May Economic Background

• Trump’s trade policies bring tariff tensions back into focus

• China responds with global outreach and trade realignment

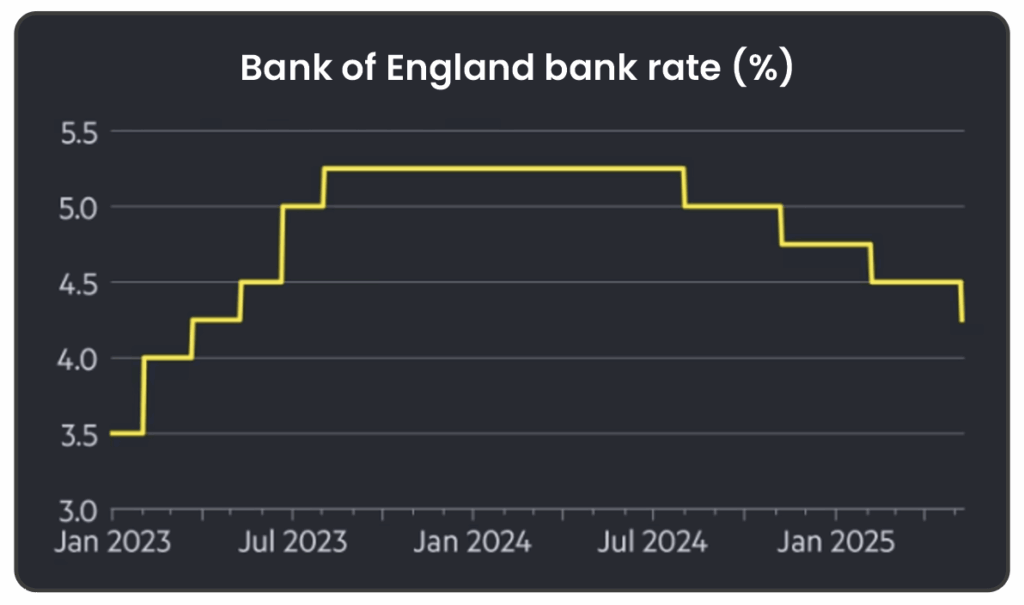

• Bank of England cuts interest rates from 4.5% to 4.25%

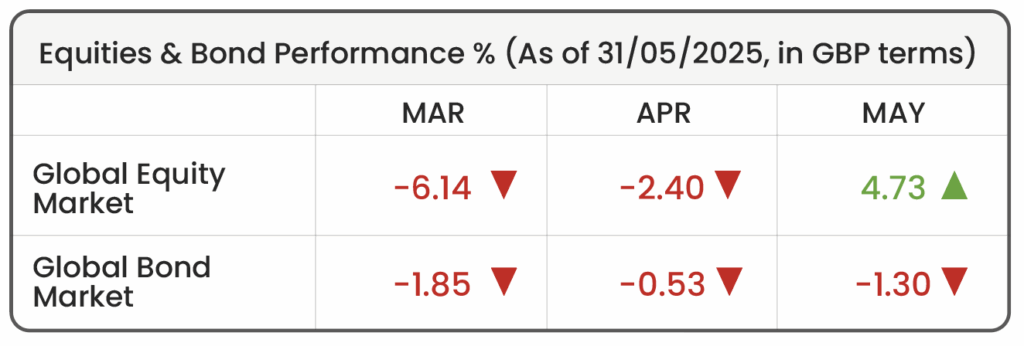

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Trade Tensions Continue: May was marked by further turbulence in global markets, driven by President Donald Trump’s aggressive trade stance and swift geopolitical responses. His sweeping tariff proposals, first unveiled in April, introduced a 10% blanket tariff and duties of up to 145% on Chinese goods, jolting investor confidence. Markets rallied mid-May after a surprise 90-day pause to the tariffs agreed between the U.S. and China, as U.S. tariffs on Chinese imports were cut from 145% to 30%, while Beijing lowered its own tariffs on U.S. goods from 125% to 10%. The following day, the S&P 500 and Nasdaq responded with gains of 2.7% and 3.7%, respectively. However, on May 23rd, Trump announced a 50% tariff on EU imports, citing stalled negotiations and “unfair trade practices.” The move reversed market momentum, as equities fell, the dollar weakened, and investors rotated into traditional safe havens such as bonds. True to form, Trump softened his stance days later, agreeing to delay the EU tariffs and resume talks after a call with European Commission President Ursula von der Leyen.

