“Alice laughed: “There’s no use trying,” she said; “one can’t believe impossible things.” “I daresay you haven’t had much practice,” said the Queen. “When I was younger, I always did it for half an hour a day. Why, sometimes I’ve believed as many as six impossible things before breakfast.” – Alice in Wonderland.

Markets appear to have entered the twilight zone; nothing appears to make much sense, as the “melt up” goes parabolic. No matter what President Trump says or does, no matter what happens in the world, no matter what valuation levels are breached, equities go up and show absolutely no sign of drawing breath, let alone actually falling. The first 11 trading days of 2018 in the US has seen an average daily gain of 126 points on the Dow, as records are broken right, left and centre, building on a record-setting 2017 [1].

But under the surface, things are not at all what they seem: there are some strange developments which undercut the market euphoria currently on display.

Let us start with Bitcoin, or more precisely, its distribution mechanism, Blockchain. In a development eerily reminiscent of the dot.com era, merely adding the word to a company’s name has led to a surge in the share price. In mid-December, the Long Island Iced Tea company, a sleepy non-alcoholic drinks manufacturer changed its name to Long Island Blockchain Corp, leading to the share price rising 500% at one point. Good sense prevailed by the close of business on that day, however, with the stock up “only” 283%. 10 days later and the company announces an $8.4 million share offering and the plan to buy 1000 Bitcoin mining machines (at $2,725 a piece). What will happen to the other $5.67 million? We don’t yet know, but buying out the existing big shareholders (and management) may not be far from their thoughts. Not to be out-done, Kodak shares rose 300% in early January on plans for “a photo-centric cryptocurrency to empower photographers and agencies to take greater control of image rights management”. It seemed to do the trick, but according to one tweet…

$KODK – Late Wednesday, no less than seven members of the company’s board of directors disclosed in SEC filings that they acquired derivative securities convertible to common stock on Jan. 8, the day before the blockchain news was released. https://twitter.com/d4ytrad3 (11/1/18).

Clearly sensing a trend developing, MoneyGram shares soared after it announced a deal with Ripple, a digital currency designed to be used in banking and global money transfers.

One Fed board member, Charles Evans, has described Blockchain technology as potentially being “very useful”. It appears it already is, though not in the way he may have imagined. May I humbly suggest that the Board of GE (whose stock was down 42% in 2017, compared to a gain of 21.8% for the S&P 500 ), consider a name change? (It isn’t a new suggestion!) [2].

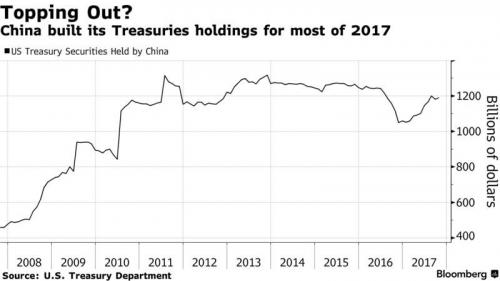

Away from things Crypto, the Dollar is in free fall, reaching levels last seen in 2014 against the Euro, and Brexit referendum levels against the Pound. This comes as the passing of Trump’s Tax reform could see as much as $2 trillion in cash held overseas repatriated back to the US to take advantage of the lower tax rates. At the same time, the Fed Funds rate has risen by 1 percentage point (to 1.5%) whilst all other major currencies have seen no move in rates at all. Bonds are increasingly unloved, too, as both the Japanese and Chinese Central Banks appear to be intending to sell down their US Treasury holdings (see below) – higher rates should be making the Dollar more attractive, not less. But this is clearly not happening.

Of course, someone must be holding the strong currency baby at all times (foreign exchange markets are relative pricing mechanisms), which for now puts the economic pressure on the Euro zone (and to a lesser extent the UK). A rise in the Euro (possibly reinforced by the end of QE?) reduces export competitiveness and raises the real value of existing debt burdens within the region (ahem, Italy); how long can either the UK or Europe cope with this and why would an investor want to buy a currency, when that very act of buying creates the conditions that makes it over-valued (and thus vulnerable to selling)? A conundrum indeed.

