Reflecting on ebi’s milestones from 2024 as we look ahead to 2025.

The Bigger Picture

ebi hits £3 Billion AUM

ebi reached £3 Billion in Assets under Management in July, a 50% increase in just over a year, solidifying our position as one of the fastest-growing DFMs in the country!

Best Model Portfolio Service

March saw ebi’s first award of the year, ‘Best Model Portfolio Service’ at the Professional Adviser Awards.

Best Outsourced

Investment Manager

In September, ebi were delighted to win ‘Best Outsourced Investment Manager’ at the Money Marketing Awards 2024. This award is a testament to the consistent hard work and effort by everyone at ebi.

Best Portfolio Management Software Provider

November saw ebi named ‘Best Portfolio Management Software Provider‘ at The Institutional Asset Manager Awards! This recognition reflects ebi’s commitment to providing world-class tools and evidence-based solutions.

Best Turnkey Asset Management Provider – UK 2024

Finally, in December ebi rounded off the year with ‘Best Turnkey Asset Management Provider – UK 2024’ by FDI Insider.

New Portfolio Suites

SRI

The SRI portfolios launched in February; A globally diversified, market-based portfolio suite with a Socially Responsible Investing focus.

The Dimensional Core, Core Plus and Sustainability Wealth Models

In April, ebi began implementing the Dimensional Core, Core Plus and Sustainability Wealth Models for its members, providing research-driven, systematic framework for pursuing a wide range of investment goals.

Impact

The Impact portfolios followed in June; a range of impact-focused portfolios, aiming to generate positive, measurable, and sustainable social and environmental change, alongside a financial return.

Cash Plus

Finally in July, ebi began offering the Cash Plus portfolios; the single portfolio solution for investors seeking a combination of yield, liquidity, and low capital risk.

Price Reductions

Fundment Platform discount secured

In May, a further Fundment platform discount was secured, with portfolios with a value greater than £500,000 seeing a reduction in fees.

New Tools

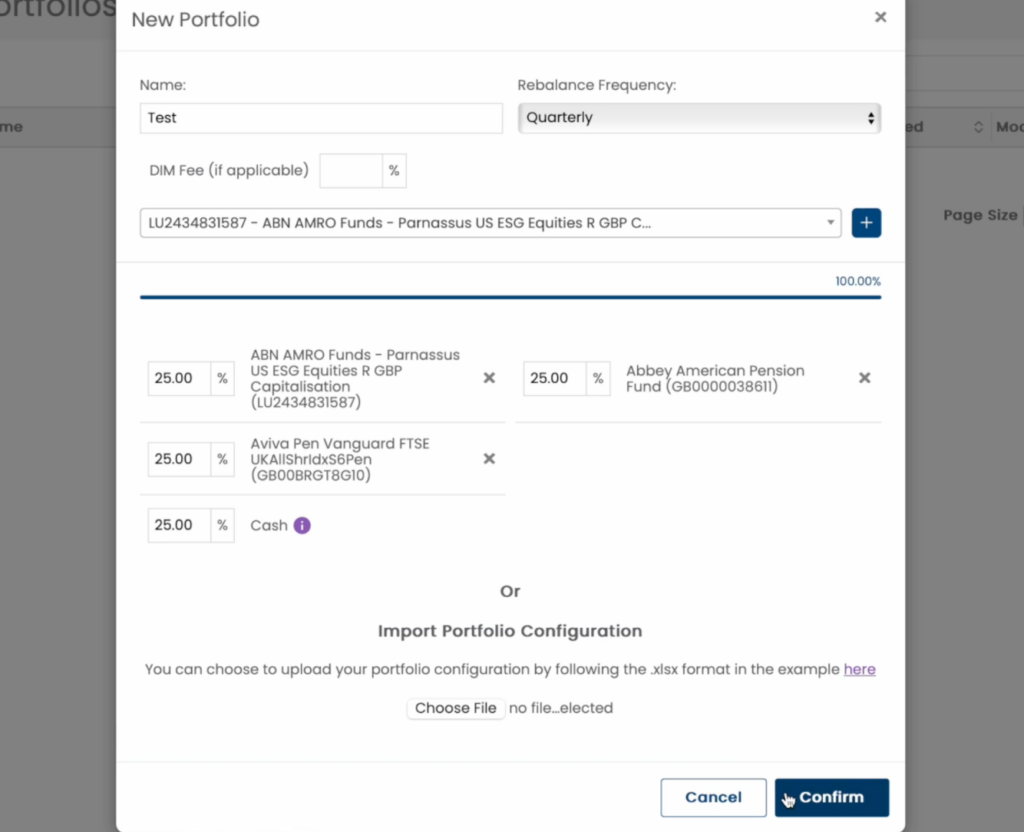

Portfolio Comparison

February saw the launch of our Portfolio Comparison Tool; enabling members to quickly build a custom portfolio, compare it against an ebi portfolio and generate a Switch Report.

Over 1,500 InSight Reports delivered in 2024

Not exactly a new tool but certainly a milestone to celebrate, with over 1,500 completed requests in 2024, up 36% on the previous year.

