers the drivers of market conditions across Q1, along with factor, asset class, and portfolio returns.

Key Events

January 20th

Donald Trump

is inaugurated

as the 47th U.S.

president.

January 27th

China’s DeepSeek announcement rattled AI investors.

February 1st

Steep new tariffs on Canada, Mexico, and China announced by the new U.S administration.

March 3rd

U.S. suspends military aid to Ukraine.

March 6th

Germany announces largest economic stimulus in decades.

March 26th

UK Chancellor Rachel Reeves delivers the Spring Statement.

Overall Market Backdrop

• Despite early optimism for equities, Trump’s aggressive trade policies create significant uncertainty, weighing on investor appetite for stocks as markets digest the impact of tariffs.

• A major AI breakthrough by Chinese start-up company DeepSeek rattled markets, leading to a historic sell-off in U.S. Tech stocks.

• Germany’s “fiscal bazooka”, an increase in European defence spending, and a potential deescalation in Ukraine catapult Europe to the top performing region in the opening quarter.

• Diversification proved key as the renowned “Magnificent Seven” mega-cap tech stocks sell-off over Q1 following exceptional growth last year.

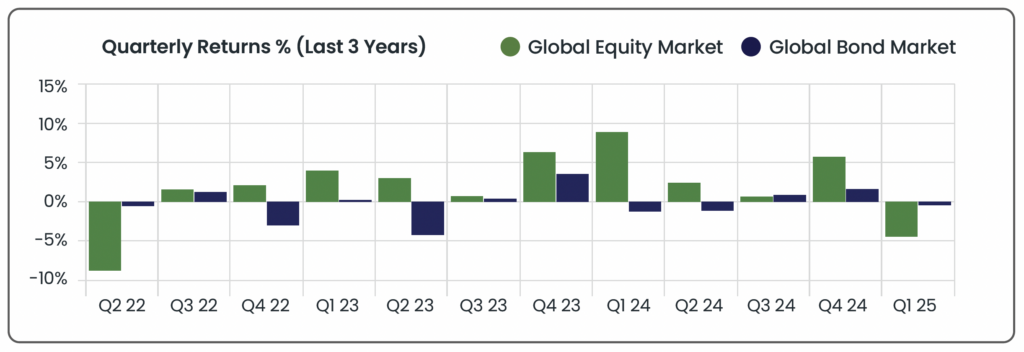

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg). Data as of 31/03/2025 in GBP terms.

Source: Morningstar. Data from 01/04/2022 to 31/03/2025 in GBP terms.

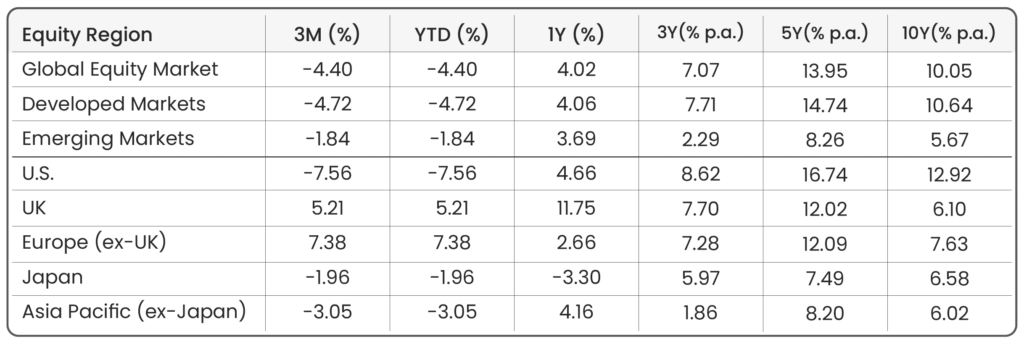

Equity Markets

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/03/2025.

U.S. -7.6%

Buoyed by optimism around Trump’s “America First” agenda and expectations of pro-business policies, many market participants expected U.S. equities to deliver strong returns heading through Q1. However, this early momentum was quickly overshadowed by the president’s aggressive trade measures, which not only weakened domestic sentiment but also triggered retaliatory actions, particularly from Europe.

