“Capitalism requires a structure and value system that people believe in and can depend upon.” – John C. Bogle

It is commonly supposed that the Dinosaurs were wiped out by the Chiucxlub asteroid that landed in Mexico around 65 million years ago, but it is possible that the die had already been cast- they had been declining in numbers and diversity over several million years, and the Asteroid may well have been akin to the knock-out punch that floored an already wobbly boxer. So may it be with Hedge Funds- there have been a number of high profile “blow-ups’ recently, which has caused even the mainstream media to wonder aloud why Investors still use them [1].

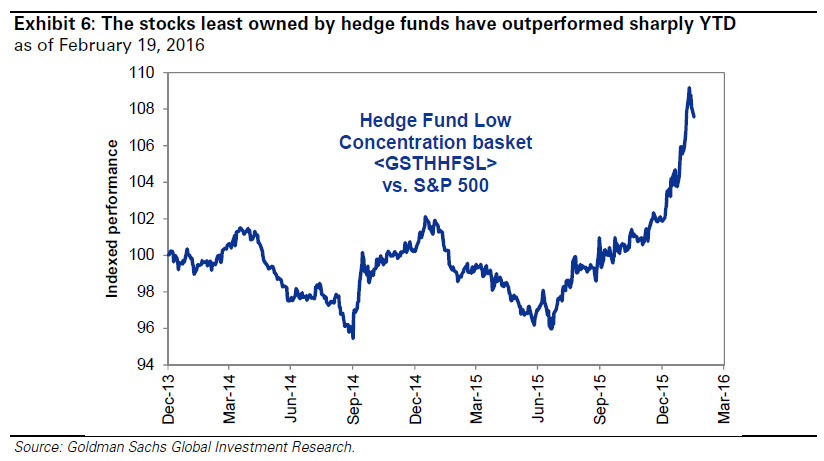

Part of the problem lies with “Group Think” : more normally seen in Company Boards, it is most clearly visible in the phenomenon of “Hedge Fund Hotels”, whereby large numbers of the self-styled “Smartest People in the Room” ALL own the same stocks (see here). It should be obvious to any sentient investor that owning a stock such as Time Warner (in the chart at number 8), which is owned by 121 other hedge funds, to the the tune of 27% of ALL the stock, which, if things went wrong , could take 31 DAYS to sell is by no means “Smart”. The chart below shows clearly that stocks not owned by Hedge Funds have done much better than their actual investments.

At the same time those stocks in which they are short have rocketed in the February surge (see below). So they have underperformed on both sides of their “hedged positions”- long positions have underperformed, as have their short positions.

This has led to a spate of news stories concerning the woeful returns “generated” by previously high profile Investors. Bridgewater’s “Pure Alpha” fund contrived to lose 10% in a fortnight during February, Citadel, the High Frequency Trading Hedge fund has cut staff after massive losses in the same month, as a result of which, New York’s Employee Pension fund has (belatedly) announced it was getting out of Hedge Funds altogether. Even Paul Tudor Jones, the Godfather of Hedge funds has been asked to return $1 billion by investors after an embarrassingly long period of sub-par returns.

