March Economic Background

• Europe sets out defence spending plan

as the U.S. pulls back its military aid

• UK Chancellor Rachel Reeves delivers

the Spring Statement

• Trump’s tariffs rattle global markets

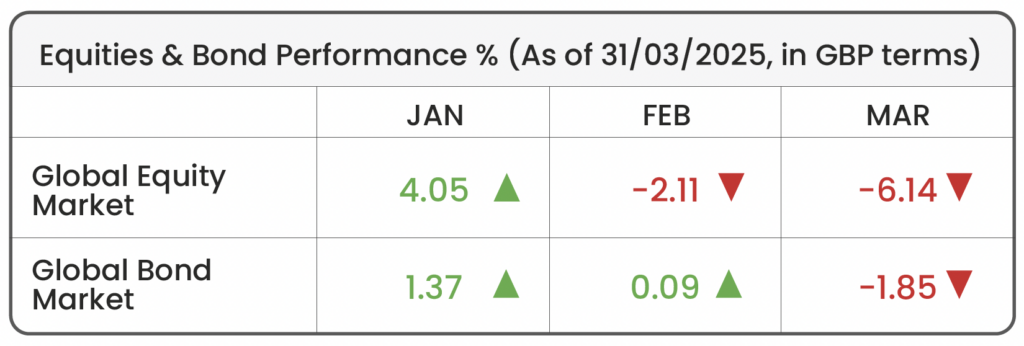

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Defence Spending: A high-stakes meeting between Ukrainian President Volodymyr Zelenskyy and U.S. President Donald Trump at the Oval Office on Friday 28th February took a tense turn as the two leaders clashed over the future of Russia’s invasion of Ukraine. Just days later, the U.S. announced it would suspend military aid to Ukraine, with Trump using the move as leverage to push Zelenskyy toward concessions in a potential peace deal. Trump’s decision sent shockwaves across Europe, prompting major European nations (such as the UK, France, Germany, and Nordics) to accelerate plans to take on greater responsibility for the continent’s defence. This included increasing defence budgets and fast-tracking existing plans for military expansion, as an extended pause in U.S. aid could provide a strategic advantage to Russia. The announcement of higher defence spending triggered a surge in many defence-related stocks, boosting European equities, as investors anticipated that increased government spending on military contracts would lead to higher revenues and profits for defence companies.

