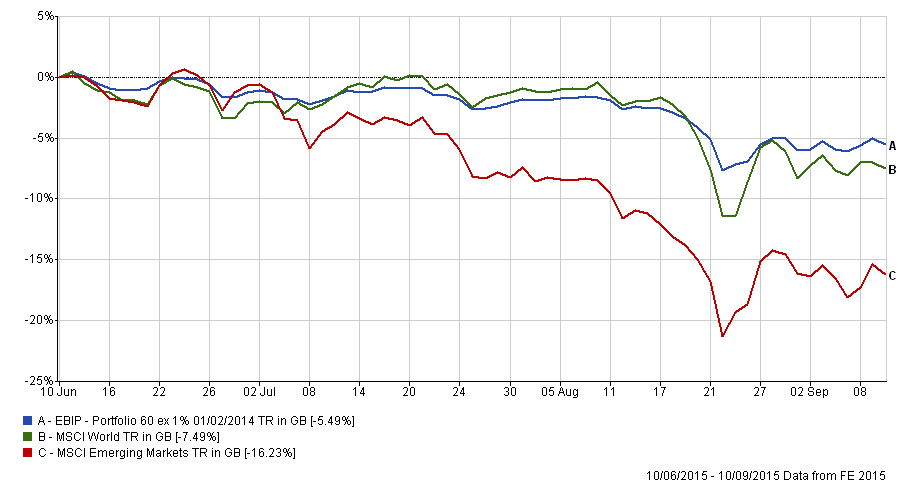

It hasn’t been a great period for all things Emerging recently.

