“It is not the strongest or the most intelligent who will survive, but those who can best manage change.” ― Leon C. Megginson (Business Professor 1991-2010).

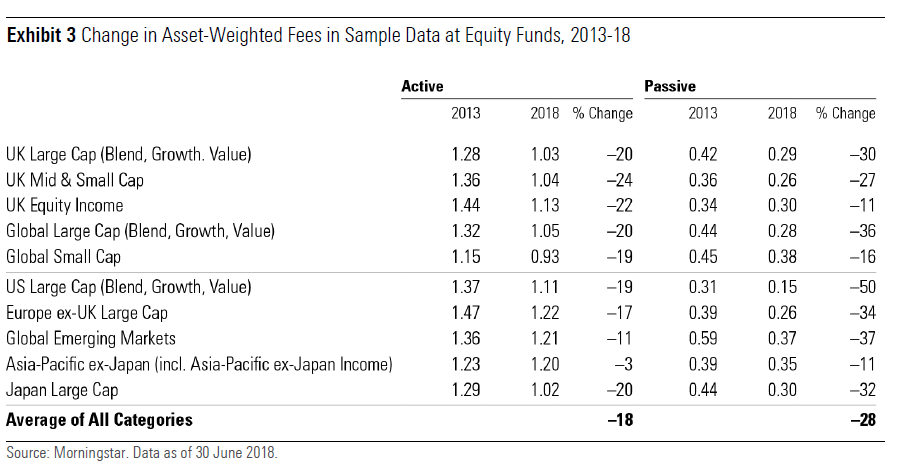

The price war between asset managers has been fierce in recent years but has been more aggressively fought in the passive arena- as this article noted late last year, Active fees have fallen by less than those of Passive funds, despite starting from a higher base. Like an eye-witness to a major catastrophe, the Active managers appear to be in a state of numbed incomprehension, unable to process what is happening to them. Meanwhile “feemageddon” as it has been dubbed, rolls on relentlessly; Passive funds have taken huge bites out of Active Manager’s assets, as investors wise up to the cost (as well as the returns) differentials.

But as with many revolutions, sooner or later the protagonists turn on each other, and we are now seeing new attempts to prise market share from erstwhile fellow-travellers. Whilst charges tend towards zero, the scope for more price drops correspondingly fall and the next target for cost reduction may well be the Index providers themselves (MSCI, S&P Indices, and FTSE Russell), who license the Benchmarks that the funds use. This has been on the radar for a while, but the recent surge in demand for low-cost ETFs has focussed minds on this issue. Anecdotally, Index providers charge fees which correspond to c.20-30% of the total costs of an ETF [1] according to one source we have spoken to. The main Index providers (as listed above) have a market share of around 80% and profit margins of around 71%, which are passed on to the fund (and thus the investor). Combined revenue for the global Index market was up 19% last year, to $3.5 billion. Hence the rise of “self-indexing” as an alternative method of benchmarking performance, whereby the fund managers construct their own benchmarks, by-passing the orthodox Index providers, sometimes by using a newer, cheaper competitor, such as the German Index firm Solactive, (who are said to be half the cost incurred by State Street for using MSCI Indices) and in the process either allowing a new reduction in fees or a lift to fund manager margins. Seven years ago, Vanguard switched the Index provider for some of their International funds, though notably between them rather than from them and Blackrock did likewise last year, though in an even more limited way. Wisdom Tree, who began self-Indexing in 2009 remains the pioneer here and as of year-end 2018, nearly two-thirds of its AUM was in self-indexing funds.

However, Index providers do have some leverage; for one, Index creation is easier to do in equities, as pricing sources are much more transparent than in some sectors of the bond market, giving rise to the possibility of LIBOR or Gold market “fixing” conflicts of interest in the latter asset class.

Is it a good idea for a bond fund manager to produce its own Index? Regulatory requirements often require a separation of Index and Product providers, to prevent the manager front-running Index changes for example [2]. Self-Indexing is not allowed in some Latin American countries and this article hints at why Index providers have enormous power to re-direct Index fund flows into (and out of) countries, with the smaller nations most vulnerable to this phenomenon. Conversely, there appears to have been a lot of behind the scenes pressure on MSCI to include Chinese shares in their Emerging Markets indices, at least in part due to concerns that the Government would hinder their efforts to grow in that country, how do we know? Because the Chief Executive of MSCI Inc felt the need to deny it…

The other major advantage they have is investor inertia – institutions still prefer to use the “big three” firms (which is a form of “Index – hugging” itself) and some pension funds have close links to those companies, reducing the demand for change. It is often easier to promote a fund using one of these recognisable Indexes rather than newer versions and as the major providers have no (direct) vested interest in the direction that those Indices take, there is less likely to be any overt manipulation in their content. For Index funds, there is also the risk that self-indexing in a major fund could provoke a backlash- the fund manager could potentially be cut off from using the same Indices in their other funds, which may be why neither Vanguard nor iShares have embarked upon this route (thus far).

But for newer funds, and fund houses, these factors may not be so relevant. They need to demonstrably add value and to get to scalable size, they need AUM. In the current environment, this means being low cost and any way of doing so will inevitably attract funds. Differences in Indexes may not mean that much for (non-institutional) investors, as they are aiming to capture returns from a style/factor/market generally and are less concerned with relatively minor tracking error discrepancies. In any event, many of the newer entrants are actually contracting out the Index calculation process to the very same Indexing providers. As we see the growth of interest ESG/ERI funds, new Indexes may need to be created anyway, as many of the existing Indices are not relevant for current needs [3], and this may provide a convenient justification for fund managers for doing what may be necessary anyway, to become (or remain) competitive. For investors, the outcome may be more important than the process and they may well decide that the lower costs justify the use of less well-known benchmarks. As the fee wars continue to rage, fund managers will probably have no choice but to comply…

[1] So an ETF which costs 0.25% per annum will be paying c.6 basis points annually, which seems like an extraordinarily high cost (for what exactly?). I write anecdotally, as the charges themselves are buried in the accounts of the fund managers, labeled as “other fees”, which do not tell us how much they actually pay- “commercially sensitive” I think is the phrase employed to justify this opacity.

[2] “Front running” refers to the practice of buying assets that are about to be added to Indices and selling those to be deleted before anyone else has the opportunity to do so. Needless to say, it is illegal and equally needless to say, it happens.

[3] This is in addition to the glaring disparities in Index weightings for example in Emerging Markets; South Korea inhabits a Schrodinger-like world, whereby it is either a Developed market (according to FTSE) or an Emerging Market (MSCI). Choosing one or the other Index can thus have significant relative returns implications for fund managers.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.