“Once a barrel of lit matches rolls into a field of dynamite sticks, you don’t try to predict which one will explode; you just get the heck out of there”- John Hussman (US Portfolio Manager).

Sterling’s immolation has taken centre stage again this week, but behind the scenes, after a long lull, problems in Europe are starting to re-appear. Both political and economic issues, long avoided, have come home to roost, putting the prospect of full-scale crisis back on the agenda. Let us count the ways…

1) If there was any doubt as to the frenzied nature of recent ECB -sponsored bond buying, in early October Italy issued a 50 year bond at a yield of just 2.85%, lower than that of France and Spain, and a rate that is lower than that which they tried (and failed) to achieve for 3 month bills in 2009. It was nearly 5 times oversubscribed, in a country that has a looming banking crisis, (see the Monte Paschi, for whom bail in still looks more likely than not, despite Government denials), a Target 2 Deficit at record levels [1], has an up-coming referendum on Constitutional reform that might un-seat the current Prime Minister, (Matteo Renzi), leading to the possible ascension to power of the anti -EU 5 Star Movement, and thus an Italian Brexit (Quitaly anyone?). The recent fall in Bond prices globally has led to big losses, and may signal the peak of Central Bank power- Mario Draghi has vowed to do “whatever it takes” to rescue the European economy, but he is limited to a maximum 30 year duration in bond purchases, which Investors should have known. Buyers remorse ensues..

2) Meanwhile, concerns over Deutsche Bank have re-surfaced. News of a muted $14 billion fine this time over mortgage mis-selling, has led to heavy share selling and a surge in their CDS [2]. Speculation that Qatar will buy more shares, or that the fine will be negotiated down to $4-5 billion has led to huge price swings, but the underlying problem is their Derivatives book. All 42 trillion Euros of it- this is far bigger than the 4 trillion Euros of German GDP, and thus (way) too big to bail (out). Despite re-assurances from senior bank executives (and some of the media), the market is becoming increasingly worried, with some Hedge Funds reportedly withdrawing money from the bank. The company has announced a bonus freeze, and has issued new bonds, but at a Junk Bond- like rate of 4.19% for 5 year issuance. Most seem to believe that Mrs Merkel will have no choice but to bail it out at some point (and in some fashion), but here, another problem reveals itself.

3) There are a raft of Elections due in the next 12 months, in France, Italy, Holland AND Germany. All of the incumbents are facing a strong challenge from populists, mostly from the Right. Economic stagnation in France and in Italy, the refugee crisis in Germany, and anti-EU sentiment in general could mean that none of the current leaders are in situ to face Theresa May in Article 50 negotiations, let alone to sort out the European banking mess. It could also mean that de-facto EU break-up is well underway.

Of course, Investors have noticed: the chart below highlights a Dollar “Shortage”, caused by investors desire to own the US currency, (selling Euros), to escape the likely turmoil. The currency swaps market is where funding pressures for the banking industry are felt first. After that, spot currency rates feel the pain. Just as with the Soviet Union break-up (gradually then very suddenly), the precise trigger point will inevitably take us by surprise.

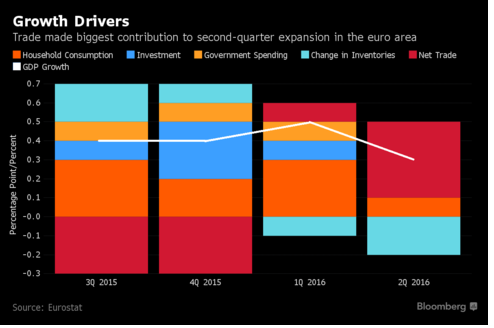

For UK Investors, the implications may be “interesting”. For one thing, it would take the pressure off the Pound, as investors re-deploy away from Europe. The European (ex-UK ) stock markets are only c.12% of the World Index, so in the absence of a “Lehman ” event, it is unlikely to have a major global effect, except in increasing the demand for US Dollars. Indeed, it is not clear that it will be a wholesale negative, particularly for the Southern European nations; Spain, Italy and Portugal (not to mention Greece), would benefit immensely from withdrawal from the Euro, (post the Brexit-style currency falls), which would allow a “re-set”. Germany would be the loser (as their currency would strengthen rapidly), but net-net, it may well be a positive. As the chart below shows, trade is about the only thing keeping the Euro-zone going. As such, a weaker currency should provide a reflationary impulse where it is needed most- in Southern Europe. Look at the recent FTSE experience; the FTSE 100 is up 15% since the Brexit result- but the more domestically-focused FTSE 250 is up 12.2% , so the effect is UK-wide; there is no reason to assume it would be any different across the Channel.

[1] Think of Target 2 as a sort of trade deficit internal to the EU – it is a sign that Investors are selling Italian assets, in order to buy other Nation’s assets (Germany).

[2] Credit Default Swaps: essentially, they are insurance against Company default. The higher the price, the more likelihood that the Company will go bust.