February Economic Background

• Trump’s tariffs rattle global markets

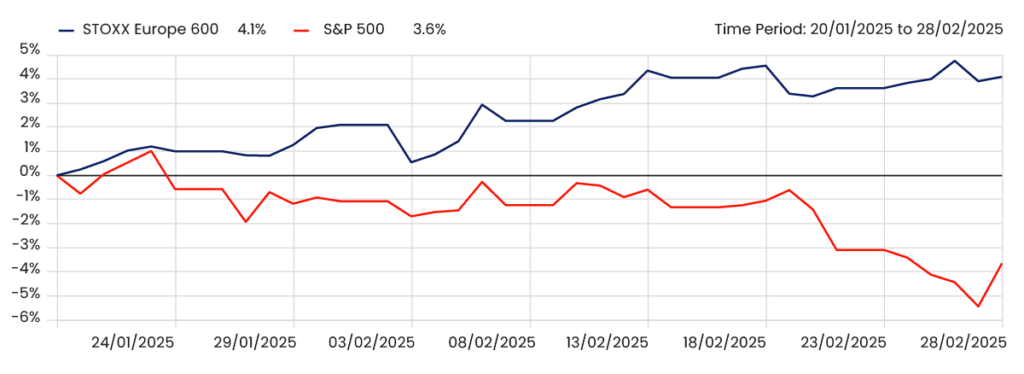

• European stocks gain as U.S lags

• Bank of England faces pressure as inflation rises

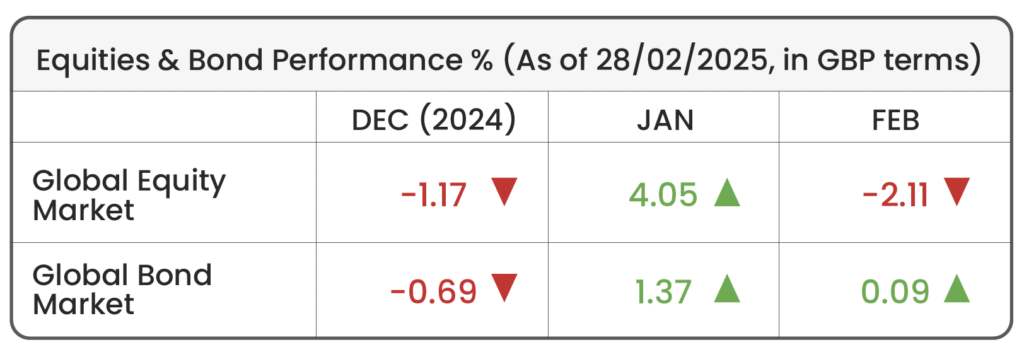

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

Trump Tariffs: Global stock markets saw increased volatility in February as investors reacted to President Trump’s new trade policies. Trump announced sweeping tariffs on key trading partners such as Mexico, Canada, and China, causing the S&P 500 to fall almost 2%. However, Trump later agreed to delay the tariffs on Mexico and Canada by a month, recovering some losses. A 25% tariff on all Mexican and Canadian imports and an increase from 10% to 20% on Chinese goods will act as an additional tax, meaning U.S businesses will face higher costs, which are likely to be passed on to consumers. All else equal is expected to add to inflationary pressures, a key concern for the Federal Reserve as it balances economic growth and interest rate decisions. The risk of “stagflation” (characterised by low or stagnant growth combined with rising inflation) could mean rates remain higher for longer, dampening investment and growth. Stock markets tend to react negatively to prolonged high interest rates, as they slow economic activity, reduce corporate earnings, and weigh on investor confidence. As the month came to a close, Trump also threatened to impose 25% tariffs on EU goods, targeting the auto sector, arguing it will boost U.S manufacturing, protect jobs, and grow the economy. In response, the EU vowed to “react firmly and immediately,” condemning the tariffs as harmful to businesses and consumers alike. This further fuelled global trade tensions, adding to a month of sharp market swings across financial markets.

European Stocks: European stocks have outperformed the U.S since President Trump’s inauguration, driven by optimism that the region may avoid a full-scale trade war. Trump’s decision not to impose immediate tariffs on the EU provided an initial tailwind for European equities, even though this stance later started to be unwound. Meanwhile, Asian markets faced pressure as Trump’s latest tariffs targeting China are expected to significantly impact the Chinese economy, which relies heavily on exports and free trade.

From a valuation perspective, European stocks look more attractive than their U.S counterparts. Sectors including financials, defence (boosted by the prospect of increased spending by European governments) and luxury goods (supported by the lack of day-one tariffs) have been a catalyst for strong regional performance. In the U.S, most of the “Magnificent Seven” faced declines over February, with Tesla (-28.5%), Alphabet (-17.6%), and Amazon (-11.9%) the biggest losers.

Source: Morningstar Direct. (Europe; STOXX Europe 600 & U.S; S&P 500)

UK Inflation: UK Consumer Prices Index (CPI) inflation climbed to a 10-month high of 3% in January, exceeding expectations and highlighting the Bank of England’s (BoE) challenge in tackling persistent price pressures amid a weakened economy. While markets still anticipate further BoE rate cuts this year, a larger concern is the global impact of Trump’s trade policies. Investors worry that a wave of tariffs could drive inflation higher, forcing central banks to keep rates elevated for longer. Despite the latest inflation data, traders still expect the BoE to cut rates twice this year but have since lowered the odds of a rate cut at its March meeting.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Reports of ESG’s death are greatly exaggerated

- August Market Review 2025

- July Market Review 2025

- Q2 Market Review 2025

- June Market Review 2025