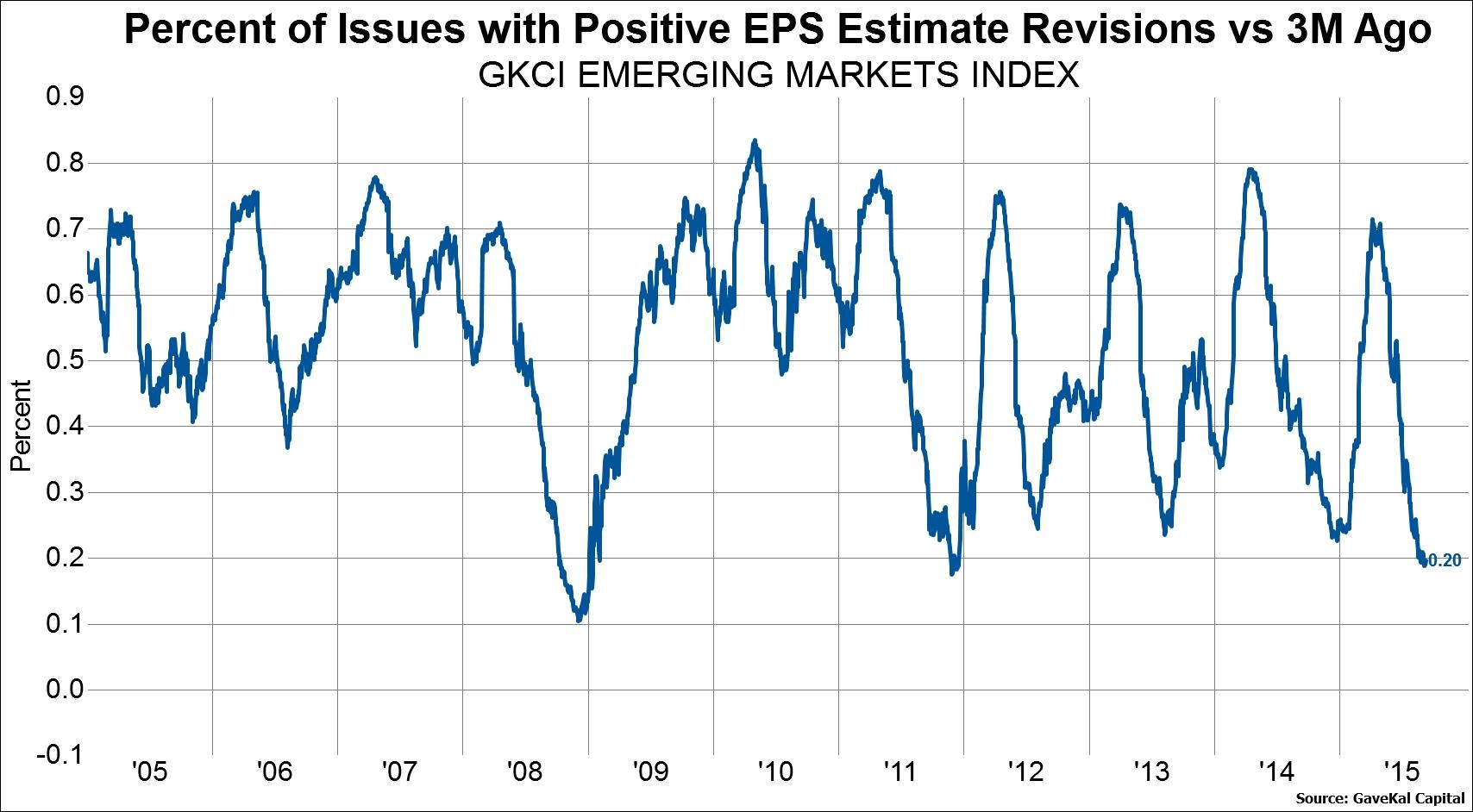

Predictably, analysts have turned negative co-incidental with the market falls. EPS forecasts have collapsed as this chart shows.

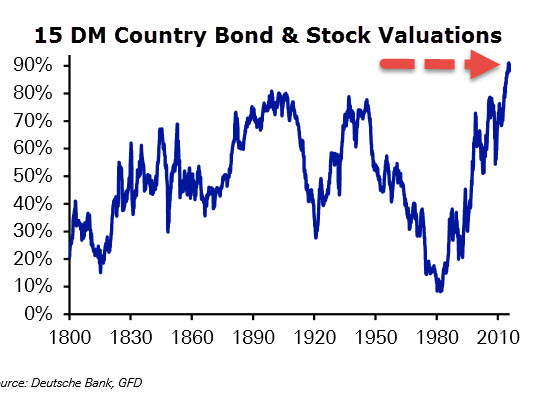

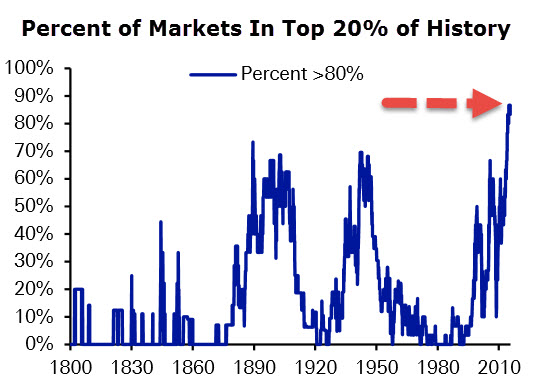

As this article points out, however, that is a bullish sign for investors. Warren Buffet is often quoted as saying, “Be fearful when others are greedy, and greedy when others are fearful”, and this may be one of those moments. Meanwhile, aggregate Developed Market Bond and Stock valuations are at their highest level of all time, according to Deutsche Bank.

The bad news keeps on coming. On September 9th, Standard and Poor’s downgraded Brazil’s foreign currency debt to Junk status, and kept it on Negative watch (which means it could be downgraded further in the near term). This has implications for many Institutions since some have mandates that forbid holding sub-investment grade bonds, which could force divestment of holdings [1].

Some are suggesting such as this gentleman that EM Index returns are being “dumbed down by the poor performers” , and that “Indices in these markets are not worth buying at this point in time because there are huge differences between relative valuations within the indices”. But isn’t that the point of Indexing, to offset the poor performers ? He has some suggestions, namely Philippines, Mexico, Indonesia Poland etc. as being better bets, but it is unclear why they will do well if EM continues to languish, and if EM recovers, would it not be better to own all of them?

Still, we are not alone in our views on EM. Rob Arnott (PIMCO All Asset fund) is quoted in a Wall Street Journal article calling EM “the trade of the decade…a lot if it hinges on simple measures of valuation”. This MSCI fact sheet highlights the valuation differentials that have evolved in the wake of the recent market declines. [For a detailed breakdown of the implications of those valuations see here] .

