“The Fed is now hostage to Wall Street. If the stock market pulls back a few percent the Fed becomes frightened. In a way I suppose, the Fed is justified in that belief because it is responsible to a great degree for the elevation of financial asset values”. Jim Grant (Grant’s Interest Rate Observer).

On Friday, Janet Yellen, the Head of the US Federal Reserve, will speak at their annual Jackson Hole Conference, (in Wyoming), and is widely expected to comment on US Interest Rate policy. With an election in November, September may be the last chance to raise rates before the traditional pre-election purdah, as the Fed tries to maintain the illusion of political neutrality. But will they take it? Opinion is divided on the subject, despite what some Fed officials say.

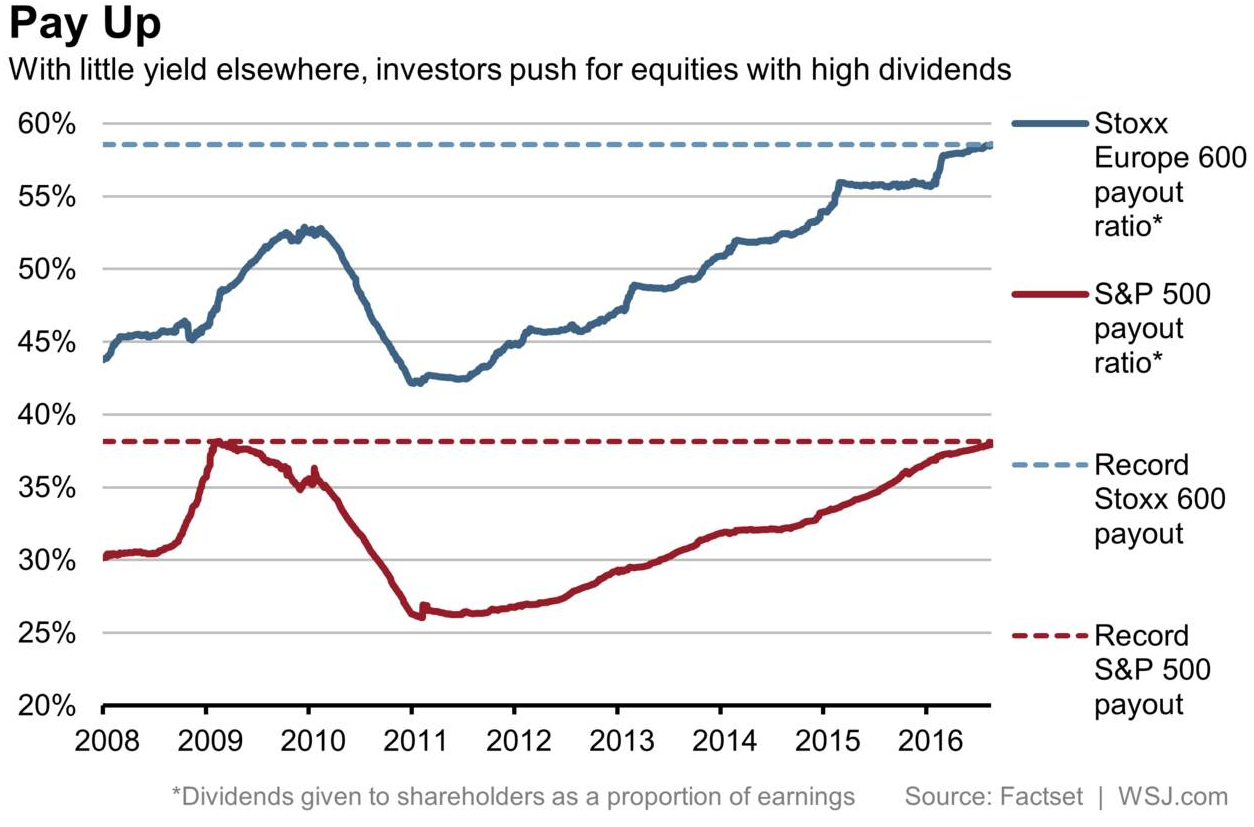

Central Bankers are getting ever more creative (or is that extreme?) in their attempts to kick start growth, and stave off Global collapse. Trillion dollar QE, Bond buying, negative interest rates etc. have had precious little real effect (except on markets). As of now, equity markets are at record highs (which implies global growth is strong), whilst Bond yields are at record lows (which implies global depression). One of them, is very wrong. Investors appear to be buying Shares for their yield, and Bonds for capital gain, a complete reversal of conventional motivations for their purchase. In the meantime, Pension funds are struggling to pay promised returns on client’s money, Banks are seeing profits shrink as interest rate spreads collapse (see here), meaning that their profit margins are similarly meagre, and Investors have become increasingly infatuated with the yield component of Equities. In response, Companies have raised their Pay-out ratios to near record levels, as the chart below shows.

How sustainable is this? Both finance theory, and common sense tells us that the more that is paid out in dividends, the less there is for investment in new (hopefully profitable) investment projects. It is thus also more heavily reliant on growth, (which makes the strategy itself somewhat circular in nature). So, this article, which includes figures that pre-date Brexit, is somewhat concerning, at least for UK investors. But the above chart shows that it is an issue for European and US investors alike.

So, what to do?

The first thing is to focus on total return; the plethora of Income-related funds are necessarily narrowing their opportunity set. After all, Apple has paid no dividends (until recently), and was thus excluded from consideration[1]. Yet it was precisely this re-investment process that provides the future capital growth (and thus dividends) that investors require to achieve their return objectives. To restrict oneself to assets