August Economic Background

• Latest Trump tariffs keep markets in a cautious tone

• Bank of England cut rates by 0.25% to 4%

• Emerging market stocks appear attractive for investors

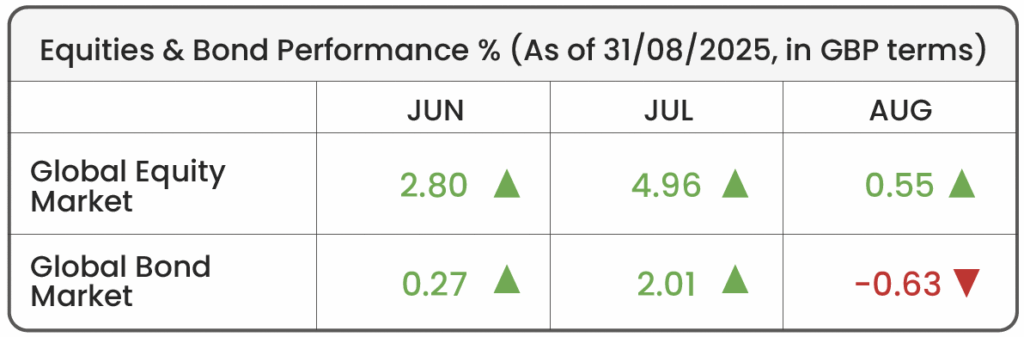

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

India holds firm as Trump’s tariffs escalate:

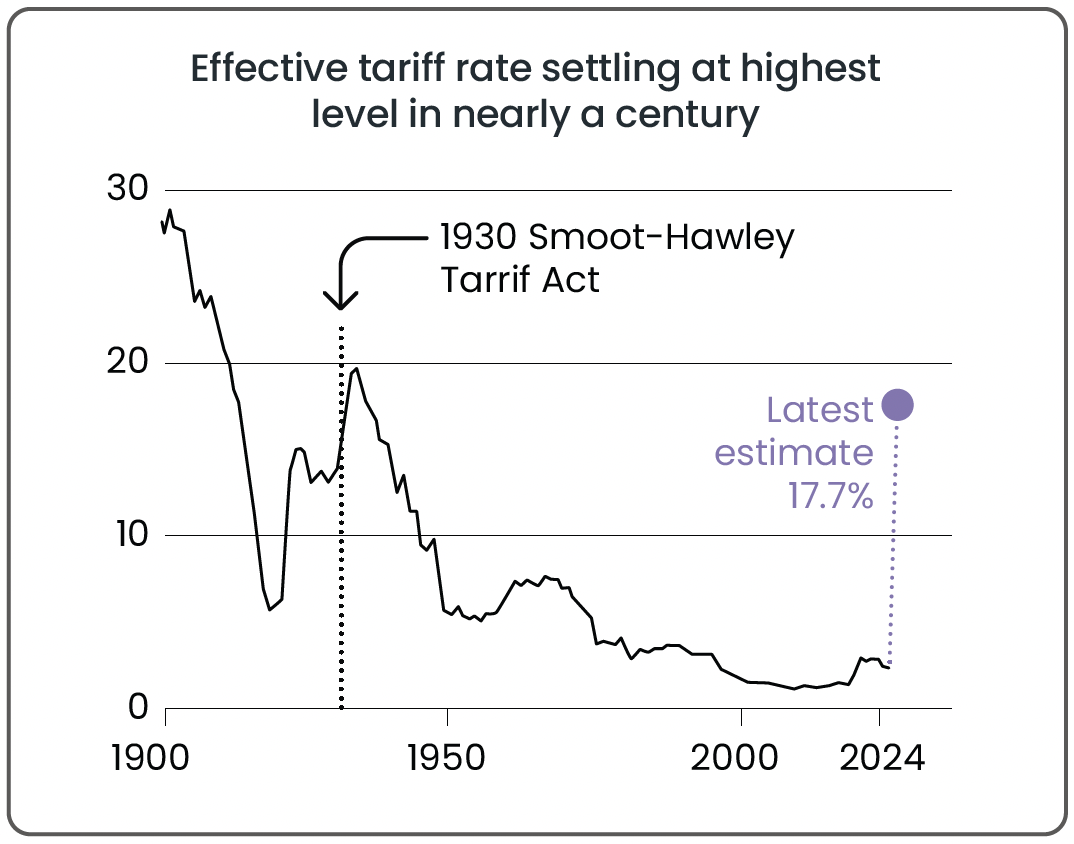

Market sentiment in August was shaken by a fresh front in global trade tensions, this time between Washington and New Delhi. At the centre of the dispute is India’s continued reliance on discounted Russian crude oil, which surged after Western sanctions on Moscow and has remained a vital source of supply for the world’s fastest-growing major economy. Despite repeated US efforts to curb these purchases, New Delhi has held firm. In response, the US, determined to reduce Russia’s oil revenues, unveiled sweeping punitive measures. From August 27th, an additional 25% tariff on Indian goods was imposed, doubling the existing rate to 50% which is among the highest in the world. The move was widely seen as a direct attempt to pressure India into scaling back its imports of Russian oil. This latest tariff also pushed the US’ effective tariff rate to its highest level in nearly a century, a reminder of just how far trade barriers have risen under the Trump administration.

Source: FT graphic: Alan Smith

For investors, the risk is not limited to India’s growth outlook. Oil markets reacted swiftly to the escalation, as analysts warned that efforts to force India to cut Russian imports could drive global crude prices sharply higher. With Indian purchases averaging 1.5-2mn barrels a day, any abrupt shift to alternative suppliers would tighten markets and push up costs globally. Such an outcome would risk fuelling inflation not only in India but also in the US and Europe. Indian stock markets fell in the immediate aftermath of the tariff announcement, with exporters bearing the brunt of investor concerns. Meanwhile, global markets remained cautious, balancing relief from July’s trade breakthroughs with fresh anxiety over a potentially destabilising standoff. While Trump insists its measures are designed to weaken Moscow, many investors worry the unintended consequence will be higher energy costs and renewed inflationary pressures worldwide.

As the month closed, attention turned to the resilience of US-India relations. Ties between President Donald Trump and Prime Minister Narendra Modi, once seen as a source of geopolitical stability, have soured, leaving investors wary of prolonged confrontation. With trade, energy, and inflation now bound tightly together, August ended on a far more unsettled note than July, reminding markets that the global tariff story remains far from over.

Bank of England cut rates to 4% in tight vote:

August brought fresh turbulence for UK markets as the Bank of England (BoE) delivered a 0.25% rate cut, lowering borrowing costs to 4% in its second reduction of the year. While the move matched expectations, the knife-edge 5-4 vote revealed deep divisions within the Monetary Policy Committee (MPC), leaving investors questioning how much further the easing cycle might run. Governor Andrew Bailey emphasised that “any future cuts will need to be made gradually and carefully”, highlighting the Bank’s dilemma as it juggles sluggish growth with inflation still running above target.

The market reaction was swift. The pound strengthened and gilt yields edged higher, an unusual reaction given that rate cuts typically weaken a currency and lower borrowing costs. Markets interpreted the close vote and Bailey’s cautious tone as a sign that the BoE may not ease as aggressively as previously thought, prompting a repricing of expectations. By month-end, markets priced in roughly a three-in-four chance of another 0.25% reduction by year-end, down from more than 90% before the announcement. The hawkish tone surprised some investors, who had anticipated a clearer path towards looser policy. Consumer Price Inflation (CPI) is forecast to peak at 4% in September (well above previous projections) driven by higher food prices and knock-on effects from global tariffs, including those imposed by the US throughout the month. At the same time, the UK economy continues to slow, raising fears of “stagflation”, which is the unwelcome mix of weak growth and persistent inflation.