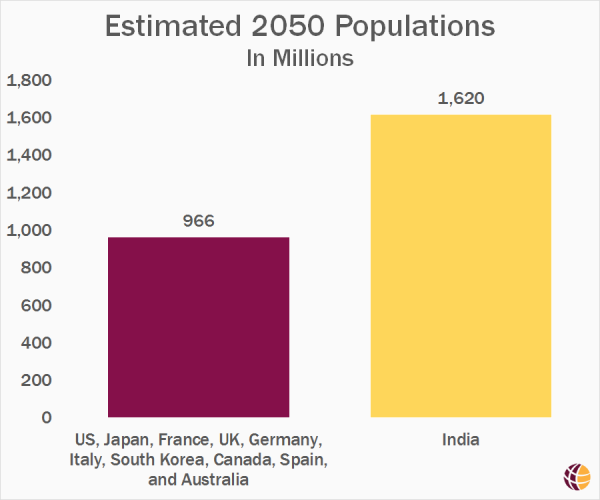

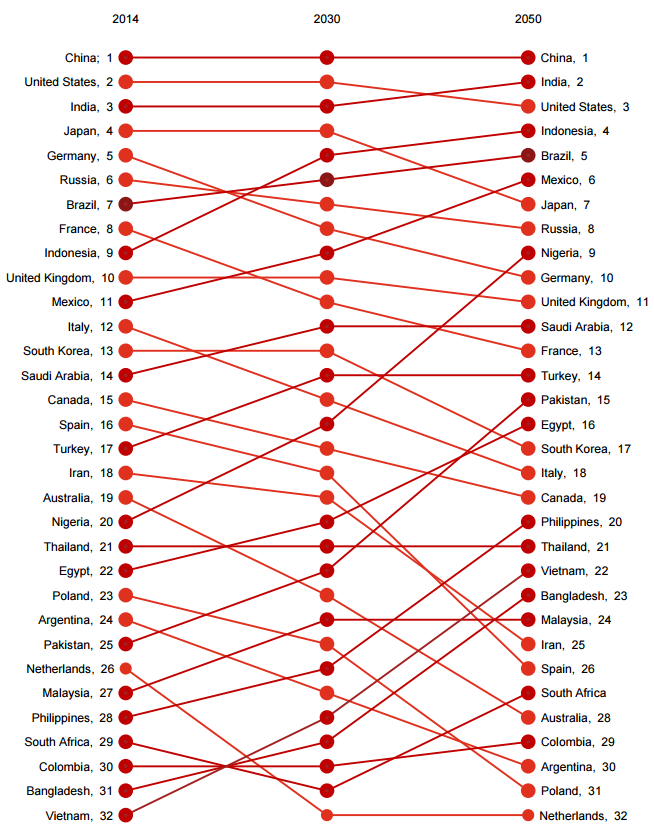

The tactical (timing) issues notwithstanding, the long term direction of travel is clear. This article lays out the full scope of EM potential, but some stand out. According to some estimates, 90% of the global population under 30 years old hail from Emerging economies as of 2014 – the under 30’s will dominate global consumer spending trends for the next 20-30 years as they look to acquire the latest Brands and Technologies. The huge potential is underlined by recent events – Greece (population 11 million) has been a source of economic worry for months, and yet there are 13 EM cities (4 of which are in China) with populations above that. The chart below paints a stark demographic picture for the West.

In addition, EM countries account for 75% of the World’s land mass and resources (the latter is a contributing factor in the recent declines), and over 60% of the World’s foreign exchange reserves (which have fallen 2-3% in the past 6 months, but remain substantial). As a side note, the impact on US, and by extension, Western world interest rates of forced Chinese or Russian T-bond sales would also put pressure on relative DM: EM valuations.

The global financial institutions are taking note. Goldman Sachs stated (in a 2010 paper ) that “EM market cap as a share of global market cap may increase from 31% now to 44% by 2020 and 55% by 2030”, and Blackrock (in the same year) forecast that “Emerging Markets make up approximately 12% of total global equity market capitalisation on a float-adjusted basis (i.e. freely traded shares) or 15% on a non-adjusted basis, with this increasing to 30% by 2030”. According to the IMF, EM Asia will see a drop of 0.2% percentage points in Output in 2015 to 6.6%, a level that Western policy makers can only dream of. The 2014 EM share of World GDP (in Purchasing Power Parity terms) was already at 50%, (up from 30% in 1990), and in view of the above, seems unlikely to reverse course any time soon. Meanwhile, Consumer and Government debt levels in the West seem likely to act as a drag on their growth for years to come. Projections suggest that 5 out of the top 6 countries in GDP terms will be current “Emerging Economies” in 2050.

Source: PWC World in 2050 Report: Reflects total GDP at PPP.

The question that needs addressing now is what could be the catalyst for this change. We are no doubt close to a full-scale revulsion of EM assets, which will mark the low, as sentiment is very bearish on EM. Mark Dow, in ETF.com , posits that 3 elements need to fall in place for this trend change – US rate hikes need to end, the Dollar needs to stabilise-preferably lower, and a growth differential needs to emerge. It could be argued that all 3 are linked: no rate hikes leads to a lower Dollar and thus higher global growth. The markets have consistently over-estimated the chance of US rate rises over the past 2 years, and if they continue to do so, all three elements will have been satisfied. The problem for Investors is that there will be no warning bell telling them to get in…

- [1] The Economist 10/9/15

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.