My latest blog discusses the market implications of a falling Pound Sterling relative to the US Dollar and how this affects UK-based investors. Both the benefits and drawbacks of this particular exchange rate movement are discussed as well as the effect it has on equity and fixed-income markets. This piece also highlights ebi’s stance on hedging currency risk.

Introduction

The latest fiscal stimulus package presented by the new UK Chancellor Kwasi Kwarteng saw the Pound sterling (GBP) lose as much as 4.7%, trading around $1.035 early Monday Morning (26th September 2022 at 01:00). The proposed plan unveiled by the Chancellor on Friday 23rd September aims to replenish economic growth amidst ongoing high inflation. The package will see tax cuts and increased government spending in an attempt to curb the rising energy prices.

Market participants reacted negatively to the news with critics saying that the new measures will not redistribute income equally. Market players have since shown less confidence in the Pound with the UK facing an increasing debt burden at a time of rising interest rates. Market players are predicting that the Bank of England (BOE) may have to scale up its bond issuance (selling bonds to the public) to pay for the debt, with some forecasting an emergency rate hike to stabilize the Pound Sterling. The BOE has since distanced itself from the possibility of an emergency rate hike. The UK is set for one of its largest ever monthly rises in government borrowing.

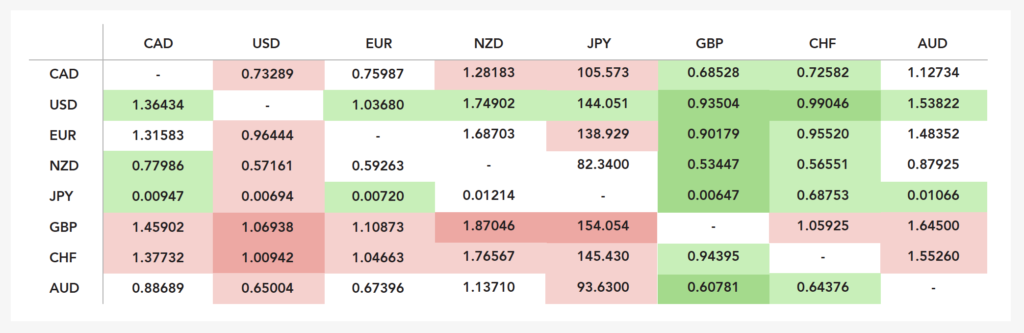

This particular exchange rate movement has many implications for UK-based investors who invest in both the US and UK financial markets. A depreciating (falling) Pound Sterling relative to other global currencies (the US Dollar in this case) reduces the purchasing power of the Pound which makes imports more expensive. It now costs more to buy the same amount. These upward cost pressures may exacerbate UK inflation which in turn may lead to future additional rate hikes on top of those already factored in. This could have negative future growth implications for the UK. On the flip side, a weaker Pound Sterling makes UK exports more competitive and cheaper to buy for foreign consumers and investors. This can help increase the sales and profit margins for export-led UK-based businesses. With approximately 75% of the FTSE 100’s companies’ revenues coming from overseas, a weaker Pound may be beneficial for the index’s returns; with a large proportion of the revenue being denominated in US dollars. In the current environment, UK-based investors may benefit from a weaker Pound. If a UK-based investor invests in a US-based company through a fund or portfolio their currency is exchanged from Pounds Sterling (GBP) to US Dollar (USD). If the Pound continues to fall and the investor decides to sell their units, those dollar earnings buy more Pounds when exchanged back into Sterling, making those revenues more valuable. The S&P 500 is down 22.5% year-to-date however UK investors’ losses have been lessened to just 3.7% due to the exchange rate differential1. Nevertheless, the Uncovered Interest Rate Parity (UIRP) – is an economic theory that states that in the long run, an investor gains no excess return due to exchange rate fluctuations2.

For the USA, a surging Dollar makes imports cheaper. In July 2022, U.S exports were $259.3 billion compared to $329.9 billion for imports3. With US exports presenting approximately 10-12% of the country’s GDP, there are underlying concerns regarding the sustainability of a strong home currency with exports becoming less competitive. A strong dollar represents bad news for US companies that generate a substantial proportion of their revenues overseas.

Fixed-income investors felt a sizeable drop in bond prices with the 10-year benchmark yield rising approximately 4.1% following Friday’s announcement, with traders betting on an emergency rate hike. There exists panic and uncertainty in financial markets with market players concerned about the massive increase in government borrowing. The risk-off sentiment – a price behaviour by investors which displays a reduction in risk tolerance, has been further intensified by the mixed policies set out by the BOE and HM Treasury. Additional interest rate hikes could prompt an influx of ‘hot money inflows’, and if successful could both stabilise the Pound and point towards lower inflationary pressures4. It is worth noting that overseas investors hold c.25-30% of the UK Gilt market with new investors attracted to the cheaper bond prices and existing bondholders concerned about the underperformance5.

In the face of short-term volatility, Kwarteng told the Financial Times that it is important to focus on the longer-term strategy and not fixate on short-term market movements6.

The chart below shows that Pound Sterling is generally trending both below and above $1.6000. Taking a long-term holistic view shows that foreign exchange markets trend both upwards and downwards.

ebi’s Stance

We are in favour of portfolios that are globally diversified and have similar geographic, sector, and asset allocations to the market. The MSCI ACWI IMI Index allocates 3.82% to UK equities, with over 60% in the USA. Investors that invest in a portfolio which closely matches the characteristics of the global benchmark average should not benefit or be at a disadvantage from exchange rate fluctuations over a long-term holding period as in the long-run currency returns even out.

Long-term bond volatility is around 7-8% on an annualized basis, equity volatility is around 16% whilst foreign exchange volatility is c.11% per annum. Our bond funds are all hedged to GBP (Pound Sterling) internally by our fund managers. The U.S. debt market makes up c.41% of the global bond market, with c.12.50% attributed to Japan, c.9% to China, and c.4.3% to UK bonds. For a UK investor, it is viable to hedge bonds to the home currency as the exposure is mainly to foreign debt which can sometimes provide unexpected risks as currencies are highly correlated with interest rates.

We do not hedge our equity funds as equities tend to be a more influential driver of the overall volatility of a global portfolio. Hedging currencies in an all-equity portfolio would therefore not significantly reduce return volatility and would provide an additional cost.

References

[1] Michael, A., 2022. What A Weak Pound Means For Your Money. Forbes Advisor UK. Available at: Online [Accessed 26 September 2022].

[2] Corporate Finance Institute. 2022. Uncovered Interest Rate Parity (UIRP). Available at: Online [Accessed 26 September 2022].

[3] U.S. Bureau of Economic Analysis. n.d. U.S. International Trade in Goods and Services, July 2022 | U.S. Bureau of Economic Analysis (BEA). Available at: Online [Accessed 26 September 2022].

[4] Potters, C., 2020. Hot Money. Investopedia. Available at: Online [Accessed 25 September 2022].

[5] Gard, J., 2022. Gilt Yields Spike, Pound Slides on Mini-Budget Tax Cuts. [online] Morningstar UK. Available at: Online [Accessed 26 September 2022].

[6] Parker, G., Giles, C. and Stubbington, T., 2022. Pound resumes slide after BoE and Treasury seek to steady markets. Financial Times. Available at: Online [Accessed 26 September 2022].

Blog Post by Amar Ghai

Investment Analyst at ebi Portfolios.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025