The passing of Jack Bogle this week leaves the world of investing much poorer, but his career has benefitted investors enormously (nearly $1 trillion) according to some. He eschewed the riches that most on Wall Street seem to covet and genuinely helped millions of investors get cheap access to capital markets returns. This post sums up what many of us owe to him; he has truly left an enormous legacy, which we should all try to keep alive.

“Success is not final, failure is not fatal: it is the courage to continue that counts.” – Winston Churchill

It may not be apparent from stock markets but the global economy appears to be weakening; trade war fears, Brexit and increasingly wild currency swings are at least partly to blame but it may be that the world has reached its debt accumulation limits- there are just no more consumers willing (or able) to go further into debt to buy “stuff”. It is beginning to filter into Corporate announcements too, with Goodyear Tyre the latest to cut guidance, following on from Apple, FedEx, Delta Airlines and Barnes and Noble, who have done so in the last 2 months. This week, Wells Fargo Bank admitted that its mortgage origination flows have reached close to financial crisis lows, whilst provision expenses also appear to be on the rise. (If the Fed is planning to raise rates further, the US housing market is in real trouble). This does not appear to be an opportune moment for Netflix to raise prices by 13-18% – it hasn’t worked out well for Apple at any rate- though the $9.5 billion increase in market capitalisation in one day suggests investors see no prospect of subscription cancellations (and the Free Cash flow numbers suggest that trouble looms if they do so).

Global Investors are becoming increasingly convinced that a slowdown is coming (and though they won’t yet say it, both Inflation and Growth forecasts are consistent with expectations of an imminent recession). As the charts below show, both Profit and Inflation expectations have fallen sharply- how will this happen absent recession? China is expected (according to Reuters) to lower its Growth forecasts to 6-6.5% GDP growth, the weakest since 1990, and even that may grossly overstate the actual growth rate as this Chinese Economics Professor recently suggested, but there is little debate about the trend rate. Growth in Europe too is on the wane, with Germany only just avoiding recession in the last Quarter. Massive Liquidity injections by the governement suggest that they are once again worried about what comes next.

.png)

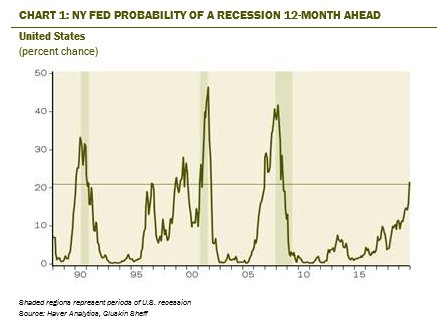

In the US too, we may be entering the “danger zone”. The on-going US government shutdown is now starting to bite (as Government employees- though not legislators mind), are now not being paid. Meanwhile, the New York Fed’s recession risk probability has risen to 21.4% (up from 14.1% in October), in the process reaching levels last seen in August 2008 according to a Gluskin Sheff analyst. But in a re-run of that period, pundits are refusing to countenance the “R” word, despite the strong evidence from the extremely flat US Yield Curve, which we discussed in a previous Blog post.

All this is happening as the US public, apparently fed up with rampant wealth inequality are warming to the idea of redistribution. A Hill-HarrisX survey, released this week suggests that 59% of registered voters would support a 70% tax rate for the highest earners, with support for it across gender, regional and even party lines (45% of Republicans are in favour!). This echoes Francois Hollande’s policy proposed in 2012, which led to an exodus of high-profile individuals and a mass pull out of investment in the country. After raising just €402 million in 2013/14 it was quietly dropped the next year. Undeterred, self-described “Democratic Socialists” such as Bernie Sanders and others appear willing to try again. The fact that it now takes around 10 minutes (and a token “investment”) to receive a new passport doesn’t appear to have registered with them, so the definition of “high earner” will likely fall over time to include most Americans to ensure tax revenues meet the government’s spending “needs”.

This sort of economic illiteracy ought not to need to be challenged, but should it gain further traction, (and opinion polls suggest it is doing so), the results will inevitably be slower economic growth as those who can do so, will (literally) leave the country to its fate.

What is an investor to do?

Start by not over-reacting- just because markets are convinced there will be a recession, does not make it so. It is a cliche (because it is true) that markets have forecasted 9 out of the last 5 recessions. The level of intensity with which a viewpoint is held has no correlation with its veracity.

If we assume that a recession IS coming, does that mean that markets will fall? Not necessarily, as it may already be “priced in”. But making the drastically negative assumption that it IS coming and that it has NOT been priced in, if we apply a 25% probability to its arrival and a 25% chance of a 50% drop in (equity) markets, we have an expected (negative) return of 0.25 (probability of recession) x (0.5 x 0.25) = -3.125%. for an all-equity portfolio [1]. This is, of course, an ex-ante calculation and the actual market fall would be larger than this (IF it happened). Conversely, the higher the bond content on the portfolio, the lower the expected decline would be

Examine your risk tolerances- we discussed this in January 2018 (here), coincidentally just before the Vix- related market crunch in February. We cannot know the future and investors may decide that they can live through (yet) another decline. But if one is concerned about the prospect, it might be prudent to consider raising the bond content/lowering the equity content of the portfolio by enough to reduce those concerns.

Accept that markets do occasionally fall- they are an unavoidable part of investing and anyone who thinks they can avoid all the bad bits and collect all the gains are fooling themselves (and others). Accepting Risk is the price for earning returns and there is no other way of building a successful retirement plan.

[1] This is referred to as Conditional Probability- the chance of event B occurring, assuming event A has already occurred and is a probability-weighted expected return (guess)timate. Clearly, it is heavily reliant on the assigned probability weights (the higher they are the bigger the expected negative return; a 75% chance of recession would lead to an expected negative return of 0.75 x (0.5 x 0.25) = 9.375%). One can endlessly change the permutations; feel free to do so according to your own views.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.