Liquidity describes the degree to which an asset or security can be quickly bought or sold in the market without affecting the asset’s price – Investopedia.

There have been some wild swings recently in asset markets (both Equity AND Bonds); in 4 trading days (between 18/12 and 24/12), the S&P 500 fell by 7.65% and then took just 5 trading days (24/12 to 2/1/19) to rise 6.76%, whilst the 10 Year US Treasury bond saw a 3.1% fall in yield on 3rd January, which was followed the next day by a 4.5% rise; yields have risen from 2.552% on 3/1/19 to 2.74% today (9/1/19). This is not normal – these are two of the most widely traded markets in the world and opinions do not change that much in such a short time. Assuming that markets are still efficient, we must look for an alternative explanation; it is increasingly looking as if the problem lies in the inability of market participants to actually get their trades done at a price that is near to prevailing levels – in other words, prices are moving around sharply due to the trades themselves, with investors unable to find a seller for their purchases and a buyer for their sales.

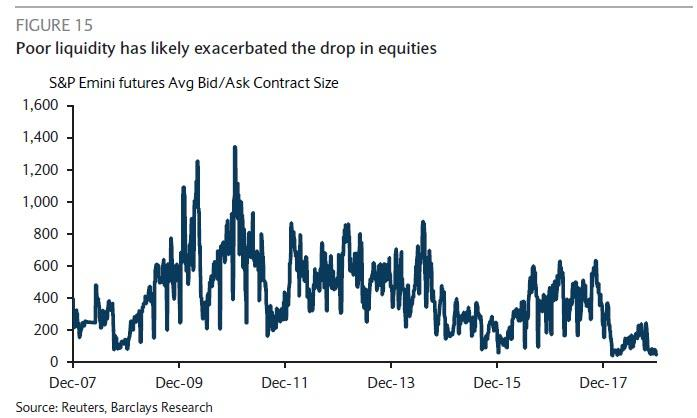

This is not entirely new – periods of price volatility often lead to drops in market liquidity, as traders etc. pull back, thereby creating a self-fulfilling prophecy. But this is becoming a longstanding trend (as seen below), with the average bid amount in the S&P 500 futures dropping substantially over the last 7 years or so. Thus, if one is looking to sell more than the prevailing bid size, the price will inevitably drop to the next bid level and so on until it is completed – the bigger the order amount, the bigger the potential price fall required to “fill” the order thereby increasing price volatility.

Why might this be happening? The easiest explanation (and thus most often the best one), is (once again) all about Central Banks (or more precisely the Federal Reserve). Since the end of 2016, a combination of higher interest rates and the end of QE (which has become QT-Quantitative Tightening), has led to 2-Year US yields rising as high as 3% in the last month. Since this is the de-facto Global Discount Rate, it has inevitably led to a re-pricing of global assets across the board, as there is now a viable yield on a risk-free investment. (90% of asset classes produced negative returns in 2018, with the exception being, you guessed it, cash or near cash).

As the Fed continues to allow its balance sheet to fall, liquidity is drained from markets (as the Fed’s assets are “bought” by investors), leading to less cash available elsewhere. The first place that this shows up is in equities – to begin with, in peripheral markets (Emerging Market equities fell 15% in US Dollar terms from February to October 2018), then in more Developed Markets (the FTSE 100 and Europe (ex-UK) fell 13.3% from August) and the last shoe to drop was the US, where shares fell 13.7% beginning in October. As stated previously, traders see higher price volatility and become more cautious, exacerbating the problem.

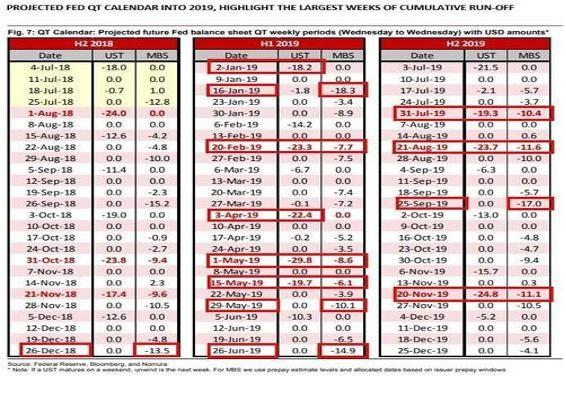

If the Fed continues to shed assets (Treasuries and Mortgage Backed Securities acquired during QE), things could get a little “sticky” in the months ahead – but that, in the light of Jerome Powell’s recent comments is still an if…

The chart below shows another effect – markets can have radically diverging / contradictory viewpoints on the economy using the same information. The chart below implies that recession is either already here (or very imminent) if one looks at the flattening yield curve, or extremely distant if one looks at the S&P 500. They cannot both be right.

Liquidity is thus an important component of risk – there is little benefit to a successful investment if one cannot exit at the prevailing price. Ultimately, it matters more than valuations, as expanding P/E ratios don’t end bull markets, but a lack of cash can (and often does) do the job.

For long term investors, this is of little immediate concern – but it becomes such if one needs to sell in the next few days or weeks. What to do?

In Bonds, focus on Quality, by which I mean Credit Ratings as far above BBB (the threshold between Investment Grade and Junk bonds), as is practical. High Yield bonds for example, are notoriously difficult to sell at times of market stress because at that point, no-one wants to take on risk period. The more esoteric the investment, the more likely it is that will find it hard to sell (at a reasonable price-of course one can always sell if one is prepared to reduce the price sufficiently). The same is true for the outer reaches of the Equity world; Hedge Funds, Private Equity and some Property investments [1] all impose barriers to exit (in the form of higher charges or restrictions on how and when the investor can sell). It is thus entirely possible that what looks like a good return on one’s investment turns out to be a poor one at the point of sale, i.e. once these charges etc. have been taken into account.

The main point is to stay diversified – liquidity is not always the same in every asset class, so a broad spread of investments will also protect investors from this risk. Ultimately there is no guarantee of the perpetual availability of a bid (or an offer) for any asset; but this is the risk one must take to achieve a return. Unfortunately, there is no realistic alternative.

[1] I am primarily thinking here of UK Property funds that have structures, which can mean that large redemption pressures can force a fund, in extremis, to conduct a “fire sale” of assets, (or just prevent redemptions altogether which is what happened after the Brexit result). The issue is less problematic for Closed-End funds and ETFs, which are traded on an exchange, though selling pressure can often lead to prices trading at a discount to NAV – but at least one can get out if needed.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.