The seemingly endless Greek saga looks to be close to denouement today (9/7/15) as Prime Minister Tsipras appears to be set to acquiesce to the terms demanded by the Troika, the ECB, (and most importantly), Angela Merkel. Indeed, they are likely to be harsher than those originally rejected by the Greek people in last Sunday’s referendum. In return, there is the prospect of a new long-term aid programme, but one that will expressly not include “haircuts” for the various creditors. The question is, who are those creditors, and how much will they lose if Greece were to go bankrupt, and exit the Euro Zone (the so-called “Grexit”).

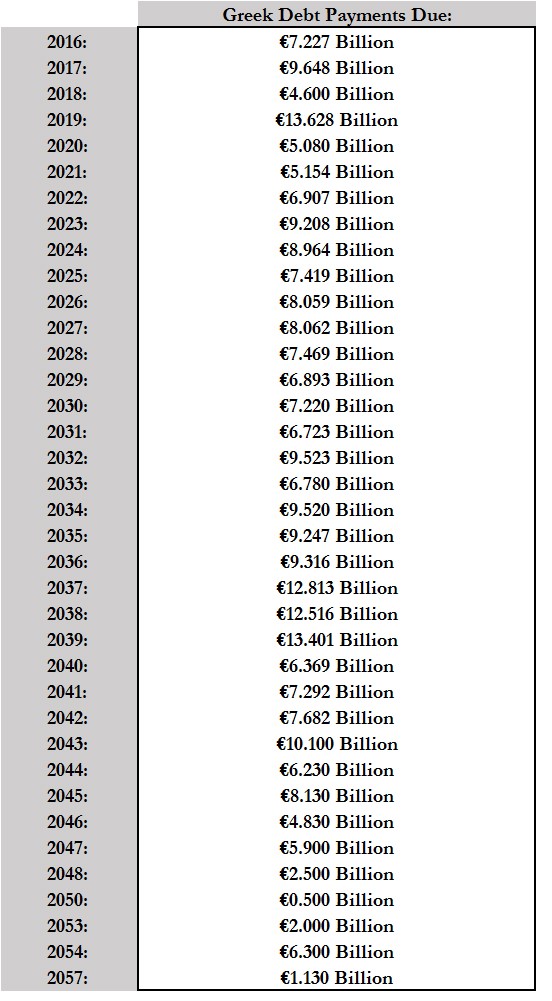

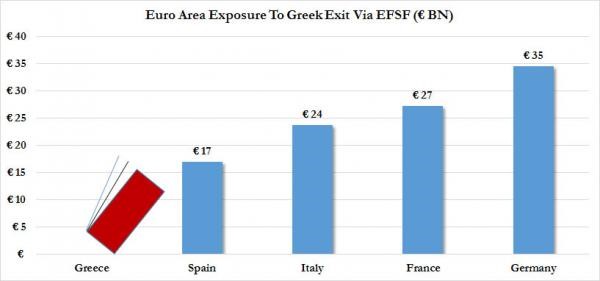

The chart below shows the extent of European exposure to a Grexit, via loans already made by the EFSF (the European Financial Stability Facility). Further loans have been advanced by the IMF and, to complete the list of acronyms, the ELA (the Emergency Liquidity Assistance Programme). All told, the Greeks have €323 billion in debts, which is a colossal burden, one that is in all likelihood, unpayable. The next chart shows that Greek debt payments are currently scheduled to stretch out as far as the eye can see…

(Zero Hedge.com 7/7/2015).

(Zero Hedge.com 6/7/2015).

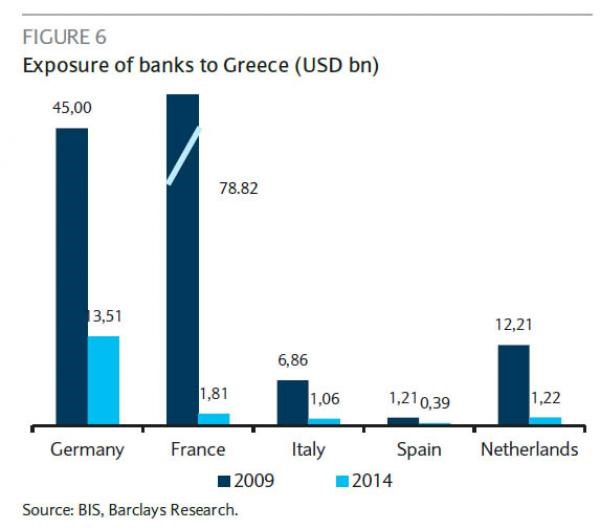

What is interesting, however, is the extent of the falls in Private Sector exposure. As the next chart shows, banks have managed to almost eliminate their potential losses, by selling their bonds to the ECB. French banks have reduced their positions by 98% in the 5 years to 2014. The consequence of this is that losses will now be borne by the European taxpayer rather than the banks themselves. This may have future consequences for sovereign creditworthiness, but for now, investors have not seen fit to react.

Predictably, the financial media is awash with stories of contagion, but the reality is much less worrisome. As Dimensional Fund Advisors have pointed out, some context is appropriate.

This is a tiny economy, ranking 51st in the world by GDP in purchasing power parity terms (which takes into account the relative cost of local goods).

On this measure, Greece is a smaller economy than Qatar, Peru or Kazakhstan, none of which currently feature prominently in world news pages. Its economy is about half the size of Ohio in the USA or New South Wales in Australia and about a tenth of the size of the UK. Even within Europe, it is tiny, representing only about 2% of the GDP of the 19-nation Euro Zone.

As of June 2015, it represented about 0.32% of the MSCI Emerging Markets Index and just 0.03% of the All World Index. Thus, even if things were to go completely awry, the direct global effect would be almost un-noticeable.

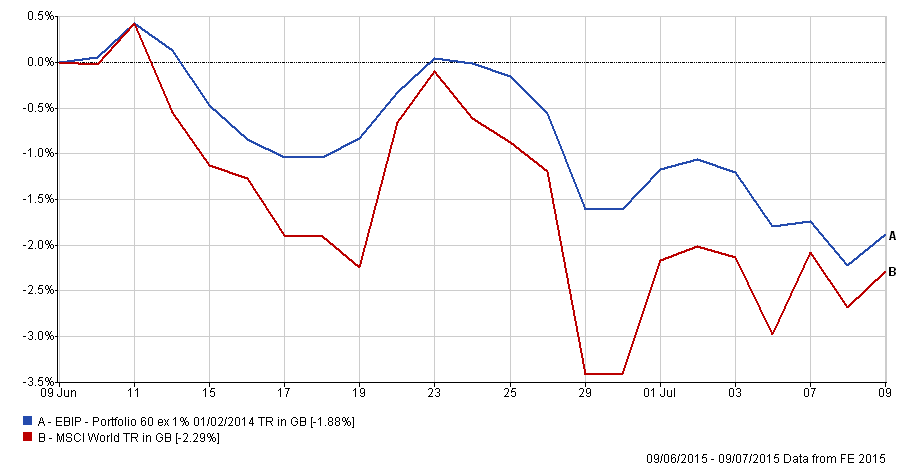

In the context of EBI, Portfolio exposure is mostly confined to the Emerging Markets Targeted Value fund, which as the Factsheet shows, is just 0.31%. The Emerging Markets Value fund which has 0.34% (Annual Report November 2014) and the FTSE Developed World ex-UK Index has a weighting in Greece of 0.03%.

Thus for EBI 60 total Greek risk amounts to 0.025% of the whole portfolio as of close of business weightings on 7/7/2015. Not something to get over-excited about as the charts below indicate.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.