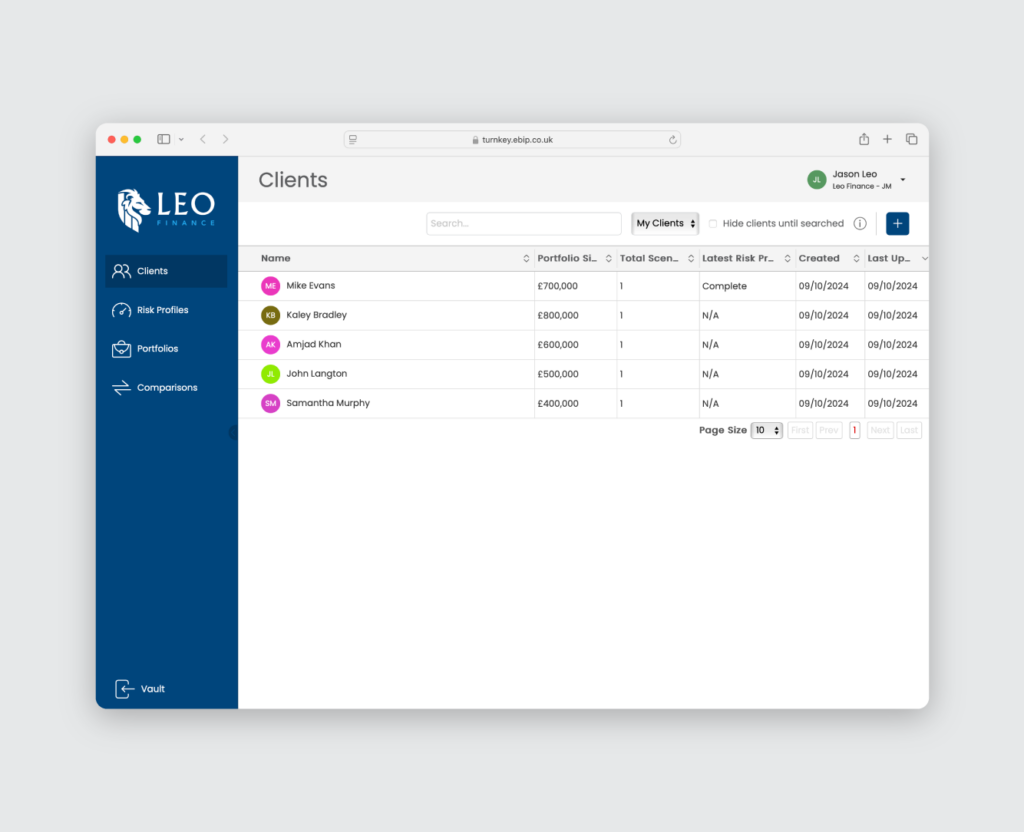

Turnkey Redesign

In September our development team launched a redesigned Turnkey (ebi’s risk profiling, lifetime cashflow modelling and portfolio comparison tool) improving navigation and a host of new features.

Member research, analysis and client tools

Core ESG Live on FE Analytics

Core ESG Live on FE Analytics.

Core/Core ESG mapped to

Oxford Risk

In March, Core/Core ESG portfolios were officially mapped using Oxford Risk’s rating service and added to ebi’s risk profiler (built within the Turnkey cash flow modeler).

Core Portfolios

mapped to EValue

Core was also mapped to EValue’s risk rating service.

DFA Portfolios as implemented

by ebi available on The Lang

Cat Analyser

In June, advisers were allowed to undertake completely independent research and due diligence on the portfolios, based on suitability, and compare them to the rest of the market.

ebi’s portfolios risk rated by

Defaqto

ebi in the news

Jonathan Griffiths joins PA Future’s podcast ‘Green Dream’

July saw Jonathan Griffiths join PA Future’s podcast ‘Green Dream‘ where he examined the potential impact of Artificial Intelligence on the Investment Industry with Professional Adviser.

Jonathan Griffiths spoke on FT Adviser Asset Allocator

In July, Jonathan Griffiths spoke on FT Adviser Asset Allocator where he discussed Factor tilts, the AI boom and SDR rules.

Top MPS performers

In August, ebi was thrilled to be highlighted in Citywire New Model Adviser, recognising top-performing managed portfolio service providers! Over 1,100 MPS portfolios were analysed across 67 providers with Vantage Earth 80 making the top ten in the 60-80% Equity MPS category.

People

New starters

ebi welcomed Tom Ranft (Business Development Manager), Richard Kelly (Business Development Manager), Rachel Wilmshurt (Product Manager) and Sue Smith (Head of Compliance) in 2024.

Qualifications

ebi are proud to support team members in furthering their professional development, and over the past year the team have achieved various qualifications, ranging from CFA Level 2 and Financial Planning Practice (RO6) to CFA Certificate in Impact Investing.

Volunteering

Members of the ebi team volunteered at St Martin’s Church in Walsall. Armed with tools and determination, the team cleared land to create space for a pond installation, which will enhance the local environment and provide a peaceful space for the community.

The ebi 10k

In June, the ebi team were proud to complete the Aldridge 10k and raised £725 for the James Brindley Foundation.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

What else have we been talking about?

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team