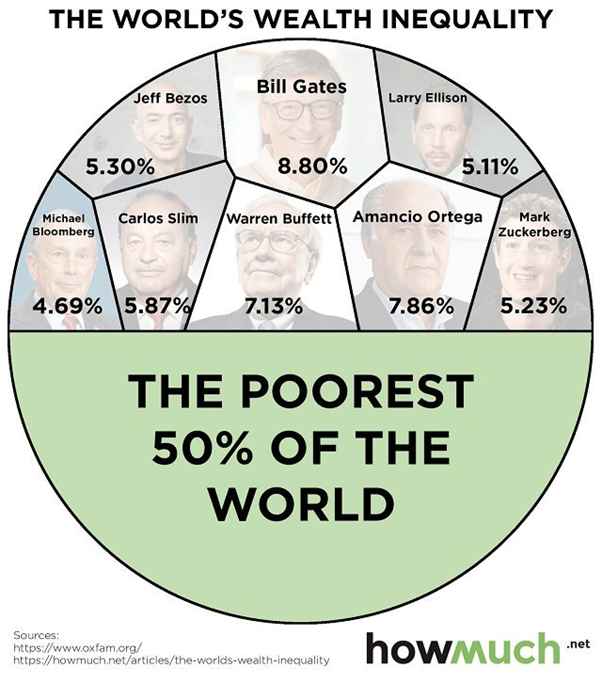

The grotesque juxtaposition of the deadliest mass shooting in US history and another 150 point surge in the Dow, following on from the seeming indifference to the prospect of nuclear war in the Korean peninsula has prompted me to wonder if capitalism (or at least it’s current version) is in any way moral. It is often said that capital itself is amoral-it merely goes to where it is treated best, but participants can (or should) be. The excesses of executive pay of recent years and the Equifax stock sales by Executives prior to the disclosure of a major data leak, however, suggests otherwise. It is of course the case that without capitalism, we would all be living in a war of all against all as described by Thomas Hobbes, but that is to potentially commit a “category error“, since at present the only winners of the current economic paradigm are the already fabulously wealthy. The picture below needs little elaboration, but there is more to emphasise the point.

There is ample evidence to suggest that living in a democratic system confers economic benefits, aside from just being a more pleasant place to live. There appears to be a positive correlation between democratic societies and future stock market returns, which one might expect since more open societies are more likely to foster trust between economic actors leading to more efficient outcomes. Recent developments in Spain over Catalonian Independence has led to a wide divergence in Spanish share prices vis-a-vis their German equivalents, (Dax +2.09% in the past fortnight versus -3.5% for the IBEX in Span), a fact that will likely not have gone un-noticed at the ECB.

An interesting development over the last 10 years or so has been the rise of interest in ESG (Environmental and Social Governance) funds, which seek to invest in a more ethical fashion, focusing (variously), on gender equality, pollution and other factors that help to mitigate the most egregious effects of unfettered Corporate activities. By doing good, investors hope to steer companies in a more ethical direction for the sake of the entire population rather than the pursuit of profit as an end in itself. But does it “work”? More importantly, is there a cost to this investment strategy that is not borne by those who choose not to adopt it? [1].

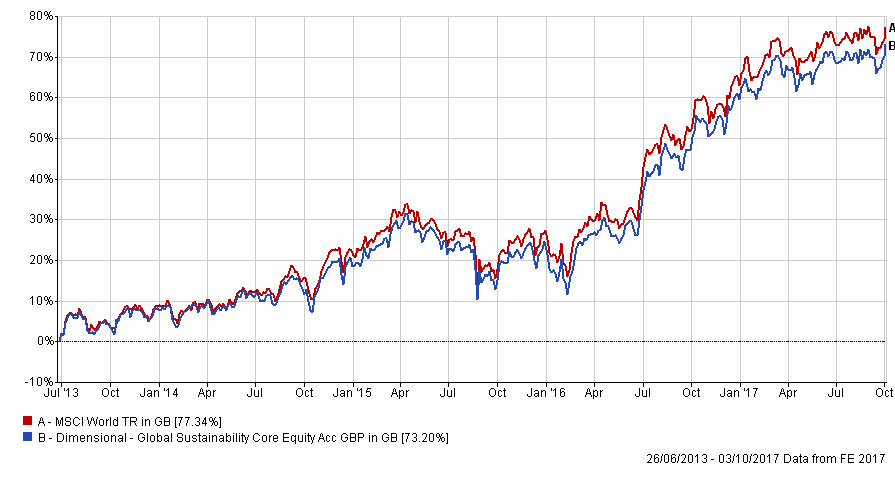

Below shows a chart of the Dimensional Sustainability fund versus its Benchmark.

The returns of the fund have been 0.71% per annum lower than the MSCI World Index, which is slightly above the annual charges of 0.47% per annum, which implies a “cost” of 0.24% p.a. for Environmentally Aware investment strategies. This is not an enormous amount (and is considerably lower than the cost of investing with active managers generally!), but it does appear to suggest that there IS a cost. Not all ESG funds have under performed however, but again that applies to active fund managers. As with the latter, the challenge lies in being able to spot them in advance.