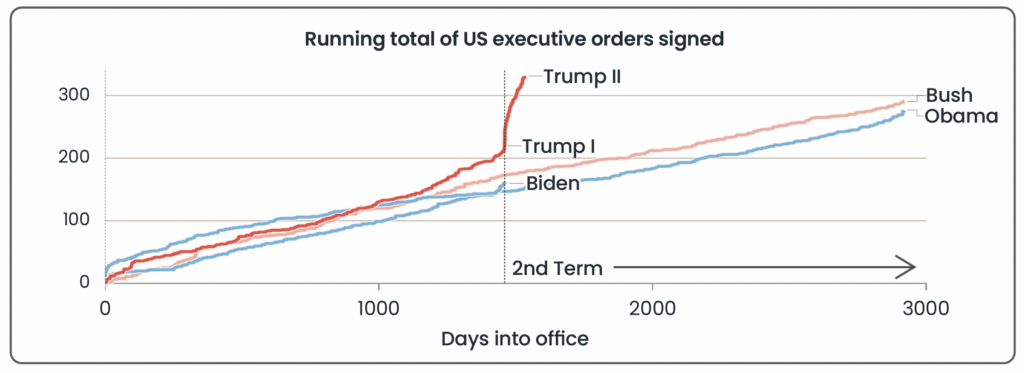

Source: The American Presidency Project (last updated 01/04/2025).

Trump has issued executive actions at an unprecedented pace early in his second term as U.S. president, including using executive orders and proclamations to introduce new tariffs. The sheer volume and unpredictability of these tariffs have unsettled financial markets, contributing significantly to weak stock market performance. As a result, investors have retreated from equities, seeking refuge in safe-haven assets such as gold and bonds throughout the quarter.

Despite modest gains in January (+3.9%), a major AI breakthrough by Chinese start-up DeepSeek rattled markets, leading to a sharp sell-off in heavyweight tech stocks. The S&P 500 fell 1.5%, while the Nasdaq dropped 3% as investors feared the competitive advantage of U.S. AI leaders, particularly Nvidia, was under threat. As the quarter progressed, escalating trade tensions took centre stage. In February, Trump’s sweeping tariffs on Mexico, Canada, and China drove the S&P 500 down nearly 2% before a partial rebound when the Mexico and Canada tariffs were temporarily delayed. However, an increase from 10% to 20% on Chinese imports exacerbated concerns about the impact of this on costs, inflation, and end-consumer confidence. Uncertainty grew as Trump threatened tariffs on European auto imports, drawing sharp criticism from EU officials and further unsettling global markets.

March continued the trend of erratic tariff policies, with abrupt reversals and delays adding to investor unease. A 25% tariff on Mexican and Canadian imports took effect on 4th March, only for Trump to soften his stance on some industries two days later. Additional levies on steel, aluminium, and Venezuelan oil imports reignited fears of escalating trade wars, while a 25% tariff on car imports announced on 26th March added even more market uncertainty. The unpredictability of U.S. trade policy eroded market confidence, as rising inflation and escalating global trade wars remined key concerns for investors, undoing most of the post-election rally. Following falls of -3.1% in February and -8.2% in March, U.S. equities posted their worst quarter since 2022, ending the quarter down, -7.6%.

UK 5.2% | Europe (ex-UK) 7.4%

European equities began the year on a strong footing, supported by improving fiscal conditions and a shift in investor sentiment. A combination of Germany’s “fiscal bazooka,” increased regional defence spending, and potential de-escalation in Ukraine helped drive economic optimism. These factors contributed to upgraded European GDP growth forecasts which reinforced investor confidence.

Germany’s announced fiscal expansion (focused on infrastructure and defence) marked a departure from its historically restrained stance, improving borrowing capacity and economic prospects. Additionally, broader European defence budget increases acted as a structural tailwind, boosting industrial and aerospace stocks. The prospect of a ceasefire in Ukraine also underpinned market stability, easing energy price concerns and enhancing business confidence. However, U.S. trade policy remained a key risk for European equities. While concerns over a sweeping 25% tariff from the U.S. subsided (shortly after quarter-end, Trump announced 20% tariffs for the EU), ongoing trade tensions continued to weigh on sectors with high U.S. exposure, such as automotive manufacturers and suppliers. These industries often depend heavily on U.S. sales, making them especially vulnerable to even modest tariff increases. Higher trade costs could force companies to either raise prices (potentially reducing demand) or absorb the costs, squeezing already thin margins and pressuring profitability. That said, many European automakers already produce domestically within the U.S., mitigating some impact.

