In theory there is no difference between theory and practice. In practice there is.

There has been increasing talk recently about the advent of “Helicopter Money” (HM). Even mainstream academics and economists are now starting to advocate it’s use to arrest the continued slump in demand, most recently noted here. But what is it, what does it do and does it work?

The term was originally coined by Milton Friedman, to describe a process whereby the Central Bank prevents deflation by literally dropping money from the skies on the population to encourage them to spend. It would represent an enormous fiscal stimulus, one that is not paid for by either borrowing or taxes. The Central Bank would simply (electronically) print the money into existence in exactly the same way as the current QE process works, except that in practise it will NEVER be re-paid. In theory, Central Banks will sell back to the market the bonds they have bought, though bond market price falls would be steep if they ever actually tried it. It is supposed to be used (as a last resort) to offset the fact that at zero interest rates, there is no further room to stimulate the economy.

There are two ways of implementing this programme currently under consideration. One is “People’s QE” as advocated by Jeremy Corbyn (here), whereby money would be spent on new homes, infrastructure and so on, presumably as directed by Government Officials (through some sort of National investment Bank); the other way would be to simply credit every individuals’ bank accounts with the money and leave them to do with it as they will. The main difference lies in who are the beneficiaries – the Labour Party wants the State to assume control of it, whilst those on the political Right want to give the money to individuals. The Swiss will be asked to vote on a Referendum to pay everyone a guaranteed income, (I can’t imagine anyone voting it down!) and the Finns are considering a similar scheme, so it is actively being considered in Europe.

There is no doubt that the current iteration of stimulus has failed because the money used to buy Government bonds etc. has NOT found it’s way into the economy – Banks have either parked it at the Central Bank (there is currently $4 trillion held at the Fed), or used to invest in the Asset Markets, boosting prices, widening Income inequality, (the rich are the biggest owners of financial assets), but in no way benefiting the real economy. There is some merit in attempting to by-pass the financial system, as the beneficiaries would be mostly those with the largest propensity to spend (i.e the relatively poor). The acid test is however, will it work?

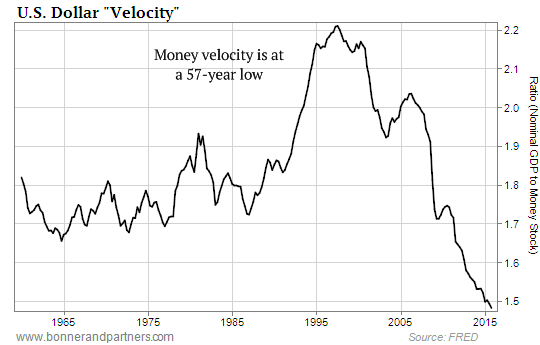

We need to go back to economics 101 to answer this question. The Monetary Exchange Equation tells us there is a clear link between increasing the money supply (as HM will undoubtedly do), and the Inflation rate. But, crucially, it assumes that Economic Output and Velocity of Money are constant, which as the chart below shows, the latter is not. It has been falling precipitously since the late 1990s.

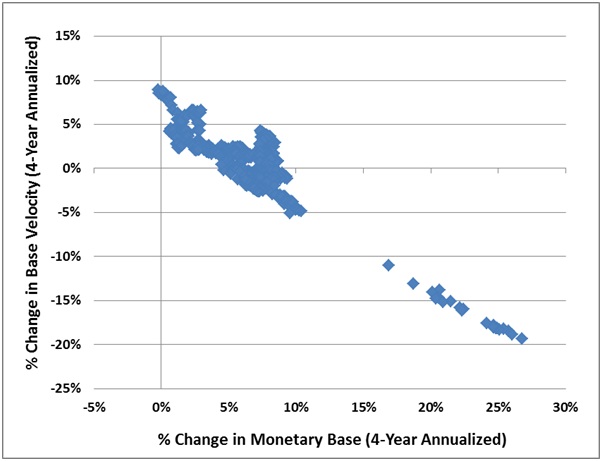

If people become concerned about the future, they save more, and spend less: if they are concerned about having enough money in retirement, they postpone retirement:(as this chart shows, older workers are the only ones seeing job gains- they cant afford to retire !). This phenomenon acts to reduce the Velocity of Money; in fact as the next chart shows, there is a nearly a directly proportional effect between Base Money growth and the decline in Money Velocity (see here for the more technical explanation). If there is no increase in Money Velocity – and this evidence suggests there won’t be – then this experiment too will fail. Indeed, there is concern that at the point where Velocity expands sufficiently to create the inflation Central Banks crave, it will reflect a loss of confidence in the Currency concerned, and by extension the governing elites. In that context, people may well spend the money because they fear it will be worth less tomorrow than it is today, which takes us into Weimar Republic territory.

There is no doubt that HM will be popular, but the price to be paid in the future may well be higher inflation than we have become used to, looking 5-10 years ahead. But Central Banks have little choice. The “alternative is an immediate visit to austerity rehab and an extended recession. I suspect politicians and central bankers will choose to fly, instead of die” (1).

The basic problem is that in order to spend/invest/borrow money people must be convinced that the future returns on their investment will be higher than the rate they pay on the funds. If one believes that a 15% return on investment is feasible, one will pay 10% interest on the borrowed funds. If there is no sign of a positive return , no interest rate will persuade an investor to use the funds. The typical State fiscal actions undertaken thus far, such as the “temporary” VAT cut from 2008-09 by Alistair Darling, merely brought forward future spending, rather than stimulated more of it. The danger is that HM will have the same effect – what will the Central Banks do then ?

(1) Bill Gross, Bond Fund Manager, Janus Capital 4/5/16.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.