November Economic Background

- Trump wins the 2024 U.S presidential election

- Ukraine strikes Russia with U.S made long-range missiles

- UK inflation rises while interest rates are reduced to 4.75%

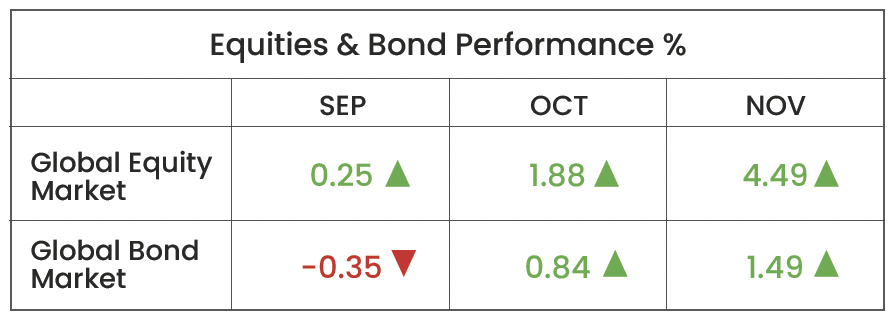

As of 30/11/2024, in GBP terms. Source: Morningstar (Morningstar Global Markets; Bloomberg Global Agg)

Market Review

U.S Election: The Republican candidate Donald Trump won the 2024 U.S. presidential election against Vice President Kamala Harris on Tuesday 5th November. Following the election, the U.S. stock market experienced robust gains, with the S&P 500 and Nasdaq Index both hitting record highs. These developments further boosted global markets, contributing to a second consecutive year of strong growth. The 2024 campaign and election results captured widespread attention, dominating headlines. However, historical evidence suggests that election outcomes have limited long-term impact on stock market performance. Instead, markets tend to be driven by corporate earnings, which play a more direct role in driving equity valuations, alongside the wider business cycle and the monetary policy backdrop. Albeit, election outcomes can influence proposed policies, regulatory changes, and the dynamics of global conflicts, each of which can have varying impacts across different sectors and industries. This highlights the importance of maintaining a well-diversified investment portfolio to navigate these potential shifts effectively.

Russia-Ukraine: U.S. President Joe Biden authorised Ukraine to carry out limited strikes into Russia using U.S.- made long-range missiles, marking a significant policy shift just a couple of months before Donald Trump is set to take office in January. The decision comes in response to the deployment of thousands of North Korean troops to assist Russia and an intensified wave of Russian strikes on Ukrainian cities. A Russian spokesperson criticised the move, accusing the outgoing U.S. president of attempting to “provoke an escalation of tensions” and warned Moscow would respond “appropriately.” Donald Trump, who has expressed scepticism about providing additional military aid to Ukraine, has pledged to swiftly end the war, though he has not detailed his specific plans for achieving this.

U.S. stock markets reacted negatively to Biden’s decision, with the S&P 500 and Nasdaq indices falling 0.6% and 0.5%, respectively, at the open on Tuesday 19th November, reflecting investor concerns about rising geopolitical tensions. European markets also experienced a sell-off, likely due to fears of further escalation in the war, which could disrupt energy supplies, heighten economic uncertainty, and increase market volatility across the region.

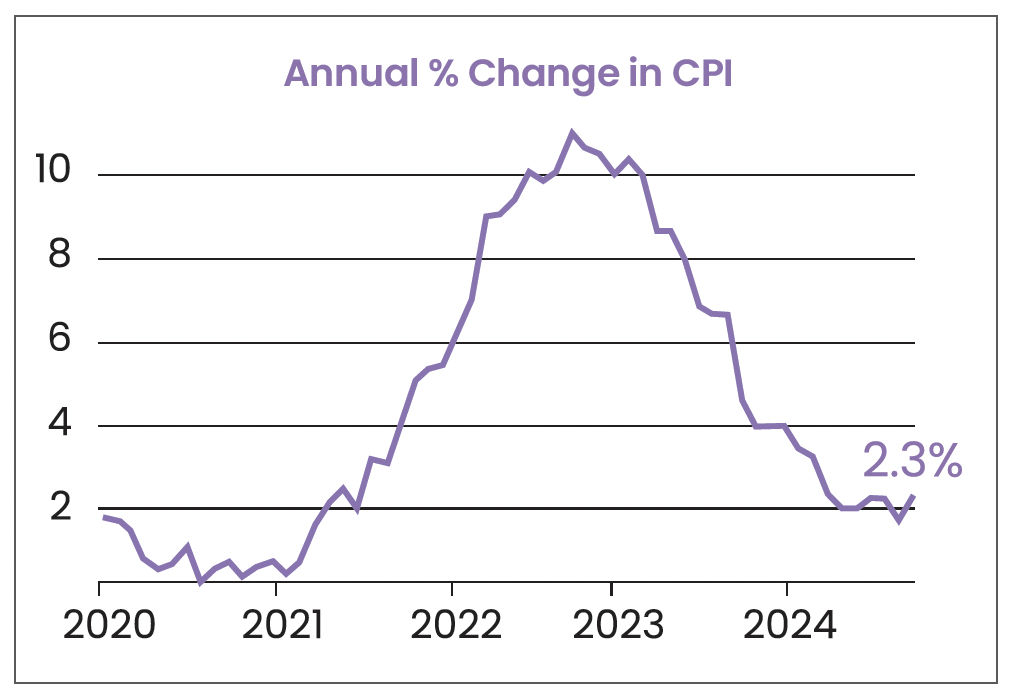

UK Inflation: The UK’s Consumer Prices Index inflation rate rose to 2.3% in the 12 months to October, marking a six-month high and up from 1.7% in September. This surpassed both the Bank of England’s (BoE) 2% target and market expectations of 2.2%. The primary driver of the increase was a surge in gas and electricity prices, fuelled by warnings of potential supply disruptions from Russia. In response to economic pressures, the BoE reduced interest rates in November, lowering the benchmark rate from 5% to 4.75% – a move widely anticipated by markets. However, investors now expect no further rate cuts this year, as the central bank is likely to maintain current rates during its December meeting. Governor Andrew Bailey emphasised the importance of avoiding overly rapid or excessive rate reductions, highlighting the BoE’s careful balancing act between supporting economic growth and keeping inflation under control.

Source: Trading Economics, extracted 29/11/2024

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup, ACSI, BA (Hons)

Investment Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025