UK equities also began the year on a strong note, driven by gains in the energy sector (supported by hopes of a potential de-escalation in Ukraine) and financials (which benefited from banking sector expansion and the long-term boost from increased defence spending). From a valuation perspective, UK and European stocks remained more attractive than their U.S. counterparts, as global investors rotated away from large-cap U.S. technology stocks following AI breakthroughs by China and concerns of Trump’s policy platform. However, sentiment for UK stocks shifted towards the end of the quarter following UK Chancellor Rachel Reeves’ Spring Statement, which dampened expectations for near-term economic growth. With limited fiscal headroom, concerns over potential tax hikes and spending cuts in the Autumn Budget weighed on investor confidence. As a result, UK equities ended the quarter on a more subdued note, with markets falling slightly in March (-2.1%), after a strong start in January (+5.7%) and February (+1.6%).

Japan -2.0% | APAC (ex-Japan) -3.1%

In January, the Bank of Japan (BoJ) raised its key short-term interest rate to approximately c.0.5%, marking its highest level in 17 years. This widely expected move provided a boost to financial stocks, particularly banks, as it signalled a departure from Japan’s prolonged ultra-low-interest rate environment. Higher rates enhance bank profitability by widening net interest margins, strengthening investor confidence in the sector. Despite lingering economic uncertainties, including the potential impact of higher U.S. tariffs, the BoJ’s rate hike reassured investors that Japan’s economy was resilient enough to withstand tighter monetary conditions (i.e. higher interest rates). This clarity supported financial sector valuations and contributed to a modest gain of +2.4% in January. However, as with other global markets, sentiment in Japan remained highly influenced by developments in the U.S. Growing concerns over trade policy and tariffs fuelled uncertainty, prompting investors to adopt a more cautious, risk-averse stance. This shift contributed to market declines in February (-2.5%) and March (-1.7%), ultimately leading to a negative return for the first quarter (-2.0%).

The broader Asia-Pacific region saw significant support from China, which experienced a strong market rally in February (+9.9%) following a breakthrough in AI. Chinese startup DeepSeek announced a new AI model that reportedly required far less computing power than U.S. competitors, triggering a global reappraisal of Chinese tech companies and driving investor enthusiasm. Albeit the optimism was short-lived as escalating U.S-China trade tensions quickly reversed sentiment. On 4th February, Trump imposed a new 10% tariff on $400bn worth of Chinese exports to the U.S, followed by an additional 10% tariff on 4th March. This new wave of trade restrictions is expected to have a more severe impact than those introduced during Trump’s first term in 2018. Low-end manufacturers, already operating on razor-thin margins, have little room to absorb additional costs or reduce prices to support U.S. buyers. Additionally, Chinese local governments, previously a source of financial support, are now constrained by recent stimulus measures, limiting their ability to cushion the economic blow. By March, market declines across most Asian regions erased previous gains, preventing the Asia-Pacific market from finishing the quarter in positive territory.

Emerging Markets -1.8%

Emerging market (EM) equities delivered mixed results in Q1. Gains in China (+10.7%), Brazil (+12.0%), and Chile (+14.9%) led the way, but were offset by declines in India (-7.5%) and Taiwan (-14.5%), resulting to an overall EM decline of -1.8%.

As aforementioned, China posted strong gains in February following a breakthrough in AI. Brazilian equities remained resilient despite global trade tensions, benefiting from strong commodity exports and stable trade relationships with China and the U.S. While U.S. tariffs on steel and aluminium posed challenges (potentially reducing $700m in steel exports), Brazil’s economy remained insulated due to its diversified export base. The government’s commitment to free trade, avoiding retaliation, helped maintain investor confidence. Chilean equities saw a strong rally, driven by political stability and economic growth acceleration. Higher copper prices and mining sector expansion supported market gains.

