July Economic Background

• Easing trade fears boost market sentiment

• Higher debt costs strain UK finances

• Interest rates hold steady as central banks eye trade talks

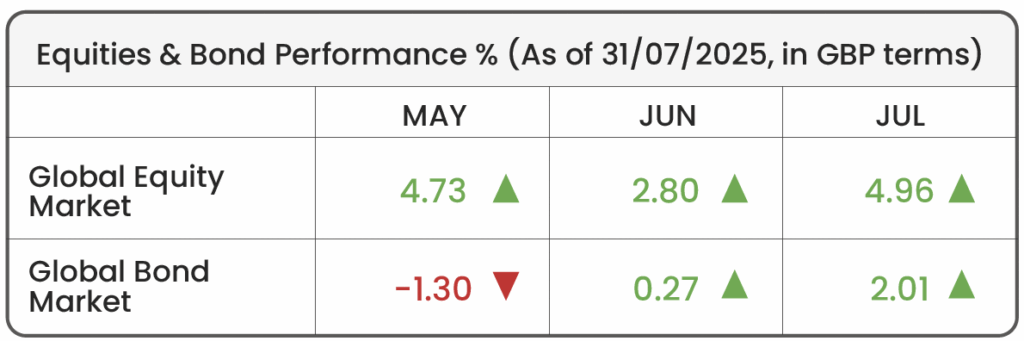

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Tariff turmoil fades as optimism lifts market:

After months of uncertainty surrounding global trade, markets breathed a sigh of relief in July as tensions began to ease. Despite a rocky start to the month marked by fresh tariff threats from US President Donald Trump, investor sentiment remained surprisingly resilient. Stock market volatility dropped to some of the lowest levels seen all year, and major indices, including the FTSE 100, hit new record highs.

At the heart of this calm was a shift in investor perception: rather than reacting with alarm to Trump’s tariff rhetoric, markets began to treat his comments as negotiating tactics rather than imminent threats. This view was reinforced later in the month when a significant breakthrough was announced. On July 23rd, the US and Japan revealed a new trade agreement, with Trump hailing it as a “massive” deal. Central to the deal was a decision to reduce tariffs on key goods from a previously threatened 25% down to 15%. This lower rate was seen as a positive development by markets, as it signalled a more measured approach to trade policy and helped avoid the kind of economic disruption many had feared. The 15% tariff is still an additional cost to businesses, but far more manageable than the originally proposed 25%, which could have seriously dented trade flows and corporate profits. Investors took this as a positive signal that the risk of severe trade disruptions was fading.

This wave of optimism quickly spread to Europe. In the days following the US-Japan deal, European stock markets rallied as expectations grew for a similar agreement between the US and the European Union (EU). Those hopes were confirmed when a deal was reached just days later, reinforcing the sense that international cooperation was gradually being restored. As such, the broader market tone in July became one of cautious optimism. With investors increasingly confident that major trade conflicts may be resolved through compromise rather than confrontation, markets have shifted their focus back toward company fundamentals and economic data. Nonetheless, the evolving nature of global trade negotiations remains a key factor to watch in the months ahead.

Source: Morningstar Direct. (UK; FTSE 100. Europe; Stoxx Europe 600. US; S&P 500) in GBP terms.