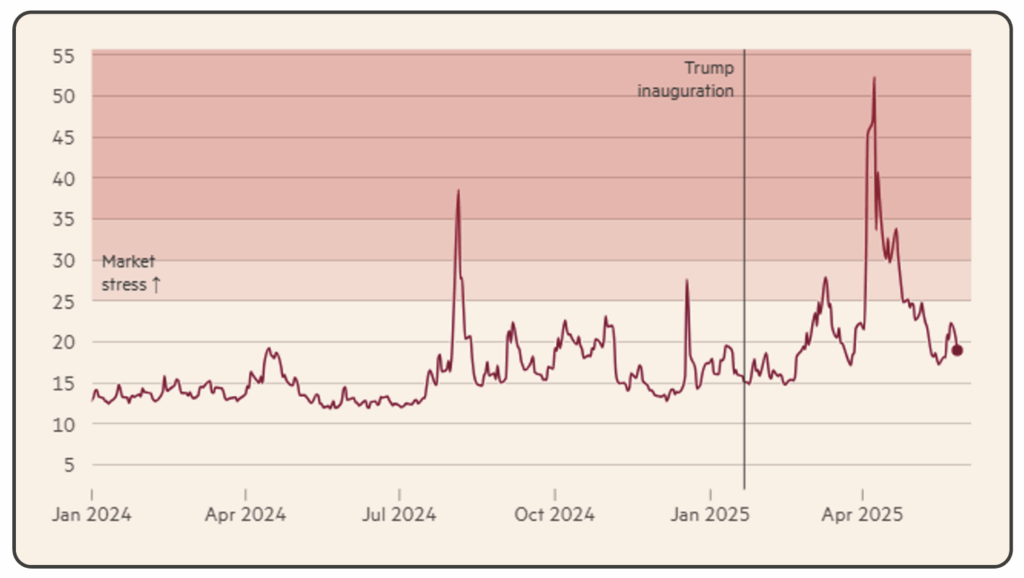

Market volatility, as measured by the CBOE VIX index (Wall Street’s “fear gauge”) had surged above 50 in April amid the tariff barrage. By late May, it had moderated to the low 20s, suggesting that the worst of the immediate tariff shock has been absorbed by markets, though uncertainty remains elevated.

Financial Times. Last Updated 29 May 2025.

The Vix index is a measure of investor expectations for volatility in the U.S. S&P 500 stock market over the next 30 days. The index’s long-term average is slightly below 20. Levels above 25 point to expectations of heightened turbulence, implying daily swings of more than 1.5 per cent in the S&P 500. A rise in the VIX above 30 is typically associated with extreme volatility and has only happened a handful times in the past few years.

China’s Strategic Moves: As the U.S. intensifies its tariff regime on global imports, especially those from China, Beijing is finding creative ways to soften the blow and secure its position in the global economy.

First, let’s talk about the tariffs themselves. The U.S, particularly under the Trump administration, imposed steep tariffs on Chinese goods in an effort to curb what it sees as unfair trade practices. In response, Chinese exporters have reportedly begun undervaluing their shipments, intentionally declaring lower prices on cargo or tweaking product descriptions to reduce the amount of duties they owe. While technically illegal, this tactic reflects how far some suppliers are willing to go to stay competitive in the face of rising costs.

Why is this happening? China’s domestic demand has been relatively weak, so its economy leans heavily on exports. With one of the largest manufacturing sectors in the world (producing about a third of the global supply), China needs international buyers to keep its factories engaged. If tariffs make its goods too expensive, demand could quickly dry up.

But China isn’t just playing defence. It’s also reshaping its foreign policy to broaden trade relationships. As the U.S. becomes more inward-looking, China is positioning itself as a leader of global trade. Recent moves include dropping sanctions on the EU, boosting diplomatic visits across Asia, Latin America, and Eastern Europe, and promoting trade ties in regions traditionally under U.S. influence. However, not all doors are opening. China recently criticised the UK-U.S. trade deal, which it fears could squeeze Chinese products out of British supply chains. This creates added tension in China’s efforts to mend ties with the UK.

For investors, the message is clear: while tariffs may disrupt short-term trade flows, China is playing a long game, recalibrating its global strategy to maintain export strength and international influence. But with abrupt policy shifts, rising geopolitical tensions, and heightened uncertainty in global trade dynamics, this highlights the importance of global diversification. Relying too heavily on any one market or region exposes portfolios to sudden shocks. A globally diversified investment strategy can help cushion against these risks by spreading exposure across multiple economies, industries, and regulatory environments.

BoE Rate Cut: The Bank of England (BoE) cut interest rates by 0.25% in May, from 4.5% to 4.25%, but struck a cautious tone, noting it is not on a “preset path” to further easing. The decision, arriving just hours before the announcement of a UK-U.S. trade deal, reflects the central bank’s attempt to balance slowing domestic growth, inflation risks, and the global uncertainty stemming from President Trump’s escalating tariff regime.

The Monetary Policy Committee (MPC) was notably divided: five members supported the 0.25% cut, two preferred a more aggressive 0.5% reduction, and two voted to hold rates at 4.5%. This divergence led markets to reassess expectations. Traders are now pricing in only two more rate cuts for 2025, down from three before the meeting. The pound climbed above $1.33 following the BoE’s decision. This more cautious, or “hawkish,” tone made investors think that UK interest rates might stay higher for longer than previously assumed.

Source: Bank of England (BoE). Published 8 May 2025.

Higher interest rates, or even just the expectation that they won’t fall quickly, tend to make a country’s currency more attractive to investors. In part this is because higher rates typically lead to higher returns on savings and investments tied to that currency. In this case, traders and global investors saw the BoE’s position as a sign of relative strength, especially compared to other central banks that may be lowering interest rates more aggressively.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Highlights of 2025

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025