December Economic Background

• Rising inflation in the UK contributed to Bank of England (BoE) holding rates at 4.75%

• Global equities fall over December, driven by U.S stock sell-off

• China signals shift to “moderately loose” monetary policy

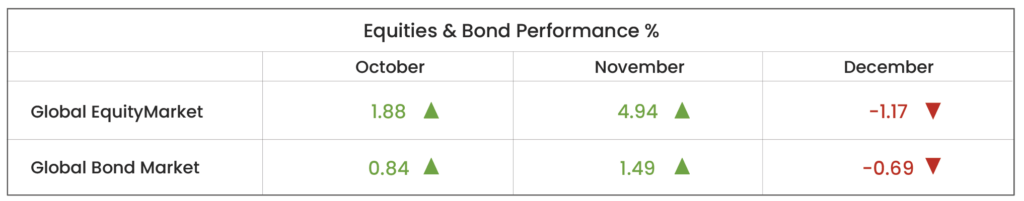

As of 31/12/2024, in GBP terms. Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

UK Market: In December, it was revealed that the UK economy unexpectedly shrank by 0.1% in October, marking a second consecutive monthly contraction. Chancellor Rachel Reeves attributed this downturn to the Conservatives’ economic legacy, which she argued required £40bn in tax rises in Labour’s autumn Budget, however political opponents claimed that the Budget measures were overly heavy handed and a cause for the decline. Regardless, it increasingly appears that the Budget measures are leading to constrained spending and investment, key drivers of economic growth, and dampening consumer confidence. UK Consumer Price Index (CPI) inflation also rose for the second consecutive month, reaching 2.6% in November (its highest since March), up from 2.3% in October, and moving away from the BoE’s mandated 2% inflation target. While markets had already largely dismissed the prospect of a December rate cut by the BoE, the news of rising inflation crystalised these expectations. This came to fruition as interest rates remained at 4.75% during the final meeting of the year on December 19th.

U.S Market: Across the pond, U.S stocks experienced a sell-off following the Federal Reserve’s (Fed) decision to cut interest rates by 0.25% but with signalling of a slower pace of easing in the coming year. While the rate cut was widely anticipated, the Fed’s forward guidance disappointed investors who had hoped for a more dovish approach or a faster pace of rate reductions to stimulate economic growth. This dampened outlook on future liquidity and growth prospects drove stock prices lower. Given the large weighting of U.S stocks in global equity markets, this sell-off was a major factor in the 1.2% decline in global equities for December.

Asia Market: Asian markets navigated a complex landscape in December, with attention centered on China’s monetary policy and South Korea’s political dynamics. China marked a historic pivot by loosening its monetary policy stance for the first time in 14 years, signalling a shift towards a “moderately loose” monetary policy stance next year, moving away from the current “prudent” approach to address the mounting challenges in the economy. Market reactions were largely positive, with Chinese equities rallying in anticipation of improved economic conditions. However, some analysts cautioned that structural challenges, including a struggling property sector and weak domestic demand, continue to temper the longer-term impact of these measures.

In South Korea, political uncertainty loomed large following President Yoon Suk Yeol’s declaration of martial law, and the triggering of a political crisis and widespread protests. While Yoon currently remains in office, on December 31st a warrant was issued for his arrest. However, at the time of writing Yoon remains defiant, vowing to “fight” authorities. South Korean markets reacted nervously, with equities dipping amid concerns about the impact of political instability on economic policies and investor confidence. Overall, while China’s policy pivot offered some support to regional markets, South Korea’s political turmoil served as a reminder of persistent geopolitical and domestic risks in the region.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup, ACSI, BA (Hons)

Investment Analyst at ebi Portfolios

What else have we been talking about?

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025

- ebi Spotlight: The Investment Team