“Investing is complicated by the fact that doing dumb things and losing money are not very strongly correlated”. Evan Bleker, tweet, 1st March 2017.

Like the Greek debt crisis, furniture store sales promotions, and Arsenals hopes of winning the Premiership, some situations are doomed to be repeated, almost endlessly. Once again, a potential US debt crisis has resurfaced, with March 15th (coincidentally the date of the Dutch general election too), the focal point of renewed angst, as some are now openly talking about another Government shutdown.

David Stockman, a former Reagan administration Budget Director warned that on March 15th, the debt ceiling “holiday” agreed between Obama and the Congress (before the last Congressional elections on October 2015) will expire, effectively freezing the US government deficit at $20 trillion and keeping it there. The US government has c.$200 billion in cash, which it is spending at around $75 billion a month, which means it will run out in the Summer. He predicts “Then we will be the mother of all debt ceiling crises. Everything will grind to a halt. I think we will have a government shutdown. There will not be Obama Care repeal and replace. There will be no tax cut. There will be no infrastructure stimulus. There will be just one giant fiscal bloodbath over a debt ceiling that has to be increased and no one wants to vote for.”

If he is right, the markets are in for a severe disappointment- circa 20% to be precise. But is he right, or is this another cry of “Wolf”, to be safely ignored?

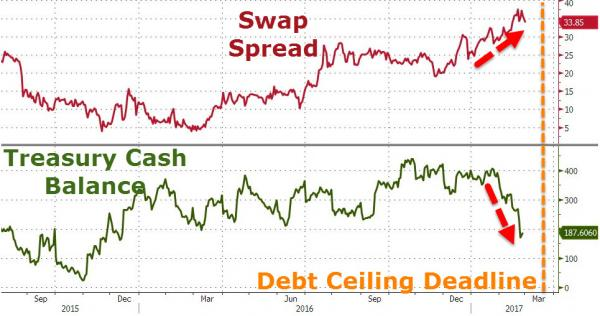

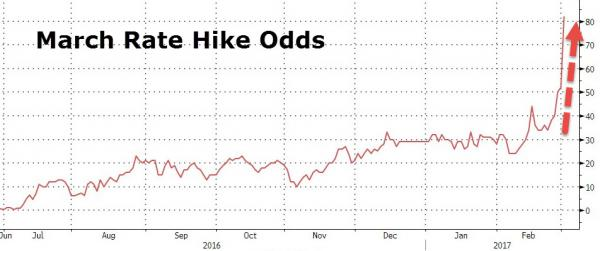

Some parts of the markets appear to be waking up to the possibility; the chart below shows that Swap spreads have widened to 5-year highs, indicating that Investors are expecting to see interest rates rise, as credit risk spikes higher. As the second chart shows, in recent days, Fed officials have talked up the chances of a rate rise, pushing the (market implied) chances of a hike up to 80%, (which makes it seem like a done deal). A $20 trillion debt does not sit well with rising interest rates!

Investors are also paying more for Bills that mature on 16/3/17 compared to 9/3/17, to avoid having no holdings over that period, as it is clearly anticipated that treasury bill issuance will slow down in the run-up to 15/3/17. This seems to be somewhat contradictory- if they truly feared default, surely they wouldn’t buy beyond 15th March at all! This is made all the stranger by the fact that the Yield curve has once again flattened, again implying investors (particularly Bank investors) are not concerned by this “deadline” and are expecting longer-dated interest rates to fall once again.

So, what’ s going on? The first thing to note is that this is by no means a new event. In fact, it is a recurrent theme in US politics; they have had a “crisis” in 2011, 2013, and again in 2015, all of which led to much sound and fury, followed by an agreement to lift the debt limit (or ceiling) again. Strangely, the majority of politicians overlooked the possibility that spending might the problem; maybe because cutting government outlays might stop them being re-elected! Both sides will look to blame the other for the impasse, which will ensure last-minute brinkmanship will be the order of the day.

In reality, a settlement is Trump’s only real option. After all, how will he pay for The Wall, the continuing war on drugs, increased security and military expenditures without one? So, as usual, the US political system will muddle through, and life will go on- market action (especially in equities) suggests there is no concern at all, and the bond sell-off may be more to do with growth expectations rather than Congressional shenanigans.

Despite clear signs of market euphoria, we have seen time and again that there is no objective way of quantifying it, and thus have no means of timing it’s demise. A “solution” (i.e. postponing the facing of the problem), is by far the most likely result, which means that recommendations along the lines of sell everything will once again be confounded. Still, it is certain that one or more analysts will be on hand to provide such “advice” in the next 2 weeks..