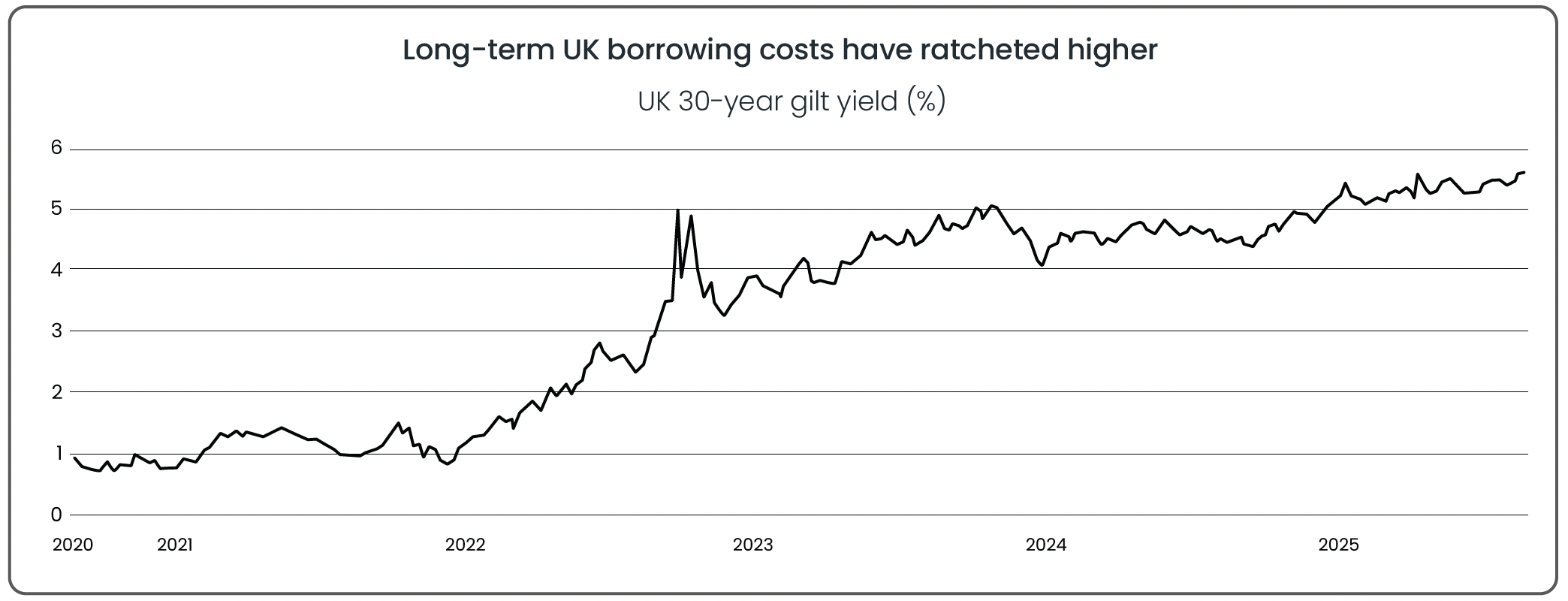

Attention has now shifted to fiscal policy, with markets watching closely how Chancellor Rachel Reeves navigates the growing challenges ahead of her Autumn Budget. Long-term UK borrowing costs have surged, with 30-year gilt yields briefly touching 5.64% in August (their highest in over two decades) as concerns over the country’s economic outlook collided with global pressures, from Donald Trump’s campaign against the US Federal Reserve to higher German borrowing. The rise has already eroded Reeves’ fiscal headroom, cutting the buffer identified in March’s Spring Statement by nearly half.

Source: LSEG (Financial Times)

Economists warn that weaker growth forecasts and rising debt servicing costs could force Reeves to raise as much as £25-30bn through spending cuts or tax increases to close the gap. Yet such measures risk compounding the very stagflationary pressures the BoE is struggling to contain, slowing growth further while inflation remains sticky. For now, the pound has held firm, supported by expectations of slower rate cuts relative to the US. But with monetary policy constrained and fiscal space narrowing, August ended with investors bracing for the Autumn Budget as the next pivotal test of UK economic credibility.

Investors pile into ‘cheap’ emerging markets:

August saw a marked shift in global equity positioning as fund managers piled into emerging market (EM) stocks, lured by attractive valuations and a weakening US dollar. The latest Bank of America survey showed a net 37% of managers overweight EM equities, the highest level since early 2023, with nearly half describing them as undervalued. By contrast, 91% of respondents judged US equities as overvalued, with the “Magnificent Seven” tech giants again cited as the most crowded trade.

Optimism on China’s growth outlook and a dollar that has fallen nearly 10% this year have provided further tailwinds, reducing borrowing costs and easing financial conditions across emerging economies. A Morningstar index of emerging market stocks has gained 8.9% year-to-date in GBP terms, comfortably outperforming developed markets and the US, which have returned 5.7% and 2.4%, respectively. Despite lingering risks, many investors see the relative strength as evidence that years of underperformance have left EM equities offering a value opportunity too compelling to overlook.

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- January Market Review 2026

- Annual Market Review 2025

- Q4 Market Review 2025

- December Market Review 2025

- Highlights of 2025