June Economic Background

• U.S. stocks deliver strong monthly and quarterly returns

• Oil prices fall on ceasefire hopes

• U.S. and UK interest rates hold steady, meanwhile the ECB cut rates again

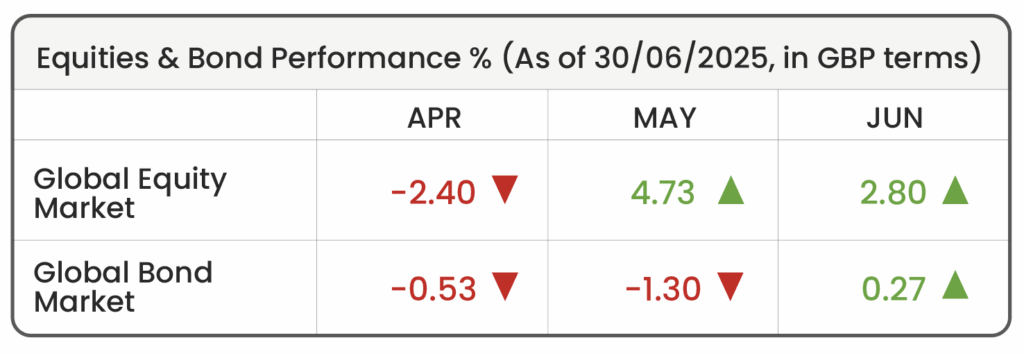

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

U.S rally challenges Europe shift: After a turbulent start to the year driven by trade tensions and political uncertainty, the U.S. stock market has staged a strong rebound. The S&P 500 index rose approximately 5% in dollar terms in June, and over 10% over the second quarter of 2025, outpacing other regional equity markets around the world. While some of this was due to the weakness of the dollar against other global currencies, the S&P 500 index still delivered a strong performance of almost 5% over the quarter when measured in pound sterling.

This performance has surprised many market participants who had shifted funds to Europe, anticipating that the U.S. would struggle under the weight of tariff policies and slowing growth. Optimism about Europe was high earlier in the year, especially following Germany’s ambitious €1 trillion plan to invest in defence and infrastructure, alongside broader moves toward looser fiscal policies across the region. While those developments remain in progress, there remains question marks over the region’s ability to deliver sustained growth.

Meanwhile, U.S. markets have been buoyed by a familiar driver: household name technology stocks. These companies have once again attracted strong interest from investors, helping to power the latest rally. This has been supported by solid economic data, including stronger-than-expected job growth and stable unemployment, leading to further confidence being regained in the U.S. stock market. While some investors have rotated away from U.S. stocks into markets like Europe or emerging economies, others argue that the U.S. remains the most resilient and dependable market globally. Ultimately, both regions present their own set of risks and opportunities and as market performance becomes more fragmented across regions, this reinforces the need for global diversification.

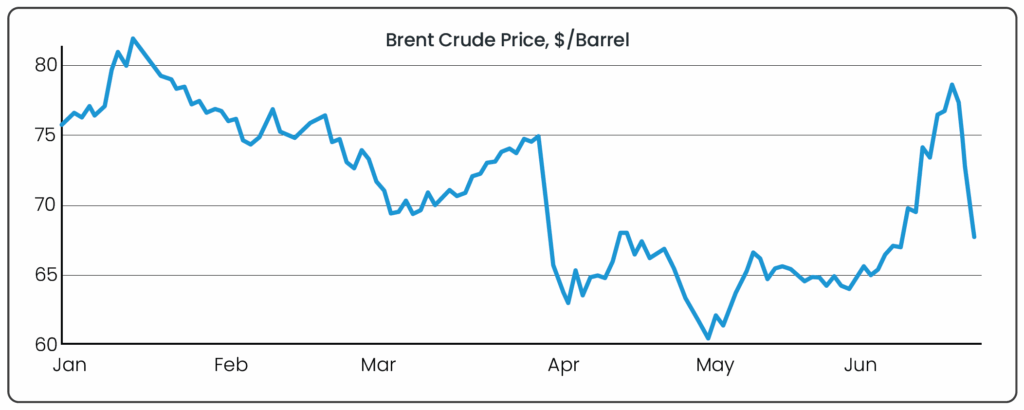

Oil prices fall on ceasefire hopes: Global oil prices, which surged in early June amid intensifying tensions between Israel and Iran, fell sharply toward the end of the month following the announcement of a ceasefire between the two countries on June 24th. The initial spike in prices was driven by fears that Iran might retaliate by disrupting the Strait of Hormuz, a critical shipping route through which a large portion of the world’s oil supply is transported. However, the ceasefire helped calm those concerns, and oil prices quickly fell as the perceived risk to global supply chains diminished. The decline in oil prices is a positive development for global markets, as it helps ease inflationary pressures, lowers operational costs for businesses, and reduces the financial strain on consumers. These factors typically support stronger investor sentiment and can boost equity market performance. While Israel did confirm a strike on Iranian territory after the ceasefire, the United States moved swiftly in an attempt to de-escalate the situation, with the U.S. noting that the terms of the ceasefire agreement would also allow China to resume oil imports from Iran, further reducing fears of supply disruptions and adding to the downward pressure on global crude prices.

Looking ahead, investors are likely to remain focused on geopolitical developments in the Middle East, where conditions remain volatile. Recent events serve as a reminder of how quickly regional conflicts can impact global markets. It wasn’t long ago that the Russia–Ukraine war triggered a sharp surge in oil and gas prices, setting off a prolonged period of market turbulence. Elevated energy costs contributed to higher inflation across major economies, and helped prompt central banks, particularly in Europe, to respond with aggressive interest rate hikes. That rapid policy tightening weighed heavily on economic growth and significantly dampened investor returns over an extended period.

Oil prices have been volatile over recent months

Interest rates: At the start of June, the European Central Bank (ECB) cut its key interest rate by 0.25% to 2%, while signalling it is likely nearing the end of its rate-cutting cycle. The move was widely expected, as inflation in the Eurozone has eased and is now holding close to the ECB’s 2% target. Over the past year, the ECB has gradually reduced its benchmark rate from a peak of 4%, aiming to support economic growth while keeping inflation under control.

In contrast, UK inflation (as measured by the Consumer Prices Index) remained higher, coming in at 3.4% over the 12 months to May, well above the Bank of England’s (BoE) 2% target. As a result, the BoE held interest rates steady at 4.25% in its June meeting, although it hinted at a possible rate cut as early as August. This is largely due to signs of a weakening labour market, with slowing job growth suggesting that demand in the economy is softening. Lowering interest rates could help ease financial pressure on businesses and households, encouraging spending and boosting economic activity.

Meanwhile, in the U.S, the Federal Reserve (Fed) also kept interest rates unchanged, despite continued pressure from President Donald Trump, who has been openly calling for rate cuts. While Trump’s push for lower rates is aimed at boosting the economy, his aggressive tariff policies, especially in the context of ongoing trade tensions, are expected to lead to increased prices for U.S. consumers. That makes the Fed hesitant to lower rates too soon, as doing so could risk pushing inflation higher and forcing future policy reversals, although a number of market participants believe a cut in July may be on the table.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Jonathan Griffiths, CFA

Investment Product Manager at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025