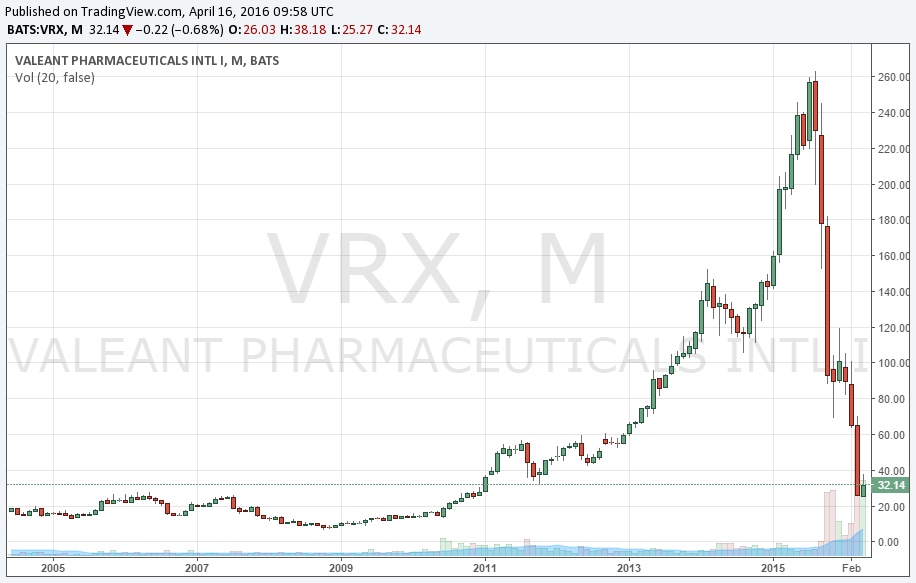

Another previously high-flying Fund, Sequoia has created its own problems by ignoring the age old adage concerning diversification. As this Morningstar article notes, this fund had 30%+ of its assets in one stock, which fell 86%, causing massive losses to investors. [At what point does “conviction” in one’s holdings become hubris? Well, at this point actually..]

It seems that some Funds have seen the trend emerging and are addressing it by….changing their self-description ! According to the Wall Street Journal, they are now defining themselves as “Alternative Asset Managers”, or “Investment Holding Companies” or just “Private Partnerships”, anything except Hedge Funds. Still others are dropping clients themselves and running the funds as a Family Offices, both to escape the regulatory burdens associated with Hedge Funds, but mainly, it seems to avoid the scrutiny of their performance. Either way, it serves as tacit, if not yet overt, acceptance of their precarious situation.

To return to my dinosaur analogy, it remains to be seen whether the Valeant Pharmaceutical collapse is a foretaste of things to come, (the asteroid), or whether they will gradually disappear as the global investment climate becomes still more adverse for them. The recent market volatility should have been a boon , but it appears that, as they no longer hedge, but merely borrow to lever up returns, they missed the chance to show their worth. With Central Banks determined to prevent nearly all market declines, it may seem an unnecessary expense to be short at all. Time is running out for them to prove themselves, or the questions as to their raison d’etre will only get more pointed.

Post Script:

The above quote from John Bogle is true in itself, but suffers from an inherent problem, which is that nothing can be truly relied upon, especially in a complex system such as Capitalism; evolution never stops, and structures and values change over time-sometimes so slowly that we barely notice. Modern markets may well have reached the point that Hedge Funds (for example ) have outlived their evolutionary usefulness. If so, they are doomed. The only question is whether they go out with a bang (think LTCM) or a whimper, (like England at a World Cup). In a decade, Investors will barely remember them, though I suppose they might make it onto the History Channel from time to time…

[1] The asteroid event highlights the role of luck , even in evolution. Given a few tens of millions of years, Dinosaurs could have further evolved, to the point of Intelligence, even sentience, and could now be running billions of pounds of assets for other Dinosaurs. It’s not obvious that their long term returns would have been much worse than the current incumbents.

Disclaimer

We do not accept any liability for any loss or damage which is incurred from you acting or not acting as a result of reading any of our publications. You acknowledge that you use the information we provide at your own risk.

Our publications do not offer investment advice and nothing in them should be construed as investment advice. Our publications provide information and education for financial advisers who have the relevant expertise to make investment decisions without advice and is not intended for individual investors.

The information we publish has been obtained from or is based on sources that we believe to be accurate and complete. Where the information consists of pricing or performance data, the data contained therein has been obtained from company reports, financial reporting services, periodicals, and other sources believed reliable. Although reasonable care has been taken, we cannot guarantee the accuracy or completeness of any information we publish. Any opinions that we publish may be wrong and may change at any time. You should always carry out your own independent verification of facts and data before making any investment decisions.

The price of shares and investments and the income derived from them can go down as well as up, and investors may not get back the amount they invested.

Past performance is not necessarily a guide to future performance.