“Historically, the claim of consensus has been the first refuge of scoundrels; it is a way to avoid debate by claiming that the matter is already settled” – Michael Crichton

Without much fanfare, last month the IMF announced that it would be including the Chinese Renminbi in its SDR (Special Drawing Rights) currency basket for the first time, in doing so adding a fifth currency to the mix [1]. It is the confirmation of the rise to global status of the Chinese economy (and by extension, the rise of Chinese political power), and has been hailed by them as them arriving on the world stage.

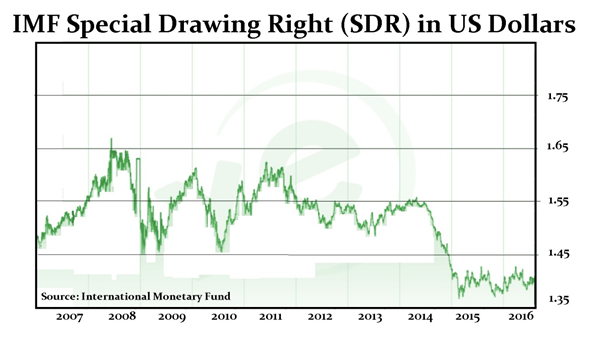

As shown below, the SDR has been falling versus the US Dollar over the last 2-3 years, prior to the Renminbi’s inclusion.

This news, of course, is manna from heaven for Dollar bears; there are many out there who are forecasting the demise of the US currency (in truth, many of them have been doing so for years). A US Dollar collapse, long foretold, would vindicate those who have been advocating Gold purchases, as a hedge against Armageddon. But does this line of reasoning make sense?

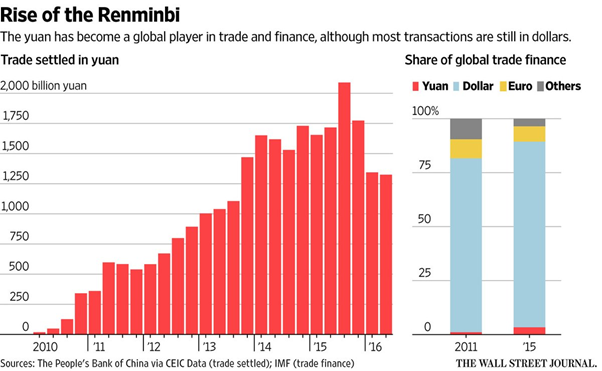

As the chart below shows, trade in Chinese currency units has risen significantly in the last 5 years, as the country has risen in economic significance. But they represent a tiny fraction of global trade volumes (and almost nothing in terms of foreign exchange trade).

It seems that the Dollar is still the “cleanest dirty shirt” in the laundry basket – big institutions need to be in highly liquid, non-volatile assets (and markets), and for this, the US fits the bill nicely. In contrast, the SDR is purely a theoretical basket used by the IMF for calculating the value of their loans to troubled governments, so no-one can invest in it anyway.

The Reserve Status of the US Dollar is based on political security (both domestic and geopolitical), and the “depth” of US equity and bond markets (i.e. how much you can buy and sell without the price being affected). Does anyone really think that the Euro, the Yen, Sterling and the Renminbi represent serious competition? Middle East conflict, European banking crisis, eruption of Sino-Japanese violence will lead to Institutions wanting to park their money in Dollars, not Sterling, Renminbi or any of the other choices. No institution (or company) can buy SDR’s, since it is essentially a notional concept, rather than a store of value – in any event, as the top chart shows, it has been falling against the Dollar. It is not clear how the SDR could destroy the Dollar when the latter represents 40%+ of the former!

In addition, Emerging Market countries (and companies) have issued US Dollar debt equivalent to 50% of the total US Government debt – on redemption, the issuers are going to need US Dollars to repay the debts. On a more practical level, paying for a McDonald’s hamburger in Moscow in Dollars is fine – try paying in Renminbi or Yen!! A change in the IMF’s currency basket will make little or no difference to this.

The forecasts of imminent dollar collapse are most frequently used to justify commodity investments (Gold in particular, but Oil is also touted as an alternative to “overvalued equity and bond markets”). It is not impossible that Commodities generally could rise, but it may not be due to the Dollar’s fall and if the premise of a Dollar fall is incorrect, it does not bode well for the investment return on these assets, as Dollar strength is normally a net negative for Commodities as they are priced in Dollars. Advisers need to be aware of the siren call of commodities, and understand what the investment premise actually is; should the Dollar fail to collapse, returns could be very different from what “Gold Bugs” are currently expecting.

[1] The weightings are now USD 41.7%, Euros 30.9%, Renminbi 10.9%, Yen 8.33%, Sterling 8.1%. (as of 1/10/16). As the currencies rise, their relative weighting in the basket will therefore, rise (and vice versa).

[2] It is not even possible to issue Yen denominated debt without Japanese Government permission!

—

Image credit: https://www.flickr.com/photos/heyrocker/117059817

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.