On the other hand, Indian equities faced steep declines in January (-3.8%) and February (-10.2%) before rebounding in March (+7.1%). An economic growth slowdown (after being the fastest growing economy in the G20 up until last year) and a record-low rupee against the dollar weighed on investor sentiment. While Prime Minister Modi’s leadership has generally been positive for markets, concerns over slower growth and a weak currency have dampened confidence. Taiwanese equities suffered heavy losses due to their reliance on semiconductor exports. U.S. tariffs on Chinese technology imports hurt demand for Taiwan’s semiconductor chips, while escalating China-Taiwan tensions triggered a sell-off amid rising geopolitical tensions, with March (-13.7%) marking the worst monthly drop in over a year.

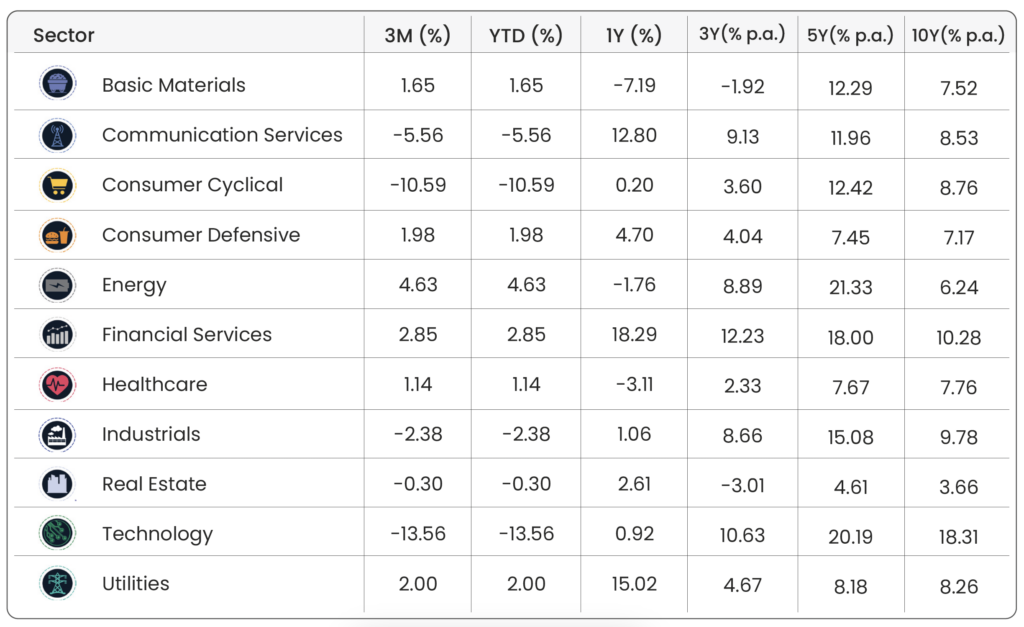

Sectors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/03/2025.

• After an exceptional year in 2024, the “Magnificent Seven” showed signs of reversal, all posting negative returns in Q1. This heavily weighed on Communication Services, Consumer Cyclical, and Technology sectors. Tesla (-37.7%) was the worst performer, spurred by negative sentiment towards CEO Elon Musk over his role in the Department of Government Efficiency (DOGE), coupled with the company experiencing declining new vehicle sales. Nvidia (-21.7%) came under pressure in the wake of a jump forward in AI capabilities from China’s DeepSeek, questions about the costly pace of AI data-centre buildouts in the U.S. and concerns over tightening export controls (i.e. tariffs) that could affect sales of Nvidia’s graphics processing units to China.

• Energy (+4.6%) was the best performing sector in Q1, driven by a combination of sustained high commodity prices, geopolitical tensions, and stronger-than-expected demand for oil and natural gas. Ongoing supply constraints, especially in key oil-producing regions, kept prices elevated, benefiting energy companies. Additionally, despite broader market volatility and uncertainty in other sectors, energy stocks remained resilient due to their status as a critical, in-demand industry, with many energy companies benefiting from improved margins and strong cash flow generation.

