April was supposed to be the month that the underperforming Value and Small cap factor premiums rebounded from their painful COVID-19 crash. After all, that is exactly what famously happened after the TMT crash in 2000 when traditional Value stocks enjoyed a recovery after long periods of underperformance (1).

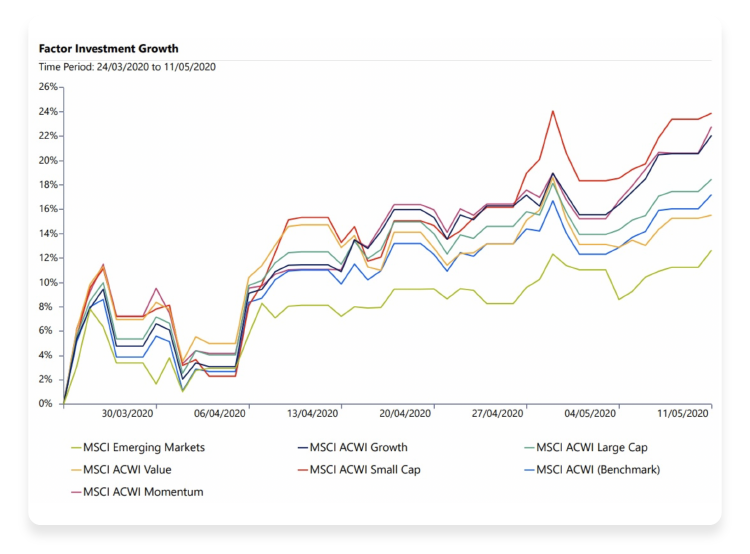

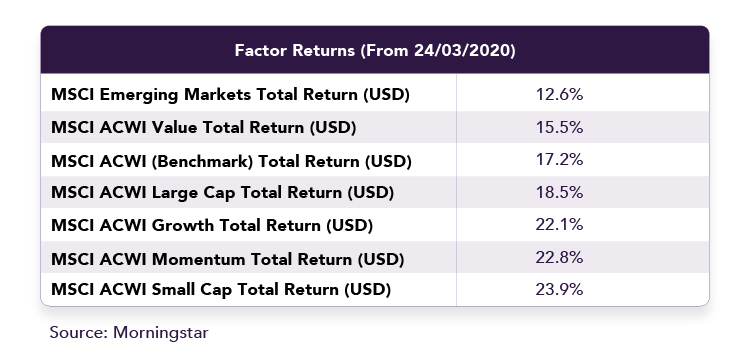

And sure enough global small cap stocks registered an impressive bounce during April, rising 23.9% from lows in March against a 17.2% move in the overall market. That’s something, perhaps not overwhelming, whilst Value just tailed the market benchmark. Most Value investors, and many (but not all) Small cap investors, know that they have to take a long view and swim against the tide of take-downs and negative opinion which can at times seem overwhelming.

Inevitably, clients are asking questions such as, “Is that it? Are booming technology stocks, such as Apple, Amazon, Facebook and even Zoom the main reason why the Growth approach has been better than the Value factor since the mid-2000s?”

Is (Systematic) Value Investing Dead?

This is the now a hot topic as the market rebound left Value somewhat behind. Systematic Value investing means applying rules to invest in securities which are regarded by investors as cheap, rather than securities such as technology stocks which might now be considered expensive.

Essentially a debate is raging about why Value investors should take an opposite view to the one baked into current market prices about the intrinsic value (2) of stocks.

Researchers from AQR, the US quantitative hedge fund, have published new research (3) evaluating whether the accounting measures we conventionally use to measure Value are actually irrelevant in an era when a handful of “global winners”, featuring abundant intangibles, R&D spend and intellectual property, now capture monopoly rents.

Using five definitions of Value ranging from traditional Price-to-Book and Cashflow to Enterprise ratios, AQR evaluate each of the sharpest and most stinging criticisms of systematic Value approaches currently circulating:

· Large cap stocks behave differently.

· Buybacks are distortive.

