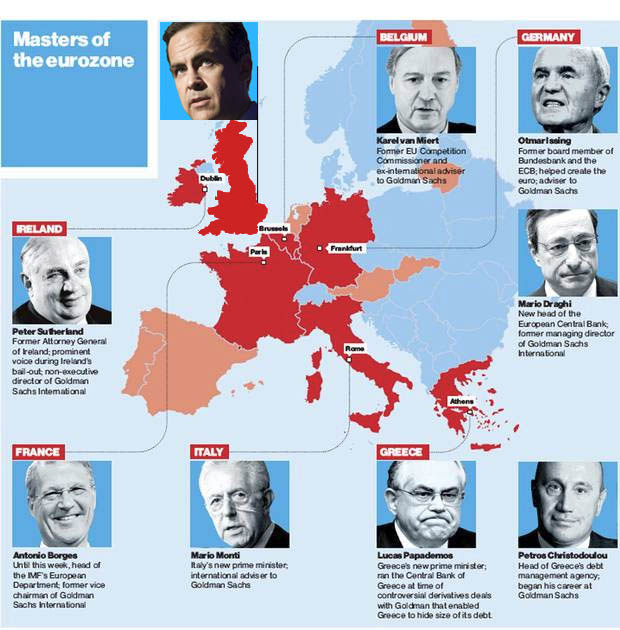

Last week’s imposition (taking effect this week) of the Bank of Japan’s negative interest rate policy, could represent the last throw of the dice for central banks. The premise is that savers are to be so heavily punished for so doing that they feel compelled to spend money to avoid paying interest on their savings. Central banks appear to have run out of ideas, and are resorting to one that cannot work. If one is living off savings, and rates are negative, one will be more likely to save yet more, to avoid future impoverishment. Of course, this policy has been in operation for a while in Europe and one has to wonder for whom this policy is being enacted. One economics professor thinks he knows; the chart below may also provide a clue:

[Disclaimer: I have always wanted an excuse to show this chart]

This rather worrying article highlights the problem:

“Over indebted sovereigns depended on domestic banks to buy their debt, but when yields on that debt spiked, the banks took a hit, inhibiting their ability to fund the sovereign, whose yields would then rise some more, further curtailing banks’ ability to help out, and so on and so forth. Well don’t look now, but central bankers’ headlong plunge into NIRP-dom has created another “doom loop” whereby negative rates weaken banks whose profits are already crimped by the new regulatory regime, sharply lower revenue from trading, and billions in fines. Weak banks then pull back on lending, thus weakening the economy further and compelling policy makers to take rates even lower in a self-perpetuating death spiral.”

Ignoring the hyperbole of the last sentence, the feedback loop argument appears is valid, (and dangerous).

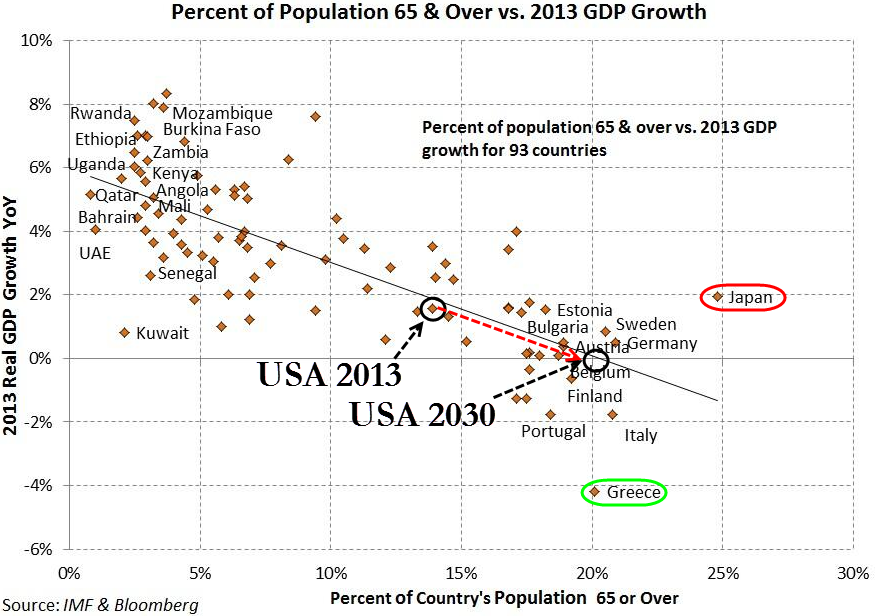

The tragic part of all this activity is that is it is both predictable and ultimately futile. The charts below explain most of the underlying cause, which is demography, (which is out side the purview of central banks). Is there a connection between the countries on the bottom right of the chart below, and the paucity of (non-artificial) growth? Correlation is not causation of course, but one can make an extremely plausible case that the lower the number of working-age members of a society there are, the lower the sustainable economic growth rate will be. Between the growth of debt over the past 20 years or so, and the rapidly ageing populations of the western world (I am including Japan in this for the sake of completeness, despite their non-proximity to Europe), irresistible forces and immovable objects are converging. Lower Interest rates will do nothing whatsoever to alleviate this problem. Indeed, they are making it worse…

(The chart below is from macrobusiness.com.au).

The two charts above may help to justify our long term “over allocation” to emerging markets – most of the projected population growth is in the “frontier” markets to the left of the first chart. As they grow they will become “emerging markets”, and we will be invested in them. It looks a tough place to be now, but the long term economic pendulum is moving in their direction, and as the West continues to struggle, they will only become more globally important.

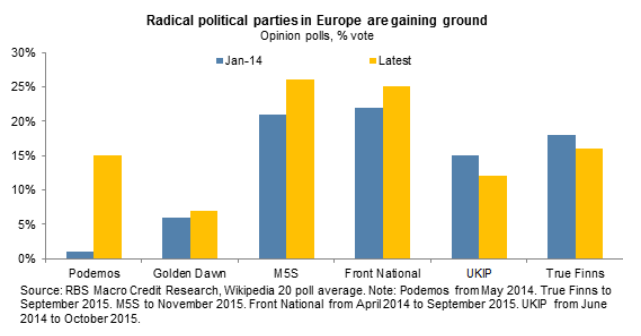

An increasingly elderly population, frightened by terrorism, lack of savings (and income therefrom), and the perceived risks of investing in asset markets that have become highly volatile, are looking away from establishment politicians and at alternatives. It should therefore not be too much of a surprise to see radical parties (of both left and right) gaining ground. In Portugal, the radical left have followed Greece’s Syriza into power, and the “thoughts” of Thomas Piketty have gained traction in a world searching for an alternative to endless market interventions (that benefit financial markets, but do little to help the “real” economy) and the seemingly endless announcements of new “austerity” measures. The continuing economic stagnation, 40-50% youth unemployment in Europe, and the controversial decision to allow thousands of migrants into Europe from the Middle East apear to have become a polarising influence on politics, as the chart below highlights.

The failure to spot the connections between these factors and consequent policy failures implies that there will be no quick end to the recent market volatility. Avoiding disasters may be ultimately be more important than hitting sixes in this environment. Although global central banks have failed to see these links, we are clear on the most important connection. Market falls now raise the risk premium on equities, implying (though not guaranteeing) higher future returns. All one has to do is to be there when they arrive, though admittedly that is far easier said than done. That, however, is what EBI portfolios are structured to achieve…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.