• The Financial sector (+2.9%) was also able to provide some support to global equity returns, driven by European banks, which benefited from an uptick in loan growth. The commitment of European nations to increase defence spending created a favourable environment for these banks, as it signalled stronger government spending and potential economic growth, leading to higher demand for credit and financial services. Additionally, the continued expansion of data centres and AI investment offered further upside for financials. These industries are capital-intensive, requiring significant financing, which in turn boosts demand for banking services such as loans and capital raising. The combination of these factors allowed the financial sector to outperform broader market trends.

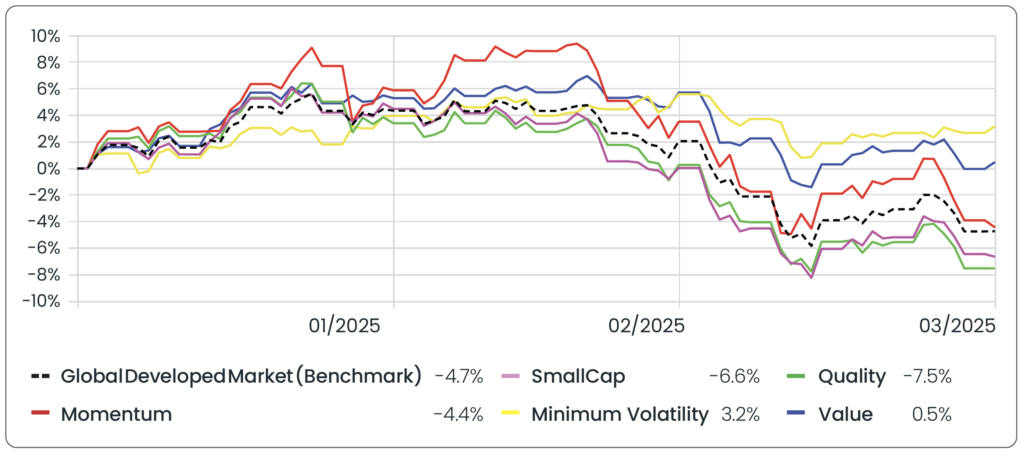

Factors

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/03/2025.

Source: Morningstar. Data from 01/01/2025 to 31/03/2025 in GBP terms.

• With a larger weighting to the “Magnificent Seven”, Quality (-7.5%) and Momentum (-4.4%) strategies were among the worst performing factors in Q1. As aforementioned, each of the “Magnificent Seven” displayed negative returns over the quarter, a severe reversal from the exceptional growth trends experienced in previous quarters.

• Meanwhile, Minimum Volatility (+3.2%) and Value (+0.5%) strategies were clear leaders in Q1, benefiting from a smaller exposure to the “Magnificent Seven” stocks, which saw a sharp sell-off during the quarter. This limited exposure helped these strategies avoid some of the downside pressure affecting broader equity markets. Additionally, Min-Vol and Value stocks tend to have higher exposures to Energy and Financial stocks (two of the best-performing sectors in Q1), because these sectors tend to exhibit more stable price movements compared to high-growth industries like Technology.

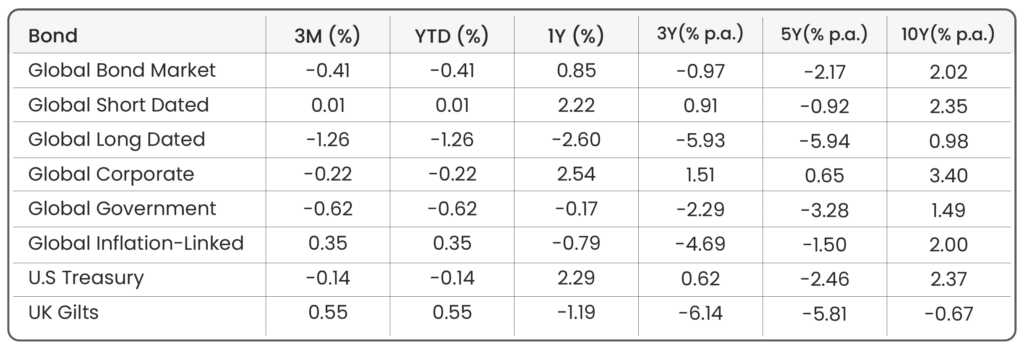

Bond Markets

Source: Morningstar. Data shown in GBP terms (annualised for time periods over 1 year). As of 31/03/2025.

