January Economic Background

• Trump’s inauguration and executive orders spur market volatility

• UK chancellor Rachel Reeves faces pressure to rebuild UK confidence

• AI disruption sparks historic Nvidia selloff

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Trump Inauguration: Donald Trump’s inauguration as the 47th U.S president on January 20th provided an initial boost for stock markets, driven by his pro-business agenda, deregulation efforts, and promise of a “golden age” for the U.S economy. However, aggressive new trade policies, including tariffs on Canadian, Mexican, and Chinese imports, unsettled investors, particularly in currency markets. Meanwhile, the U.S economy grew at a 2.3% rate in Q4, a weaker-than-expected end to a year defined by consumer resilience. The Federal Reserve (Fed), wary of inflation, kept interest rates steady at 4.25%-4.5% during its January meeting, pausing its ratecutting cycle after three consecutive reductions in 2024. Fed Chair Jerome Powell emphasised there was no urgency to lower rates, highlighting lingering inflation risks. Markets remain wary of Trump’s influence, as his push for aggressive rate cuts contrasts with the Fed’s cautious stance.

UK Economy: In January, gilt yields surged to their highest levels in decades, reflecting investor concerns over the UK’s deteriorating fiscal position. The yield on 10-year gilts (UK government bonds) hit its highest level since the 2008 financial crisis, while the 30-year gilt yield hit its highest since 1998. This rise in yields signals growing concern about the government’s ability to manage its finances effectively. Rising yields mean that the cost of borrowing for the UK government has become more expensive. As confidence in the government’s fiscal plans weakens, gilt investors (i.e. those who lend money to the government by purchasing bonds) perceive higher risks associated with UK debt, resulting in less relative demand compared to other assets, a lower price, and a higher yield. Consequently, the UK faces higher borrowing costs on new bond issuances, limiting fiscal flexibility and making it more expensive to finance public projects or stimulate economic growth. This dynamic heightens concerns about a potential recessionary environment, as reduced government spending and investment (due to higher borrowing costs) can hinder economic expansion and dampen growth. There are also wider concerns regarding the potential for stagflation (slow or falling economic growth, combined with high inflation and elevated unemployment), in light of the wider inflationary backdrop faced by the UK, alongside its challenging debt dynamics and relatively weak economy.

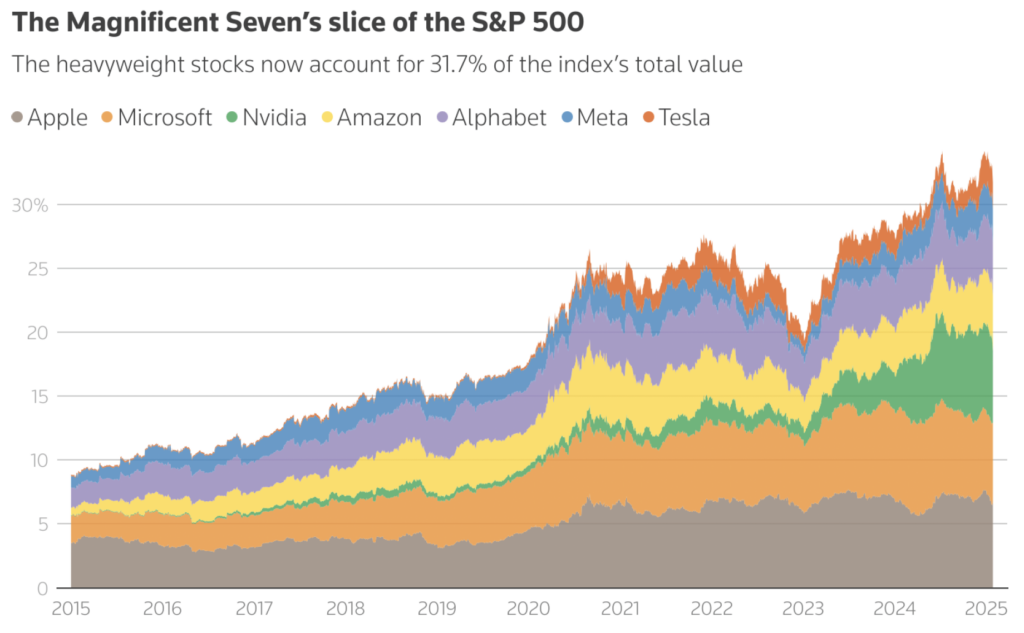

Tech Sell-off: Donald Trump called Chinese AI start-up DeepSeek a “wake-up call” for U.S. industries as Nvidia suffered a shocking $589 billion market cap wipeout in a single day, and a share price fall of 17%. The selloff on Monday 27th, (also experienced across other AI stocks and the tech sector more broadly) rattled global markets, triggered by DeepSeek’s launch of a free AI assistant, which seemingly boasted greater efficiency and lower costs than existing products (such as Open AI’s ChatGPT), while making the software code open source (rather than proprietary, in the case of ChatGPT). While Nvidia somewhat rebounded the following day (+9%), the sharp decline exposed the risks of inflated AI valuations and the market’s heavy reliance on a handful of tech giants, with investor capital remaining highly concentrated in the renowned “Magnificent Seven”.

Published January 28, 2025 By Reuters. Source: LSEG

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team