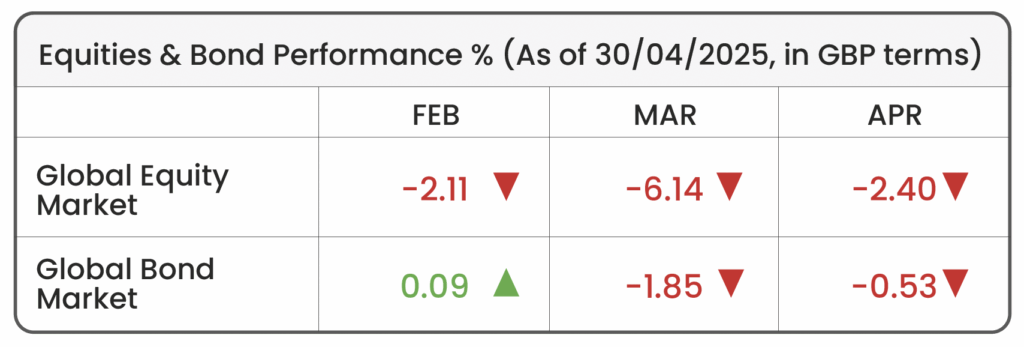

April Economic Background

• President Trump’s April 2nd “Liberation Day” signifies start of new global trade landscape

ㅤ

• U.S-China trade tensions escalated, causing increased volatility in financial markets

ㅤ

• Trade uncertainty weighted on business confidence, easing inflation but dampening growth forecasts

Source: Morningstar (Morningstar Global Markets; Bloomberg Global Aggregate)

Market Review

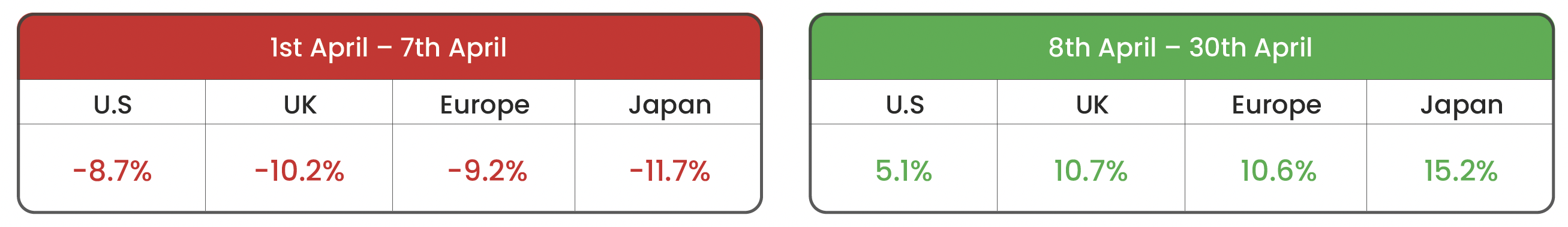

Liberation Day: April was marked by heightened geopolitical tensions and market volatility, primarily driven by an abrupt shift in U.S trade policy. On April 2nd – referred to by President Trump as “Liberation Day” – the U.S administration announced a sweeping set of tariffs on its nation state trading partners. A universal 10% blanket tariff was implemented on April 5th, with more targeted measures proposed on April 9th. True to past behaviour, the administration later moderated its stance across a range of prior proposals. By mid-month, tariffs above the 10% baseline were suspended for 90 days for all countries except China, offering temporary relief to many trading partners. However, relations with Beijing deteriorated rapidly. The U.S imposed tariffs of up to 145% on selected Chinese imports, prompting swift retaliation from China, which introduced its own 125% tariff on U.S goods. This tit-fortat escalation quickly evolved into a full-blown trade conflict, dominating headlines and unsettling global markets. Stock markets experienced their sharpest weekly decline since the pandemic, as fears of a prolonged trade war weighed heavily on investor sentiment. Yet, amid the turmoil, there were moments of relief. A rebound in global stocks occurred in the second half of the month, spurred by signs that the White House was open to trade talks. Announcements of planned tariff negotiations with key partners helped stabilise markets, with Japan emerging as the first country to enter formal talks. Treasury Secretary Scott Bessent noted that Japan would be given “top priority” due to its proactive approach. Despite this late-month recovery, the initial market shock left a lasting imprint, and many major indices ended the month in negative territory.