Following a strong final quarter in 2024 for equities and a weaker period for bonds, this quarter saw a reversal, with stocks selling off and investors shifting towards the relative safety of fixed-income assets. Despite this, global bond markets declined -0.4% in GBP terms, with bond yields surging across multiple regions. Bond yields and prices move in opposite directions – when yields rise, bond prices fall. Investors demand higher yields when they perceive bonds to be riskier, requiring greater compensation in the form of higher interest payments. This dynamic played out across bond markets this quarter, as yields hit record highs, and bond prices fell.

Trump’s Inflationary Pressures and Bond Duration Performance

Fears that Trump’s tariff plans will be inflationary led markets to price in interest rates being higher for longer. When interest rates remain elevated, newly issued bonds offer higher yields, making older loweryielding bonds less attractive. As a result, investors may sell off existing bonds, pushing down prices. This environment particularly impacted longer-dated bonds, which are more price sensitive to interest rate changes. Since long-term bonds lock in fixed payments for a prolonged period, their value drops more sharply when yields rise. This played out in Q1, with long-dated global bonds declining -1.3%, while shortdated bonds remained flat (+0.0%), continuing the trend of shorter-duration bonds outperforming their longer-duration counterparts.

Government Bond Sell-Off: UK & Germany

Global government bonds also saw a -0.6% decline this quarter, as concerns over rising government debt led to higher borrowing costs. However, the reasons behind the yield surge differed between the UK and Germany. In the UK, long-term borrowing costs hit their highest level since 1998 due to concerns over the government’s ability to meet fiscal rules. With limited fiscal headroom, investors demanded higher yields as compensation for the perceived risk of lending to the government. Weak growth expectations for the UK economy further fuelled concerns about the sustainability of debt issuance, leading to rising yields and a bond sell-off. In contrast, Germany’s government bond yields surged in March after policymakers announced plans to increase funding for military aid and infrastructure. Unlike the UK, where debt sustainability was a key concern, Germany’s sell-off reflected a shift in economic policy. Historically, Germany has been fiscally restrained, maintaining low debt levels and avoiding large-scale borrowing. This recent policy shift (effectively turning on the “growth tap”) signalled a more expansionary stance, prompting a rise in yields as investors anticipated higher economic activity and potential inflationary pressures. In both cases, rising yields and lower bond prices reinforced the broader weakness seen across global fixed-income markets in Q1.

Market Proxies

Equity Indices: Morningstar Global Markets (Global Equity Benchmark) | Morningstar Developed Markets | Morningstar Emerging Markets | Morningstar US Market | Morningstar UK Market | Morningstar Developed Market Europe (ex-UK) | Morningstar Japan | Morningstar Asia Pacific (ex-Japan)

Sector Indices: Morningstar Global Basic Materials | Morningstar Global Communication Services | Morningstar Global Consumer Cyclical | Morningstar Global Consumer Defensive | Morningstar Global Energy | Morningstar Global Financial Services | Morningstar Global Healthcare | Morningstar Global Industrials | Morningstar Global Real Estate | Morningstar Global Technology | Morningstar Global Utilities

Factor Indices: Morningstar Developed Markets (Factor Benchmark) | Morningstar Developed Markets Small-Cap | Morningstar Developed Markets Quality | Morningstar Developed Markets Momentum | Morningstar Developed Markets Min-Vol | Morningstar Developed Markets Value

Bond Indices: Bloomberg Global Aggregate (Global Bond Benchmark) | Bloomberg Global Aggregate 3-5 Yr | Bloomberg Global Aggregate 10+ Yr | Bloomberg Global Aggregate Corporate | Bloomberg Global Aggregate Government | Bloomberg Global Inflation-Linked | Bloomberg US Treasury | FTSE Actuaries UK Conventional Gilts All Stocks

All data is sourced from Morningstar and presented in GBP terms, unless otherwise specified. An appropriate index from the Morningstar database has been selected. For further details about each index, please refer to the corresponding index provider’s official website.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025