“The best way to destroy the Capitalist System is to debauch the currency” – V.I. Lenin

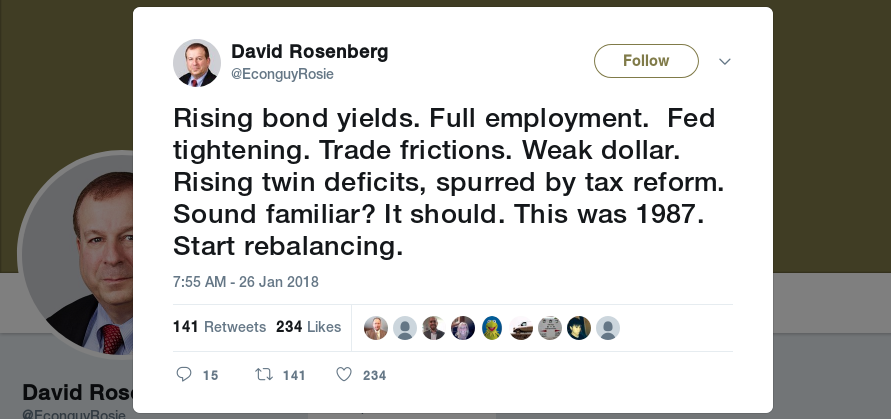

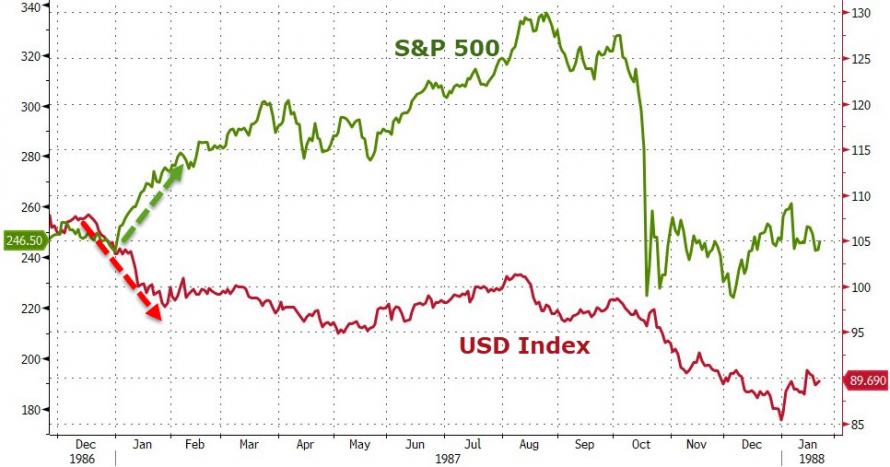

The Dollar appears once again to have fallen off a cliff- even rising Treasury bond yields have had little effect in stabilising the currency as FX traders rush to sell every up-tick. Having lost 10% in 2017, the slide has accelerated in January; at one point (25/1/18), it was down a further 3.3%, in the worst start to a year since 1987, as comments from the US Trade Secretary, Steven Mnuchin suggested the US Government wanted a weaker Dollar, sparking fears of a possible trade war [1] (with currency as the weapon of choice). This was later “clarified” to be “we want a weaker dollar in the short term, but a stronger dollar in the long term”, a message of almost labyrinthine complexity, which did little to calm nerves. It also bears a resemblance to the situation pertaining in 1987 and as one tweet suggested, that did not end that well…

But the Dollar’s demise has long preceded this latest row; the Dollar peaked in December 2016, so something else is going on and that something is global growth; both the ECB and the Bank of Japan appear to be edging away from QE (for now!), leading to the Euro and the Yen rising on expectations that interest rate differentials will narrow, as the latter two raise rates, while the Fed gets close to their target range (and thus slows down the extent of their rate rises). Whether either nation’s economy can withstand any serious monetary tightening is open to question, but this suggests that it is still interest rates that dominates FX trader’s thoughts. Even the perennially gloomy IMF predict that world growth will pick up both this year and next, partly as a result of Trump’s tax cuts, which further boosts the attraction of other currencies- the Dollar tends to benefit from “safe haven” status and as such rises when investors are concerned about the world economic prospects and vice versa.