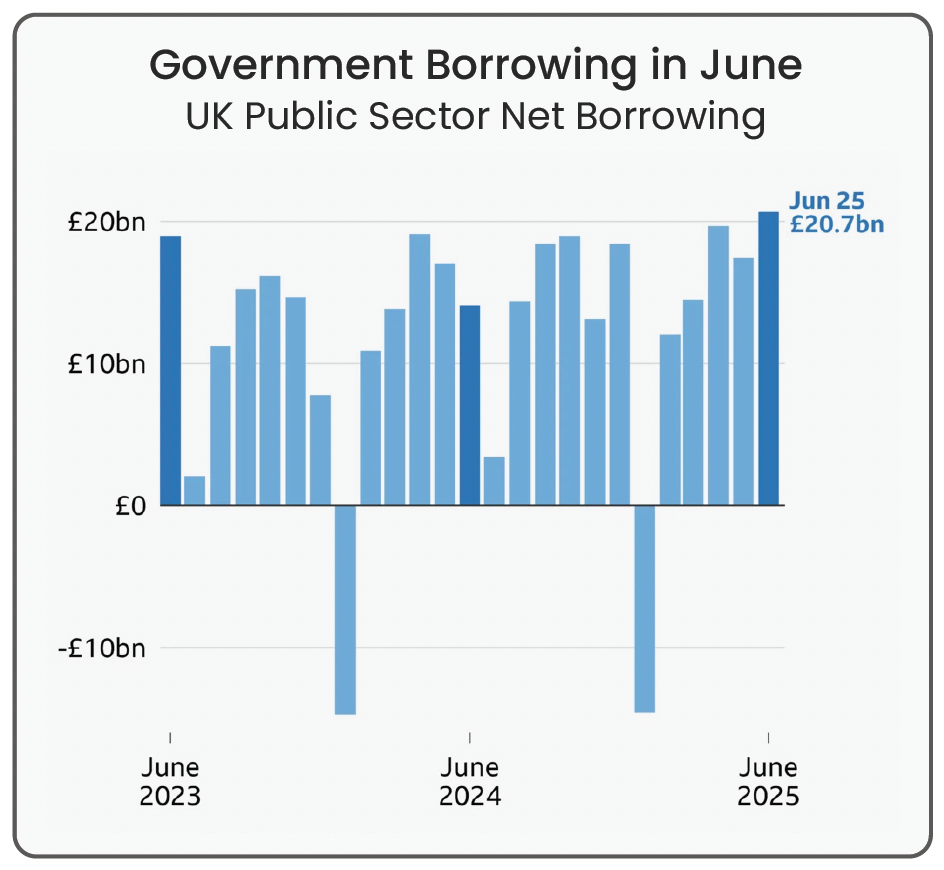

Surging interest costs push UK borrowing higher than expected:

The UK government borrowed £20.7bn in June, significantly above the official forecast of £17.1bn, adding to growing concerns about the country’s financial outlook. When government spending exceeds the money it collects through taxes and other income, it must borrow to make up the difference, typically by issuing debt. This borrowing helps fund essential public services but also goes toward repaying existing debt payments. In June, borrowing rose sharply mainly because interest payments on the government’s existing debt surged, reaching one of the highest monthly levels on record. Much of this is linked to older debt that adjusts with inflation, meaning higher prices have pushed repayment costs up considerably. This growing strain on the public finances has raised concerns about how the government will manage its budget going forward, particularly as it tries to meet its own fiscal rules while supporting a slow-growing economy.

Source: Office for National Statistics. June figures highlighted in dark blue. All figures exclude public sector banks.

This news had a noticeable impact on UK government bonds (known as “gilts”). Bond prices fell, pushing the yield (i.e. interest) on 10-year gilts up to 4.65% before easing slightly. Put simply, when investors worry about government borrowing, they demand higher returns for lending money as its perceived as riskier, which causes bond yields to rise and prices to fall. For stock markets, the reaction was more muted, but the underlying implications are important. Higher borrowing and rising debt costs increase the pressure on the government to raise taxes or cut spending for upcoming budgets. This could dampen consumer spending or hurt certain sectors, particularly those reliant on public funding. On the other hand, some expect potential tax increases on wealthier individuals or capital gains, which could affect investor behaviour and market sentiment. Looking ahead, the government’s limited room for manoeuvre means fiscal policy could remain tight. That adds to the broader uncertainty facing UK assets, especially if economic growth remains sluggish. Market participants fear the UK government is borrowing too much, at too great a cost. Albeit, other argue extra borrowing helps the economy grow faster, generating more tax revenues in the long run.

Interest Rate Watch | Central banks tread carefully amid trade uncertainty:

Central banks opted for caution in July, keeping interest rates unchanged as they assessed how President Trump’s new tariff regime might impact the global economic outlook. For now, central banks appear to be hitting pause, waiting to see how trade tensions play out.

The European Central Bank (ECB) kept its benchmark rate at 2%, signalling a “wait-and-watch” approach ahead of the August 1st trade deadline with the US. ECB President Christine Lagarde struck a cautiously optimistic tone, noting inflation is back at target and recent rate cuts may be nearing an end. However, any trade escalation could reignite inflation and dent growth, making policy decisions highly dependent on geopolitics.

Across the pond, the Federal Reserve (Fed) also left rates unchanged for the fifth straight meeting, holding firm at 4.25%-4.50%. The decision revealed internal disagreement, with two Trumpappointed governors dissenting, arguing rates are too restrictive (i.e. high). Fed Chair Jerome Powell emphasised that no decisions have been made for September, keeping markets guessing as the Fed weighs mixed economic signals.

The Bank of England (BoE) didn’t meet in July, but with its next rate decision set for August 7th, attention is firmly on how it will balance slowing inflation with the wider uncertainty caused by global trade tensions. Falling inflation typically paves the way for rate cuts, but ongoing economic risks may prompt the BoE to hold off, wary of potential inflation spikes ahead.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025