“Oft expectation fails, and most oft there, where most it promises”. Shakespeare

Donald Trump will have been in office 100 days on the 2nd May. However, it has already been anything but plain sailing; with the delaying of the attempt to repeal Obamacare, the future of his Tax plan looking increasingly doubtful, (as he admits), as the latter relies on the former to be viable. The failure to repeal the Healthcare provisions, (something that most Republicans were supportive of), puts his “flagship” proposals at risk since Infrastructure investment and tax cuts are nowhere nearly so universally popular, even in his own party. Recent about turns on previous campaign statements suggest that Trump is about to disappoint his core voters…

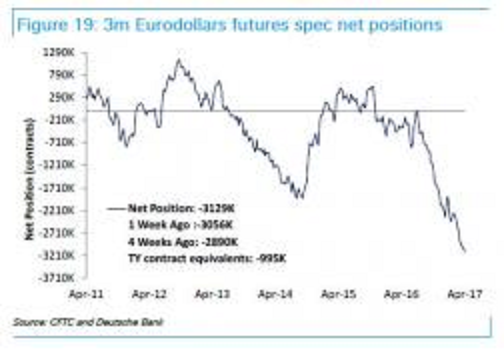

This creates a problem for investors, as ever since the election of Donald Trump, financial markets have been enthused by the “reflation trade”. Buy “Growth” stocks and sell Interest rate futures, as the latter are going to rise as spending ramps up (goes the theory). As the chart below shows, short positions on Interest rate futures have now reached record levels, as traders bet on (at least) two rate hikes this year -and maybe more.

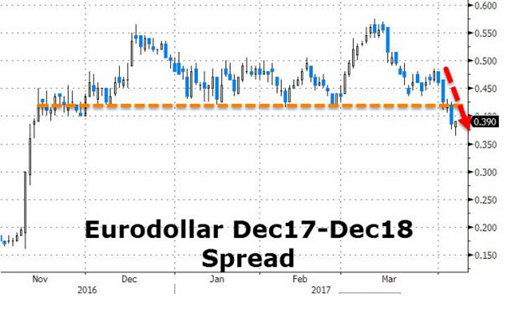

But an obscure part of the Interest rate futures market may now be suggesting the opposite. (See below).

Some explanation is probably in order here; this chart measures the difference in yield between 9-month Interest rates and 21-month rates. As the spread widens, the market is expecting higher (or faster) rate rises. The spike in November represents the reaction to Trump’s victory, and it has remained elevated for the last 3 months. But the defeat of Healthcare reform etc has led to a re-appraisal of both the speed AND scope of interest rate rises (as the spread falls, rate rises fall in likelihood). The chart below suggests this belief is starting to falter.

We have talked before about the failure of “consensus trades” (see here and here), and this looks like a classic example of the genre. There are currently over 3 million short-term Interest rate futures contracts that will need to be bought back, potentially leading to a sharp fall in short-term yields in the US (and probably around the globe). On the 12th April, there were c.73000 contracts traded– the exit door is thus very narrow, and not all will get through unscathed.

What are the implications of all this?

Apart from the obvious effect on Bonds, (whose death may, once again have been exaggerated), this could have a major effect on equities. Yesterday, the S&P 500 fell below the 50- day Moving Average, (a widely watched indicator), as Banks and Tech stocks were sold off aggressively. More importantly, (for EBI), it may well influence the Value/Growth relationship, to the benefit of the former. Both in the US and Globally, Growth has consistently beaten Value over 5 years and since the election of Trump, the Growth return premium has remained. But if the market now believes that “reflation” is going nowhere, it may be time to reverse the trade.

Of course, we have suggested this before, most recently here, so don’t take my word for it. But it could represent a major shift in market perceptions with regard to both Trump and the US economy. Another false dawn for economic optimists and the economy is back to square one. The ball, therefore, is once again back in the Fed’s court- will we see QE4 in 2017 ?

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.