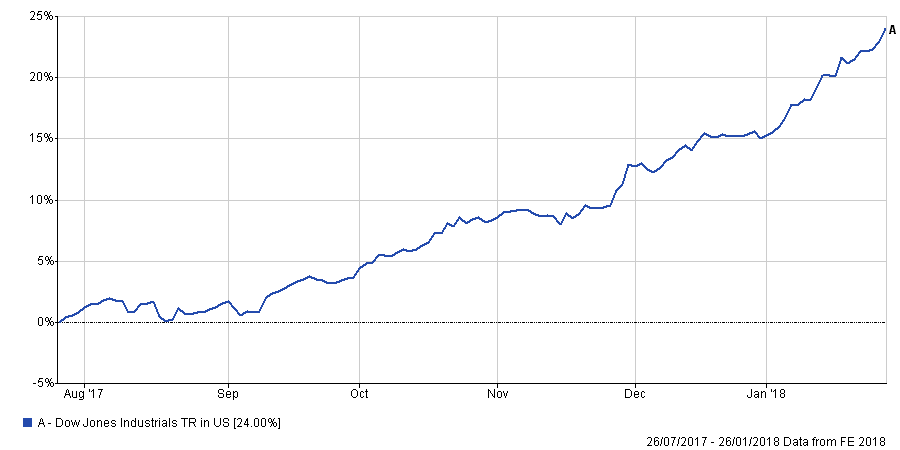

As the chart below shows. the Dow has just gone straight up. The return in Euros, however, is just 16%, over the same 6 month period, highlighting the effect of currency on market returns. If the stock market likes a weak Dollar, so too, will Trump (as he is already laying claim to responsibility for the market’s rise). But there comes a point when neither the Dollar nor equities can ignore bond yields and a 28 basis point (0.28%) rise in yields in January alone may lead to some profit-taking if it should continue, (in both assets). For now, an uneasy peace prevails..

The problem stems from the Dollar’s world reserve currency status- its weakness provokes more US Dollar bond issuance (up another 5% in the year to September 2017, according to the BIS), as both overseas governments and corporations find that investors much prefer to borrow in Dollars (rather than local currencies) and a weaker Dollar implies a lower expense bill, as one is paying the loans back in a devalued currency. Of course, this process also works in reverse; Emerging Markets are often at the sharp end of Dollar rallies, for exactly the same reasons; it tightens monetary policy in those nations, as they are forced to raise interest rates to prevent capital flight. Alternatively, of course, they can devalue their own currencies; but that caused the Asian financial crisis of 1997-98 and few governments want a repetition of those events.

There is a delicate balance to be struck- the Dollar is used globally because it is trusted- the US Treasury estimates that nearly 60% of ALL Dollars in circulation (c.$500 Billion) are held outside the US, which is more than those held inside the country. To weaken it too much runs the risk of the rise of an alternative (Bitcoin?), whilst at the same time worsening the trade positions of Japan, Europe etc. But the opposite would inflict the same damage on to the US economy, (something that Trump would not accept). So, the “prisoners dilemma” continues, with all sides trying to get away with depreciating their currencies, hoping that the other side doesn’t notice (or complains too much). Thus far, the Americans appear to be “winning” the currency war.

However, the Dollar Index may now be testing a previous trend line support, which could change the game again. After what seems like an age of tranquility, things might be about to get interesting again. Whether investors like it will depend on their risk exposures.

[1] According to analysts, 43% of the S&P 500 Company’s earnings come from overseas, so a weaker Dollar is definitely a tailwind for earnings. Unless of course, a full -scale trade war breaks out…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.