yielding above an arbitrary level increases concentration risk – after all, Companies do not cut pay-outs unless they are in severe difficulties (debt burdens, rapid falls in income etc.) and these events tend to affect them all at the same time – for example, an OFGEM decision on price cuts for the Big 6 Utility companies is going to affect N Power, SSE and Centrica equally – there is no escape in diversification within sectors.

A high yield is not necessarily a good sign in any event; it may be a sign of a future cut in itself. This article was extolling the virtues of high yielding UK shares in January 2015. Two months later, Morrison’s dividend was cut 63% ; since 2015, Sainsbury’s and Centrica have both cut their pay-outs, with the former share price falling 6.7% on the news, the latter by as much as 9%, wiping out more than one years’ dividends in one fell swoop. To avoid this sort of “value trap” requires much more detailed analysis than is practical for most investors[2]. It is not a game that non-professionals can expect to win…

In addition, the popularity of Income funds (there are 96 UK Equity income funds, a similar number to the constituents of the FTSE 100), means that Investors are also concentrated by Investment style; if it goes out of fashion, (and there is preliminary evidence for this – the IA UK Equity Income sector has under performed the All Share by 6.5% in the last year) – there could be a mass exodus, leaving investors with large capital losses, and little chance of an exit on reasonable terms. There may be little warning of this occurring.

The Income approach has been very profitable in the recent past, but past is not prologue, and it makes little intuitive sense in the long run. Returns are a compensation for risk, and thus far, there has been little of the latter. Investors found to their cost that Property funds were nowhere near as “safe” as they had assumed post-Brexit. It is possible that a similar lesson is about to be imparted to yield-seeking income fund investors.

[1] As an aside, it could be said that if Company’s can re-invest the profits from previous ventures at a rate of return above that which shareholders can achieve themselves, they should not pay it out in dividends / buy-backs etc. The fact that Apple is now paying dividends could indicate that they have run out profitable opportunities in which to invest. Does this mean the company’s Growth will slow? Possibly.

[2] Even the “experts” get it wrong; Deutsche Bank, for example recommended Morrison’s as a buy in March 2014, since when it has under performed the FTSE All Share by 14.5%. (To be fair, it downgraded the share to a sell in April 2016, since when it has under-performed by 4%).

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.