The rise in interest rates is also putting the “low interest rates justify high equity prices ” narrative under pressure. Leaving aside the fact that the assertion “low interest rates justify high equity prices” requires that these rates stay low for the investment horizon, it fails to answer the second-order question of WHY are they low? If it is because growth is also low, (which it is, according to the Central Banks), then no premium valuation is necessary at all (and if growth is strong, then rates will have to rise MUCH more). Even if we allow the validity of the premise, the large valuation premium currently priced into equities implies, (assuming a linear negative correlation between valuations and future returns), commensurately lower returns going forward, something that is completely independent of interest rates.

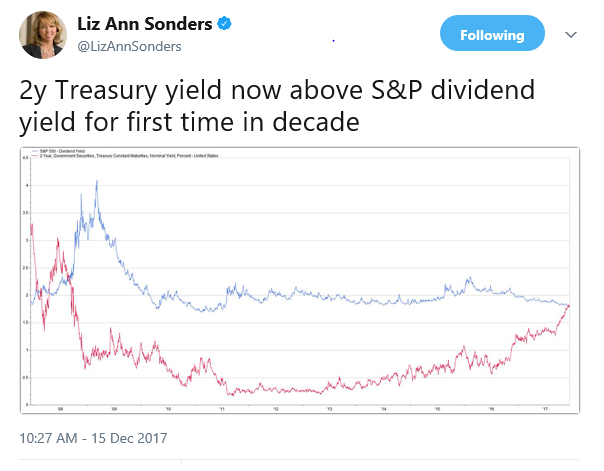

In any event, US rates are now rising, to the point that 2-year US Treasuries now yield above that of the S&P 500 for the first time for quite a while, meaning that Pension funds, Life Companies and other big Institutions will now be able to get a better yield on bonds than on equities with minimal capital risk.

But equity markets appear not to care, at least for now.

The cognitive dissonance extends beyond markets too and into the realm of politics (or in this case, wage levels). In what should (but won’t) be a warning to those in the UK looking to extend the level of the minimum wage, Walmart in the US announced (to great fanfare) that as a result of the Trump tax reform, they would raise the starting wage for new staff to $11 per hour and pay a $1000 bonus to long-serving “associates” as a result of the passing of Donald Trump’s tax reforms, which has lowered Walmart’s effective tax rate from 32% to 23%. On the same day, with considerably less fanfare, they also said that they intend to close 63 Sams’ Club stores and fire thousands of employees.

But what did anyone expect? Competition in the retail sector is fierce and pricing power is near zero, so they cannot raise prices to offset the increased wages-someone has to pay for it and as usual (since it is never executives that do so), it means fewer employees (or shorter working hours). A union in the UK is campaigning for a minimum wage of £10 per hour for all workers. Do they really believe that firms will absorb the hit to profit margins, with no effects on employment levels? Employees might ask themselves whether they prefer the status quo (however tough it is at present), to unemployment, but it seems that most believe that they can obtain higher incomes with no consequences for themselves or others.

Market anomalies are a fairly run-of-the-mill occurrence, as investors are wont to get carried away at times, but it appears to be happening in a multitude of places and assets all at the same time. It may be a bubble, but we have no way of knowing ex-ante. We can try to reduce the downside of it being so however, by lowering the asset exposure (specifically equities) of the portfolio to a level consistent with investment aims and tolerance for risk. This in no way will completely protect us from a 40-50% market decline, but it will make it more bearable and thus easier to avoid the fatal mistake of panicking and getting out at the lows.

Next week, we shall look at how how we can effectively do this, while avoiding the temptation to try to time the peak of the market.

[1] It is therefore a rather strange time for Norway’s $1.1 trillion sovereign wealth fund to be seeking permission to invest in Private Equity, despite the fact that PE firms are already awash with cash and have few places to invest what they currently have. Even Bloomberg thinks they should give it a miss…

[2] Warren Buffett has stated that he would be prepared to buy 5-year Puts (i.e. sell) on any cryptocurrency as he believes that they will come to a sticky end. But in almost the same breath, he says “Why in the world should I take a long or short position with something I don’t know anything about… But I do think what’s going on will definitely come to a bad ending.” So maybe we should take his views with just a pinch of salt…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.