· Internally generated intangibles such as Facebook’s intellectual property undermine valuation models.

· The impact of central bank interventions and low rates distort valuation models.

· High investor awareness of the Value anomaly and crowding.

None of these criticisms are found to be convincing or especially robust when tested quantitatively. For example, AQR found that although business models are changing, with tech companies holding intangibles off balance sheet, this is an incomplete explanation and not unique to recent times.

They tested analytical measures (Credit Suisse’s Holt model) designed to account for such accounting distortions but found the growing importance of intangibles or changes in business models does not explain the underperformance of Value strategies.

AQR conclude that whilst there is strong evidence that fundamental earnings information is relevant for stock prices, changes in annual earnings expectations explain much of the variation: in short, markets simply do not consider these fundamental metrics as relevant now as at other times.

AQR make a bonfire with the other common criticisms about Value, such as that low interest rates trip up financial valuation models commonly used for Value and growth stocks. Low rates breaking models does nevertheless have intuitive appeal.

Similar to duration in fixed income securities, Value (growth) stocks are seen as effectively short (long) duration assets and will therefore move inversely to interest rates. But AQR argue stocks do not have fixed incomes, and fixed income interest rates anyway consist of risk free and risky components which are modelled very differently to stocks. So much for that criticism.

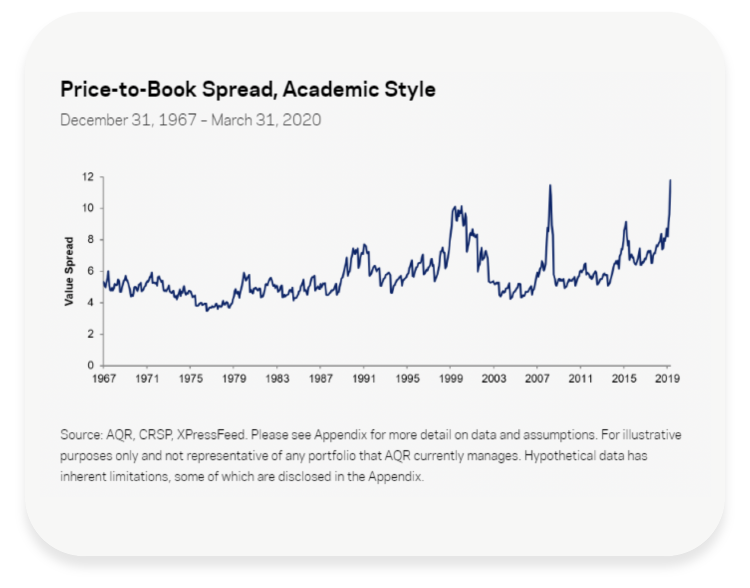

More likely, the current scepticism about Value, and the cheapness of high book Value stocks, is a consequence, or a side-show of expensiveness in other areas of the market. And the extent of that disparity has grown and grown. In a follow-on note, AQR point out the expensive stocks are usually around four times as expensive, using a price-to-book spread, as the cheap stocks but today are around twelve times more expensive.

Even after making adjustments to the data, to account for the tech industries and mega caps, the mis-valuation of a wide group of expensive stocks is still visible. It’s not just coming from the big few stocks, according to AQR. Investors are currently prepared to pay up more for a wider group of expensive stocks than before.

So systematic Value investing is not dead, but might continue to be underappreciated until market valuations in other areas of the stock market adjust in a downwards direction. One thing that remains unknown, difficult and perhaps dangerous to predict, is exactly when this adjustment will occur.

(1) Brandes.C , Brandes on Value: The Independent Investor, 2014, McGraw-Hill.

(2) Intrinsic value, the firm’s potential to generate cash flows, is often measured using book value, free cash flow yield and forecast earnings yield.

(3) Israel, Ronen and Laursen, Kristoffer and Richardson, Scott Anthony, Is (Systematic) Value Investing Dead? (March 14, 2020). Available at SSRN: https://ssrn.com/abstract=3554267 or http://dx.doi.org/10.2139/ssrn.3554267

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.