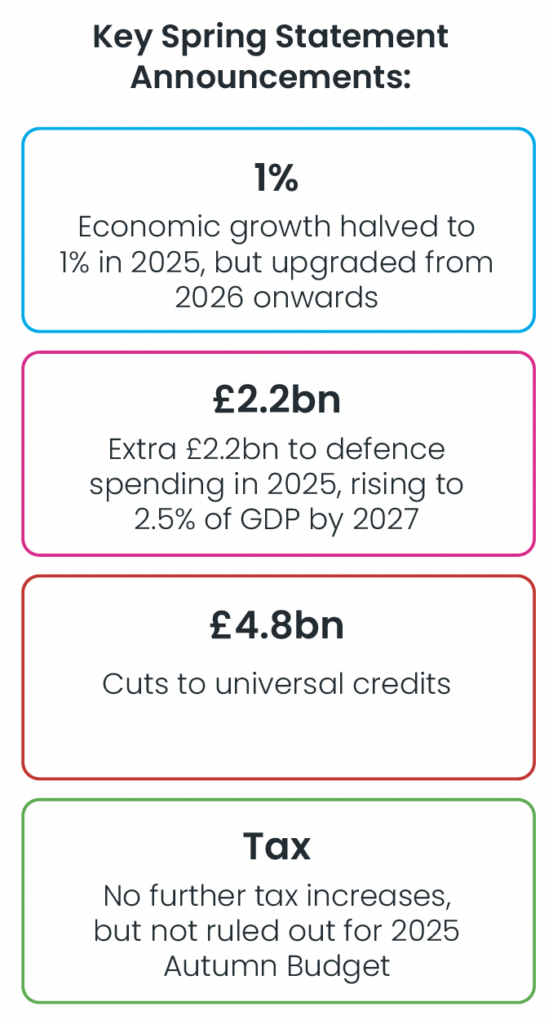

UK Spring Statement: The Spring Statement delivered a mixed outlook for UK economic policy, with limited fiscal headroom of £9.9bn in 2029-30, restrained public spending, and no immediate tax increases – though the door remains open for hikes in the Autumn Budget. While economic growth projections were revised upward from 2026 onwards, the near-term outlook is weaker, with growth expected to fall to just 1% in 2025 (previously expected to be 2%). For UK equity markets, the most immediate impact stems from increased defence spending, with an additional £2.2bn allocated next year, bringing the budget to 2.5% of GDP by 2027. As aforementioned, this has been a tailwind for defence companies, which could see stronger demand and higher valuations. Similarly, the government announced £2bn in investment funding for startup companies, coupled with £2bn for affordable housing and £600m for construction training, which may boost related industries. However, the limited fiscal headroom leads to continued uncertainty, especially if economic conditions worsen, potentially necessitating future tax increases or spending cuts. This lack of flexibility (combined with the prospect of higher taxes) could erode business and consumer confidence, ultimately putting downward pressure on stock prices. On a global scale, market participants continue to monitor the UK’s fiscal credibility, as any signs of unsustainable debt expansion could lead to volatility in UK assets, and UK government debt.

U.S. Tariffs: Donald Trump has issued executive actions at an unprecedented pace early in his second term as U.S. president, introducing a series of new tariffs. Below we discuss the timeline of tariffs throughout the month and their implications on markets and for investors.

Reminder: What are tariffs?

A tariff is a tax placed on imported goods, making them more expensive. This is meant to encourage consumers and businesses to buy locally made products instead of importing from other countries, as well as raising revenue from purchases of imported goods. For stock markets, tariffs can have both good and bad effects. For example, companies that make goods domestically (like steel or car manufacturers) may benefit because their products become more price competitive, which can boost their stock prices. However, businesses that rely on imported materials, may face higher costs, cutting into their profits and lowering their stock prices.

Tariffs can also lead to trade tensions between countries, sometimes resulting in retaliatory tariffs – where other nations impose counter-tariffs in response to initial tariffs being levied. This can create uncertainty in global markets, causing stock prices to fluctuate as investors try to assess the economic impact. In general, markets tend to react negatively to aggressive tariff policies

Key Tariff Timeline:

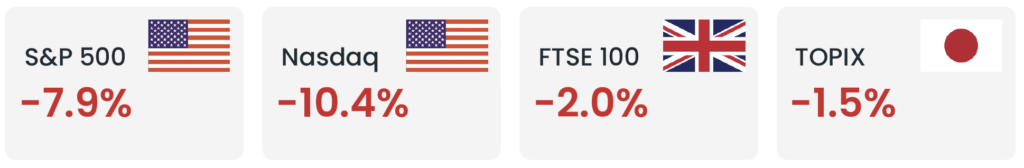

The uncertainty surrounding Trump’s tariff strategy persists, characterised by abrupt shifts between imposing and retracting trade barriers. Throughout the month, he repeatedly threatened new tariffs, only to reverse or delay them shortly after. As economic concerns grew in both the U.S. and overseas, Trump softened his stance, downplaying the severity of future trade restrictions – a sharp contrast to the strong rhetoric he had issued earlier. Economists caution that widespread retaliatory tariffs could further weaken an already struggling economy, increasing costs for businesses and, ultimately, consumers. Since tariffs act as taxes on imports that companies typically pass down through price hikes, fears of inflation and slower growth have escalated. As a result, the market rally that followed Trump’s November election victory has largely been unwound, with several major stock indexes ending the month in decline.

Source: Morningstar. Data from 01/03/2025 to 31/03/2025 in GBP terms.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team