Stock Market Performance (%) – A tale of two halves

Source: Morningstar. Data from 01.04.2025 to 30.04.2025 in GBP terms. U.S; S&P 500. UK; FTSE 100. Europe; Stoxx Europe 600. Japan; Topix.

Tariff Disruption: The renewed wave of U.S tariffs announced in April has sent shockwaves through global supply chains, creating uncertainty for businesses and investors alike. These aggressive trade measures – particularly those targeting China – have forced companies across sectors to rapidly reassess where and how they source critical components and finished goods. In April, Apple announced plans to shift all U.S-bound iPhone production to India, accelerating its pivot away from China. This move reflects a broader trend among U.S companies seeking to reduce reliance on Chinese manufacturing in response to steep import duties (tariffs), some as high as 145%. The disruption extends far beyond tech; tariffs on Chinese crude oil imports have led China to begin stockpiling oil at scale, distorting global energy markets and further pressuring prices. In Europe, the fallout is equally acute, with the UK car industry warned of potential layoffs at luxury car plants (such as Aston Martin, Bentley, and McLaren), as U.S tariffs threaten to make British exports more expensive to U.S consumers, and therefore less competitive. Meanwhile, Dutch semiconductor giant ASML reported weaker-than-expected orders for its advanced chipmaking machines, citing client hesitation due to tariff-related uncertainty.

For investors, these disruptions serve as a timely reminder of why global diversification remains crucial. Concentrating exposure in a single region or sector can amplify risk when geopolitical or policy shocks occur. A well-diversified portfolio across geographies, industries, and asset classes, helps cushion against localised shocks and positions investors to potentially capture opportunities wherever they emerge.

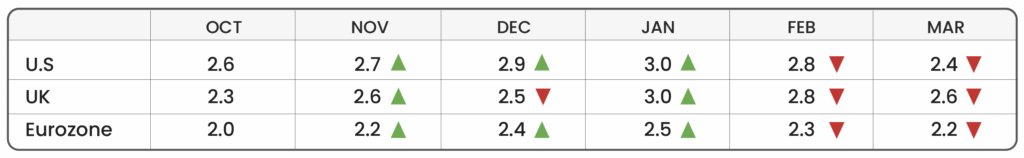

Global Inflation: Inflation* continued to ease across major economies in March, coming in below market expectations and central bank forecasts. The UK’s inflation rate slowed to 2.6%, below both market and Bank of England forecasts. Similarly, U.S inflation cooled to 2.4%, its lowest level since September, while Eurozone inflation edged down to 2.2%. These figures are particularly notable given the expectation by some market participants that Trump’s new wave of tariffs would be inflationary by raising import costs and pressuring supply chains. So why isn’t inflation accelerating as expected? One explanation is that the uncertainty created by these tariffs may be dampening consumer and business confidence. Faced with unpredictable trade policy and rising costs, many companies have delayed investment, while consumers are becoming more cautious with spending. As a result, overall demand has softened, and this has offset some of the inflationary pressure from tariffs. Moreover, industries affected by disrupted supply chains (such as tech, cars, and energy) have seen slowing sales as companies and consumers wait for greater clarity. In this context, tariffs may be acting more as a brake on growth than a driver of inflation. While policymakers and central banks remain alert to upside risks on inflation, the recent data suggests inflation is currently being contained by weaker underlying economic momentum.

CPI Inflation (%) – Last 6 months

Source: Trading Economics. Data collected 01.05.2025.

*As measured by changes in respective consumer prices index over the prior 12 months

For financial professionals only.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Blog Post by Sam Startup

Investment Analyst at ebi Portfolios

What else have we been talking about?

- Highlights of 2025

- October Market Review 2025

- What Happens if the AI Bubble Pops?

- How the US Government Shutdown Could (But Probably Won’t) Impact Investors

- Q3 Market Review 2025