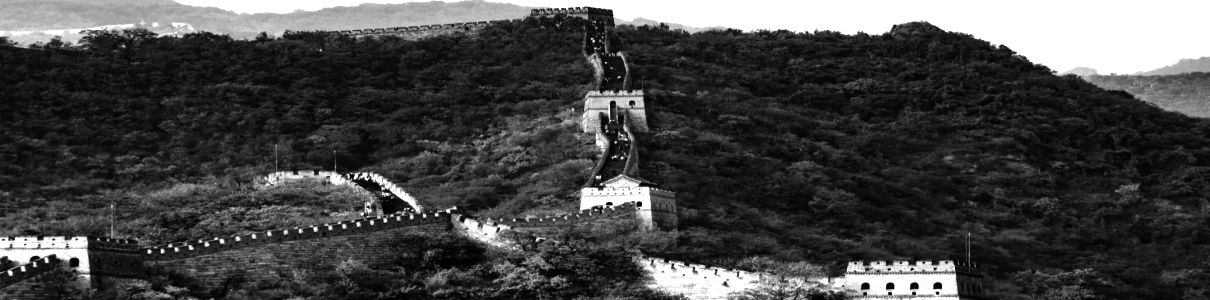

China in Your Hands

“The key issue is the shift of the centre of gravity from the West to the East, the rise of China and India” – Klaus Schwab. (Chairman of the World Economic Forum).

“The key issue is the shift of the centre of gravity from the West to the East, the rise of China and India” – Klaus Schwab. (Chairman of the World Economic Forum).

“Better a diamond with a flaw than a pebble without.” ― Confucius We return once again to the subject of Value (last discussed c.18 months ago). In truth, not much has changed, except that the chart below now shows an underperformance of Value vis-a-vis Growth of c.4% per annum annualised compared to 2.73% over the period shown in the December 2016 blog post. This has left many (including ourselves) in a quandary. Nearly all of the arguments advanced in the previous blog are still valid (if not more so!), but it has not, aside from a brief 6-month recovery in the second half of 2016, amounted to much; if anything, Growth has recovered with renewed vigour in the last 3 months.

“Invest in emerging market debt for value and diversification, not for “safety,” betting against the U.S. dollar, or an inflation hedge” – Tina Vandersteel, Grantham, May, Van Otterloo & Company (US Hedge fund).

“A basic principle of modern state capitalism is that costs and risks are socialized to the extent possible, while profits are privatized” Noam Chomsky. (Equity) markets appear impervious to risk of any sort; no matter what politics, economics, diplomacy or military conflicts throw at them, they either ignore it totally or bounce back within days (and sometimes hours). What gives? Is this a(nother) bubble, or has something changed to reflect a new reality that we may not yet appreciate?Going back to 2013 (May 2013 to be exact – i.e. 5 years ago), the S&P 500 was at 1,627 and trading on a trailing P/E of 17.6; fast forward to today and we are 2,705 and a P/E of 24.6. So the market has risen by 66%, but earnings by only 19% over that time. The residual is the rise in the multiple that investors are willing to pay for those earnings streams. The P/E has risen by more than twice the growth rate of earnings over that period. Why?

“A reliable way to make people believe in falsehoods is frequent repetition because familiarity is not easily distinguished from truth. Authoritarian institutions and marketers have always known this fact.” – Daniel Kahneman Extend and Pretend is a phrase that encapsulates a desire to bring forward gains into the present, whilst deferring costs or risks into the future. It refers to the practice of Banks during the mid-2000’s of refusing to accept losses on loans (mortgages for example), by allowing borrowers to pay back over a longer time-frame, thus avoiding having to book loans as non-performing in the short-term, but in the process storing up even greater risks into the future. It came back to haunt the financial system in 2007-09, leading to the biggest financial crisis for at least 70 years. The policy never ends well in any sphere of life.

“Tina Turner doesn’t need another hero, but Bonnie Tyler is holding out for one. Tina, give one of your surplus heroes to Bonnie. Job done.”- @limberstar (Dean w) Tweet from 26/04/18…

“It is nice to have valid competition; it pushes you to do better” – Gianni Versace.

“You will always hate something in your portfolio. Really, really hate it”. James Osbourne (Bason Asset Management) October 2014. We often get communications from advisors telling us that they have clients who have concerns with regard to one (or more) of their holdings in EBI Portfolios, which for whatever reason are doing badly at that point. What follows is an attempt to explain why the portfolio is diversified and how (and why) this methodology works.Looking at the One Year chart for EBI 100 (Home Bias) it is not hard to spot the outlier; Global Property has lagged badly in the last year (and indeed over two years as well).

This is an up-date to a post I wrote a while ago. “The investor’s chief problem – and even his worst enemy – is likely to be himself.” – Benjamin Graham. It is late on a Friday evening, and my local pub is evincing a, ahem, somewhat liberal interpretation of the UK Licensing laws. So, I get two more drinks and settle back down into the corner of the bar to find my friend, (John) returning to his favoured topic, that of his investments and how well he has done since we last met. J: Well, I have had a good run in recent months, despite all the market twists and turns of late. Only last month, I bought into Anglo American shares and made 10% in two weeks! Its gone down since, so I am feeling quite pleased with my efforts.Me: Really? I remember that you also bought Barclays shares a while ago, how is that one going?

“Consumption is the sole end and purpose of all production; and the interest of the producer ought to be attended to, only so far as it may be necessary for promoting that of the consumer” – Adam Smith (the Wealth of Nations).