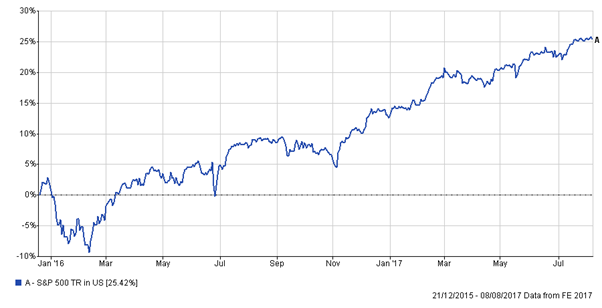

It is becoming a bit of chore to keep up with the doom-laden predictions emanating from the twitter-sphere about the fate of markets, (though I am doing my best). The causes are variously, low volatility, passive investors, Central Bankers or market valuations or a combination thereof. The latest panic-du-jour concerns “market breadth”, which measures the number of shares advancing compared to those declining; the theory is that if too few shares are rising relative to those falling, the market is due for a tumble. On the face of it, it seems intuitive, but the problem with using market breadth to foretell market moves is that it is hugely unreliable; consider these two articles (from the same source), dated December 2015 and August 2017. They both warn of the “narrow” base of the rise in the S&P 500, with only a small number of stocks pushing the overall Index higher (FANGS at the moment). Below shows how the S&P 500 performed over that period….not too bad at all for a market that was flashing a red warning signal!

Here is another way of looking at the same thing from a more bullish perspective; which one is right? Darned if i know…

This isn’t the (main) point of this post, however. An interesting article this week cited research [1] that suggests that just 4% of all publicly traded stocks accounted for ALL of the net investor wealth created since 1926. Thus 24 out of 25 stocks generated negative returns over that time!

Assume that there have been only 1000 stocks in the universe over the last 91 years. This implies that you need to find just 40 issues out of a total of 1000; the odds of finding ONE of them is 4% and the odds of owning all of them-and none of the losing ones- is a minuscule 0.000256% [2].

This leaves the investor with a decision to make- do you try to find these needles in the proverbial haystack, or just buy as much as possible (a.k.a the “market”)?

The former involves in-depth research and analysis to find these rare beasts, which as the odds above implies, is a long shot. But you also have to hold them, sometimes through some serious declines – 20% or more has not been uncommon in the last 10 years (for Apple for example-see below), requiring a lot of courage/patience/resolve to continue to hold them; few succeed at this even if they do find these gems.

The latter is about owning the whole gamut of investment opportunities. There is little glamour and few opportunities to curry favour at the local golf club, or anywhere else for that matter; nobody will ask you for tips about the latest hot stock and you won’t get to hold court in the pub. But it has at least two major advantages over the research/analysis approach. It is way less effort and you WILL own the winners (and as they appreciate, they will automatically become a larger proportion of your portfolio over time, as the losers fall in value).

Those who are still reading by this point will have realised that this boils down to the Active versus Passive debate; there is little likelihood of Active Managers undergoing a Damascene conversion as too many livelihoods are at stake, (despite the continual evidence of their failure, which has been longstanding and persistent). So, we can expect it to rumble on for as long as there are still journalists ready to promote the Active case.

At EBI, we are not clever enough to spot the “winners” (and more importantly, avoid the “losers”) and we have little inclination to take such bad odds. The record of fund managers’ failure to win such “bets” (and the propensity for them to go wrong all at once) leaves us preferring to stick to the basics. Find a well-diversified portfolio (and stay with it) is a better (and less stressful) occupation than shooting for the moon. We will never be on the telly (and if we were, it would have to be after the watershed!), but that’s the way we prefer it. As I suspect, do most of our clients, not to mention License fee payers…

[1] Hendrik Bessembinder, finance professor at the W.P. Carey School of Business at Arizona State University.

[2] 0.04^4= 0.000256. Translated into betting odds, that equates to 390,625:1. For comparison, the odds of getting 5 numbers in the UK National Lottery is a mere 144,415:1. Arron Banks, the founder and principal UKIP donor by contrast, is 500:1 to be the next UK Prime Minister…

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.