The bigger difficulty with ESG funds is the enormous diversity within them. There is no agreement on the common criteria that would apply, so choosing the “right” fund is a herculean task. This article points out some of the problems investing with an ESG mandate, including defining it, measurement of it, as well as its effectiveness in achieving the stated aims (both in performance and social goals terms). A consequence of this is that no two funds are going to have the same policies, resulting in different return characteristics, meaning that the investor can never be sure exactly what they are investing in [2]. The article mentions eBay as an example of markedly different ESG ratings assignment by Sustainalytics and MSCI, one of which by definition must be wrong. Which one? It is largely a matter of interpretation…

Investors too will likely have different approaches and focus on different issues at any one time (climate change, corporate governance etc.), but even if they are the same, the possibility exists that the fund management company may be more “flexible” on the criteria used- to take one example, BNP Paribas “incorporates” ESG into their investment approach, which is not the same as exclusively using it. This has the potential for a messy compromise that no-one is entirely happy with.

When we last canvassed opinions from our EBI clients (around two years ago), there was little interest in ESG investing. This of course may have changed, or may do so in the near future, but we are not sure that it will be or can be an effective investment strategy; the main reason for this is that ESG/Ethical investment has no direct impact on the Companies they avoid. The investor is buying on the secondary market, which is separate from the market which does affect a company’s cost of capital (the new issue, or Primary market). By investing in this manner one is reducing the opportunity set dramatically, reducing the benefits of diversification potentially leading to sub-optimal portfolio outcomes.

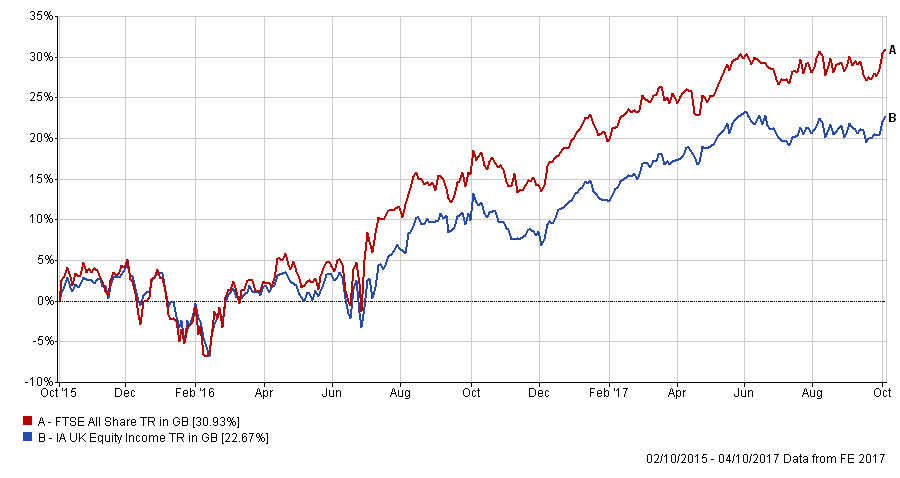

The other broader concern is that this investment outlook may not survive a 25% market drawdown (unlikely as that currently looks!); it is quite easy to be “ethical” in bull markets, where absolute returns are relatively easy to come by, but a decline of any significance may alter opinions quickly, leading to a potential rush for the exits. The obsession with Equity Income investments (thank you HL), has not benefited investors over the last 2 years (see below), as the sector became “overcrowded”. The ESG sector is smaller still, and the liquidity that is currently available may not be there when investors want to sell (especially if they all do so at once).

Most investors are no doubt sincere in their desire to promote positive change but it may be more effective to simply donate a portion of the market’s returns to charity rather than adopt ESG as an investment strategy. The difficulties involved with creating efficient and cost- effective portfolios create problems in both generating good returns AND measuring how successful any given ethical policy actually has been in promoting the ESG agenda. It is undoubtedly a worthy aim, but the potential pitfalls are many in number and the outcome may not be worth the time invested in its implementation in terms of performance.

EBI will continue to monitor this situation however as our advisers’ views on ethical investments evolve. Watch this space…

[1] I shall use the Dimensional Global Sustainability Core Equity fund as an example of this genre. It is by no means a representative sample of the whole, but it serves as a proxy for the niche. It has only been in operation since June 2013, so it is too early to be definitive on conclusions, either way.

[2] For example, the choice of whether to invest in Financial shares (Global Banks for example) will make an enormous difference to overall performance- it is not clear that much of their activities post 2007 can be described as “ethical”, but in the present investment climate, not having Banks could have a seriously detrimental effect on returns, (due to their large weighting in the major world Indices) exhibited in substantial tracking error, vis-a-vis those Indices-there is always a trade-off, which may not coincide with some investor’s values.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.