October Economic Background

- Labour government presents inaugural Budget,

announcing £100bn additional capital spending

and £40bn tax increases

ㅤ - Final campaigning takes place ahead of US

Presidential election on 5th November

ㅤ - European Central Bank announces 0.25% rate

cut, taking deposit facility rate to 3.25%.

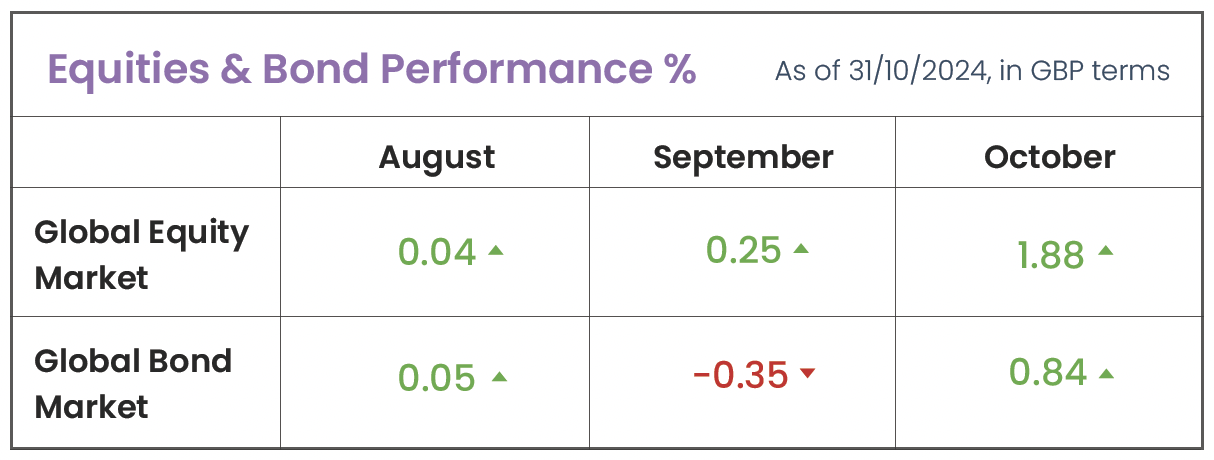

Source: Morningstar Direct (Global Equity Market: Morningstar Global Markets index, Global Bond Market: Bloomberg Global Aggregate index)

Market Review

UK Budget: UK Chancellor Rachel Reeves presented the Labour government’s first Budget since being elected in July. The measures announced include a £40bn increase to taxes (the largest Budget tax hike in decades), and an increase in public borrowing to fund £100bn of additional capital spending, with a particular focus on the NHS and public schools.

While income tax rates, rates of national insurance paid by employees, and VAT rates remained unchanged, the government announced an increase to the rate of capital gains tax (CGT), and increases to employers’ national insurance, with the latter expected to raise £25bn of additional revenue. Alongside this a range of other tax hikes were announced, including higher taxes on private equity, second homes, private jets and private schools.

Source: CNBC, extracted 4/11/24

With proposed extra borrowing of £28bn on average per year over the life of parliament, markets were somewhat unsettled by the news, with UK government borrowing costs increasing following the announcement. For example, the UK 10-year government bond yield continued the upward trajectory it had been on since September, increasing from 4.27% at the open of Budget day, to 4.45% by early November (bond yields move inversely to prices, with rising yields signifying falling prices).

Attention now shifts to the Bank of England (BoE); following a reduction to interest rates of 0.25% to 5.00% in its August meeting, expectations are for a further rate cut of 0.25% in its next meeting on 7th November, as the BoE focuses on slowing long-term CPI inflation despite the fiscal loosening announced in the Budget. This would follow in similar footsteps to the European Central Bank (ECB), which announced a 0.25% rate cut during October, taking its deposit facility rate down to 3.25%.

US Election: As the US Presidential Election campaigning went into its final days, polls were split regarding the expected victor. While Donald Trump had been gaining ground in the weeks prior, a surge of support for Kamala Harris was noted as October drew to a close, with the dollar weakening as a result (a Trump victory has been expected to lead to a stronger dollar, through proposed tariffs and tax cuts leading to inflationary pressures and a lower likelihood of interest rates cuts by the Federal Reserve). With Americans going to the polls as this market commentary went to print, the direction for the US over the coming 4 years will shortly be determined.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Simpson, MSci

Investment Support Analyst at ebi Portfolios

What else have we been talking about?

- June Market Review 2025

- May Market Review 2025

- Calendar-Based Rebalancing (CBR) vs Tolerance-Based Rebalancing (TBR)

- April Market Review 2025

- Ruffled Feathers: Exploring Black Swan Events